Will the Fed Kill the Trump Trade?

Today's wave of earnings brings data points for these 7 targeted exposure models

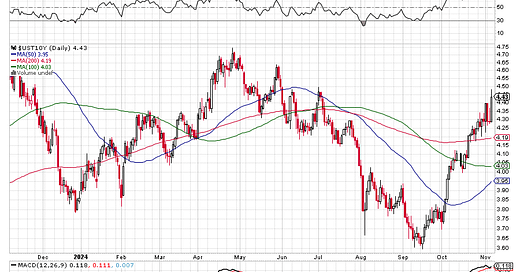

Futures point to the post-election rally continuing when US equity markets open later this morning. While the final tally for the House has yet to be determined, the results thus far point to a red sweep in Washington. After jumping yesterday back to levels last seen in early July, ahead of the Fed’s latest monetary policy decision, the 10-year Treasury yield is inching up further this morning. While the Fed is widely expected to deliver a 25-basis point rate cut today, following the October Services PMI report, which brought with it a very different perspective than the one found in the October Employment Report, and the outcome of Tuesday’s election, the market is going to hang on Fed Chair Powell’s words about the path for further rate cuts.

The disastrous data collection issue riddled October Employment Report cleared the way for the Fed to dial back monetary policy further. Despite this, the underlying strength of the economy and potential Trump economic policies are raising another round of questions about how many rate cuts the Fed could deliver in the coming months. Recent market expectations tallied by the CME FedWatch Tool called for as many as five 25-basis point rate cuts exiting the Fed’s June 2025 meeting. That figure now stands somewhere between three and four such cuts.

Currently, that same tool shows the Fed delivering another cut in December, but in analyzing the shifting probabilities it’s worth noting the odds of no December cut have been climbing. The same tool shows the market expects the Fed to take a rate cut pause in January. Our thinking is these expectations are very much in flux but across the Fed’s last two policy meetings this year and all 8 next year, the market sees the Fed delivering just four rate cuts. That puts the Fed funds rate between 375-400 basis points, and suggests the Fed will need to lift its 2025 Fed funds targets when it updates its December set of economic projections. The same is likely true for its GDP forecasts for this year and next as well.

Where we’re going with this is even though the Fed will likely deliver a rate cut today, if we were betting people we would be laying some money down on Powell’s presser comments not being as dovish as they were in August and September. Yes, he’ll reiterate the Fed being data-dependent and making decisions meeting by meeting but the underlying data increasingly suggests the Fed will take a measured path to get monetary policy back to a more neutral stance.

That likelihood could be akin to throwing some cold water on the market’s face following yesterday’s post-election pop.

While we wait for the Fed’s policy announcement and Powell’s press conference, we have another sea of quarterly earnings this morning. Results last night from Qualcomm (QCOM) were very supportive of our Digital Infrastructure model and what we learn this morning from Canada Goose (GOOS) and Tapestry (TPR) should bring some color to our Luxury Buying Boom model. We can say the same for our Guilty Pleasure model as we drink in (we know you saw what we did there) quarterly results from Molson Coors (TAP) and Hershey (HSY).

After today’s market close, earnings from AMN Healthcare (AMN), Axon (AXON), Blink Charging (BLNK), Capri Holdings (CPRI), Cloudflare (NET), Fortinet (FTNT), Green Dot (GDOT), Motorola Solutions (MSI), and Trade Desk (TTD) should deliver some insightful data points for our Aging of the Population, Safety & Security, EV Transition, Luxury Buying Boom, Cybersecurity, Digital Payments, and Digital Lifestyle models.

Model Musings

Aging of the Population

“China is struggling to find money to retrofit hundreds of thousands of lifts in ageing apartment blocks as their residents also grow older, with increasingly parlous local finances making it hard to support a greying population.” Read more here

Artificial Intelligence, Digital Infrastructure

“The third quarter of 2024 proved to be a return to form for hyperscale revenue growth, as enterprise interest in artificial intelligence (AI) translated into big buckets of green for the cloud giants. Amazon Web Services (AWS), Google and Microsoft all saw a year on year uptick in revenue growth, with AWS and Google making the biggest gains. AWS’ growth rate increased from 12% in Q3 2023 to 19.1% in the recent quarter, while Google’s jumped from 22% to a whopping 35%… it has now gone to another level with accelerated growth rates pushing the market to $84 billion in Q3. AI is clearly a big factor behind that growth surge.” Read more here

Artificial Intelligence, Safety & Security

“Meta will allow U.S. government agencies and contractors working on national security to use its artificial intelligence models for military purposes, the company said on Monday, in a shift from its policy that prohibited the use of its technology for such efforts. Meta said that it would make its A.I. models, called Llama, available to federal agencies and that it was working with defense contractors such as Lockheed Martin and Booz Allen as well as defense-focused tech companies including Palantir and Anduril.” Read more here

Cash-Strapped Consumers

“Car buyers across America—even those with comfortable incomes —are dropping out of the new-car market. The pandemic supply shortages that drove sticker prices skyward are in the rearview mirror, but the cost of a new set of wheels continues to climb. The average price of a new car this year is $48,205, up 21% from five years ago, according to researcher Cox Automotive Inc.” Read more here

Cybersecurity

“Court systems across Washington state have been down since Sunday when officials said "unauthorized activity" was detected on their networks. This ongoing data system outage affects all state courts' judicial information systems, websites, and associated services.” Read more here

“Nokia is investigating whether a third-party vendor was breached after a hacker claimed to be selling the company's stolen source code… This statement comes after a threat actor known as IntelBroker claimed to be selling Nokia source code that was stolen after they breached a third-party vendor's server.” Read more here

“Schneider Electric has confirmed a developer platform was breached after a threat actor claimed to steal 40GB of data from the company's JIRA server… Schneider Electric is a French multinational company that manufactures energy and automation products ranging from household electrical components found in big box stores to enterprise-level industrial control and building automation products… This breach has compromised critical data, including projects, issues, and plugins, along with over 400,000 rows of user data, totally more than 40GB Compressed Data…” Read more here

Digital Infrastructure

“The next big round of investments will be triggered by one of two things. The first will associated with spectrum for 6G and densification to support the 6G build. The second will be driven – interestingly enough – by a paucity of spectrum… Currently, the FCC has no auction authority and there’s no spectrum being queued up for auction. There was speculation that Dish Network, now under parent EchoStar, might be in the market to sell some of its spectrum, but given recent announcements about its financing and the buildout extensionit received from the FCC, it doesn’t look like that spectrum is going to be on the market anytime soon.” Read more here

“Fiber M&A is on fire – even with the unknown of the U.S. election tomorrow. This morning, Bell Canada announced it was acquiring Ziply Fiber for $3.65 billion in cash plus the assumption of debt, resulting in a transaction value of about $7 billion. This deal follows Verizon’s recent announcement that it’s acquiring Frontier for $20 billion. Today’s announcement between Bell Canada and Ziply would make Bell the third largest fiber internet services provider in North America, after AT&T and Verizon.” Read more here

Digital Infrastructure, Nuclear Energy & Uranium

“Taiwan’s laboured energy transition is straining its industry, with sudden electricity price jumps and growing outage risks affecting companies including Asia’s biggest — the semiconductor giant TSMC… While Taiwan is investing heavily in offshore wind power and aims to generate 27 to 30 per cent of its electricity from renewables by 2030, it started very late. Meanwhile, the country has begun to phase out nuclear power, which accounted for half of supplies in the 1980s but is down to 6 per cent and will disappear when the last reactor is switched off next May as planned.” Read more here

“The U.S. needs to at least triple its nuclear fleet to keep pace with demand, slash carbon dioxide emissions and ensure the nation’s energy security, said Mike Goff, acting assistant secretary for the Office of Nuclear Energy at the Department of Energy… Goff said the advent of large data centers that consume up to a gigawatt of electricity only reinforces the need for new reactors.” Read more here

Homebuilding & Materials

“US mortgage rates continued to climb, putting a further damper on refinancing and homebuying activity. The contract rate on a 30-year mortgage increased 8 basis points to 6.81% in the week ended Nov. 1, the highest since July, according to Mortgage Bankers Association data released Wednesday. In the last five weeks, the rate has risen 67 basis points, the most in two years.” Read more here

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

Cash Strapped Consumer - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption or destruction of data.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Digital Lifestyle - The companies behind our increasingly connected lives.

Digital Payments - This model focuses on companies benefitting from the accelerating structural adoption of digital payments and financial technology (FinTech).

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed below.