US equity futures point to the stock market looking to build on yesterday’s tech-led rally thanks to comments from Meta’s (META) Mark Zuckerberg - see Model Musings below for what Zuck had to say.

Looking at today’s earnings and economic data docket, there isn’t much that would deter the market from closing out the week on a positive note. That will change next week with more than 430 companies reporting quarterly results, and the January US Flash PMI data as well as the December PCE Price Index are published.

Following three appearances by Atlanta Fed President Raphael Bostic yesterday, during which he stated he does not see the Fed’s first rate cut coming until 3Q 2024, we do have another round of Fed speakers today. At 1 PM ET, we have Michael Barr, Vice Chair for Supervision and soon after the stocks stop trading for today, we’ll hear from San Francisco Fed President Mary Daly. Given recent data that has lifted 4Q 2023 GDP expectations, we would be surprised if their comments about monetary policy differed significantly compared to Bostic’s. Should their messaging lean more hawkish, it could fuel some profit taking into the weekend, especially for some of the higher-flying tech stocks.

For more, be sure to read our Daily Markets column published each day by Nasdaq.

Model Musings

Aging of the Population - “As the International Monetary Fund (IMF) puts it, “the most formidable demographic challenge facing the world is no longer rapid population growth, but population aging.” Read more here

Digital Infrastructure & Connectivity

Shares of Super Micro Computer (SMCI) jumped in aftermarket trading last night after the company bumped up its quarterly sales and profit guidance. The company now expects net sales of $3.60-$3.65 billion versus an earlier forecast of $2.7 to $2.9 billion. Super Micro makes products such as rackmount servers and graphics processing unit (GPU) servers, motherboards and chassis, and ethernet switches and adapters.

“Meta is spending billions of dollars on Nvidia’s popular computer chips, which are at the heart of artificial intelligence research and projects… In an Instagram Reels post on Thursday, Zuckerberg said the company’s “future roadmap” for AI requires it to build a “massive compute infrastructure.” By the end of 2024, Zuckerberg said that infrastructure will include 350,000 H100 graphics cards from Nvidia. Read more here

Guilty Pleasure - “Coffee and tea shipments are being rerouted to avoid the Red Sea following repeated drone and missile attacks. Ongoing US-UK airstrikes failed to halt Yemen-based Houthi rebels who this week hit a Greek-registered bulk carrier, a Malta-based cargo ship, and an American-owned cargo ship in the Gulf of Aden… According to Reuters, coffee deliveries to Europe from Vietnam and Indonesia have been delayed up to three weeks, and container freight rates have increased by 150% on Asian-European routes.” Read more here

Luxury Buying Boom - “Burberry posted lower than expected sales growth in China in its final quarter of the year and blamed a worsening slowdown in demand for luxury goods when it issued a profit warning last week. But for Richemont, one of the world's biggest luxury groups after France's LVMH, China's improvement helped push it towards its highest ever quarterly sales in the three months to the end of December… Richemont said its sales in China, including Macau and Hong Kong, were 25% higher, with Chinese tourists preferring to travel in the region rather than heading further afield.” Read more here

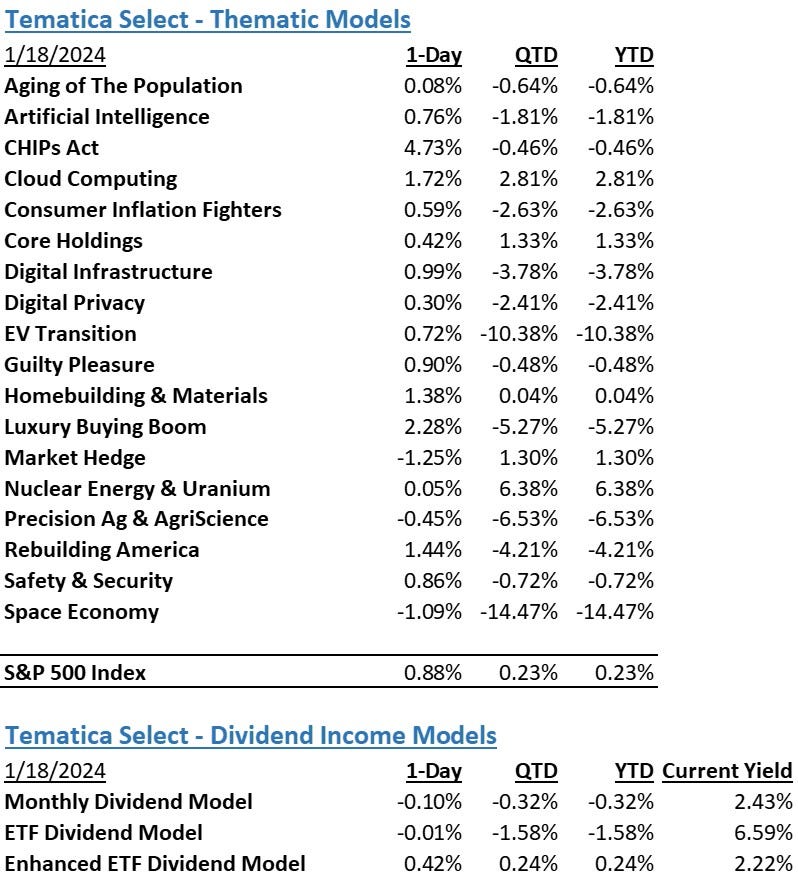

The strategies behind our Thematic Models:

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Consumer Inflation Fighters - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Precision Ag & Agri Science – Companies that look to address shrinking arable land by helping maximize crop yields utilizing technology, science, or both.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The strategies behind our Dividend Income Models:

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.