Will Q3 2025 Guidance Feel The Brunt of Trump’s Attempt to Regain the Trade Narrative?

Samsung's Q2 profit miss, but guidance from Foxconn reinforces these two models

Market Recap

The thing about markets is that they really don’t like uncertainty. If the July 9th deadline had remained unchanged, at least we’d all have some hard numbers on which to base projections. As it is, we’re still stuck in tariff limbo, except, of course, for the Vietnam agreement and the announced 25% tariffs on Japan and South Korea. Small caps led the way lower as the Russell 2000 fell 1.55%. Mag 7 and technology didn’t have any outsized impact on broad indexes as the Dow dropped 0.92%, the S&P 500 shed 0.89%, and the Nasdaq Composite closed 0.94% lower. Sectors were down across the board except for Utilities, which got a nuclear-powered boost as evidenced by Constellation Energy (CEG) and NextEra(NEE) combining to contribute to just over 145% of the sector’s 0.21% gain. The remaining sectors saw results ranging from -0.09% (Consumer Staples) to -1.27% (Consumer Discretionary), with Tesla (TSLA) contributing to just under 80% of the sector's performance.

Equities had a roughish day, and we saw the Cboe Market Volatility Index (VIX) rise about 8.60%. Gold ended the day close to flat, up 0.28% to $3,335.29/oz, perhaps an indicator that while US stocks are giving traders pause, sovereign and institutional gold buyers seem content with their current allocations. Not to be left out of any “excitement”, crude oil prices rose as reports of Houthi rebels attacking a Greek tanker in the Red Sea emerged during market hours. While not anticipated, these attacks seem to be overshadowed by previously announced OPEC+ output hike pledges.

As discussed in our Sunday post, we saw some strategies play out along “Beautiful Bill” expectations as Nuclear Energy & Uranium (NUKE) topped yesterday’s leaderboard and EV Transition (EVTRANS) lagged most among the suite. While Market Hedge once again did its job, it wasn’t the only strategy to end the day in positive territory, as Space Economy (SPACE), Digital Lifestyle (DLIFE), and Data Privacy (PRIV) also ended higher. With the July 9th deadline now moved to August 1st, we continue to take cues from economic data updates as well as try to decipher companies’ Q2 earnings statements, or lack of statements, as we roll into earnings.

Will Q3 2025 Guidance Feel The Brunt of Trump’s Attempt to Regain the Trade Narrative?

Approaching the US stock market’s opening bell, equity futures are mixed as investors digest the 14 letters sent by the White House that raise tariffs on August 1. Markets are responding to reports that U.S. tariffs will return to April 2 levels on August 1 if there is no progress on trade deals with the U.S. President Trump also threatened an additional 10% tariff on countries that align with the “Anti-American policies of BRICS,” which refers to emerging market countries including Brazil, Russia, India and China.

We view that move by President Trump as an attempt to jumpstart trade deal talks as timetables for those conversations, especially with the eurozone and China were going to miss the Trump-imposed July 9 deadline. We say this given comment by Trump that "we're not going to be unfair" and would look favorably on countries continuing to offer additional concessions, as he suggested he was still open to negotiations.

Unsurprisingly, this morning, China warned the Trump administration against reigniting trade tensions by reinstating tariffs on its goods in August and threatened to retaliate against nations that strike deals with the United States to exclude China from their supply chains. How this plays out following the June deal between the US and China that set US tariffs on Chinese imports at 55% and Chinese tariffs on American imports at 10% is TBD.

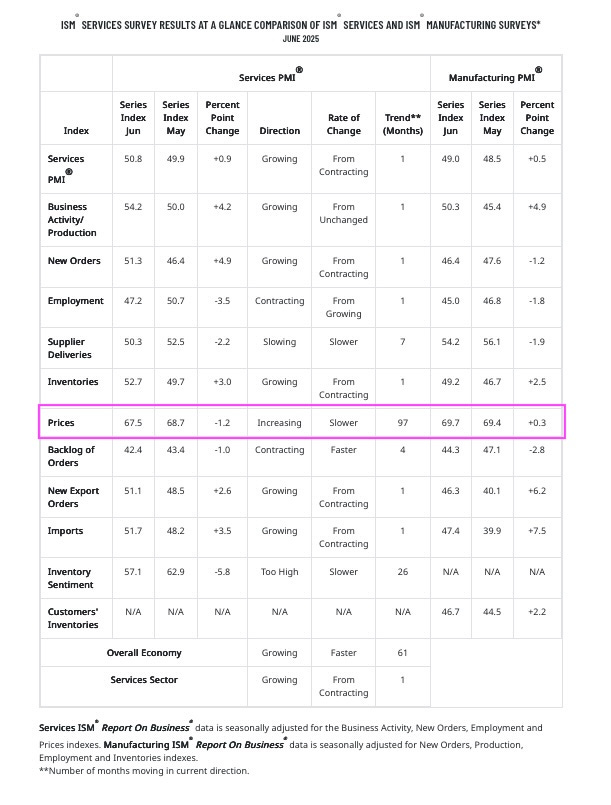

While last week’s June Employment Report and June ISM PMI pricing data removed a July rate cut from the table, the market must now contend with renewed trade and tariff uncertainty as the June quarter earnings season kicks off next week. We’ve talked before about the decline in H2 2025 EPS growth for the S&P 500 compared to the first half, from its high near 14% exiting March to lower levels. As of last Thursday, per FactSet data, the consensus is now at 8.4%.

Should the initial wave of corporate guidance for the current quarter and or H2 2025 suggest that 8.4% figure needs to come down further, odds are high we’ll see at least some question the current market multiple of 23.6x expected 2025 EPS. We’ll continue to follow the data, especially enterprise and consumer spending data that will be captured in our thematic framework.

Today’s Roadmap

We have no market moving earnings reports out today, and the only two pieces of economic data at the June NFIB Small Business Optimism Index and the May Consumer Credit Report, which will be published this afternoon. The NFIB Small Business Optimism Index remained steady in June, edging down 0.2 of a point to 98.6, slightly above the 51-year average of 98. However, a substantial increase in respondents reporting excess inventories contributed the most to the decline in the index. The Uncertainty Index decreased by five points from May to 89. Other learnings from the NFIB’s June data include:

Labor Markets - A seasonally adjusted net 13 percent of owners plan to create new jobs in the next three months, up 1 point from May. Job creation plans remain weak compared to recent history. Overall, 58 percent reported hiring or trying to hire in June, up 3 points from May.

Capital Spending - Fifty percent of small business owners reported capital outlays in the last six months, down 6 points from May and the lowest reading since August 2020.

Inflation - The net percent of owners raising average selling prices rose 4 points from May to a net 29 percent seasonally adjusted. Actual price increases still remain too high to achieve and maintain the Federal Reserve’s 2 percent inflation target, but are closing in on a range of greater price stability.

As we wait for the June quarter earnings season to hit with full force next week, we and others across Wall Street will be mindful of earnings pre-announcements, good and bad. We have one of the latter ones this morning from Samsung(SSNLF), which now sees a 56% drop in its Q2 2025 profit due to the combination of inventory value adjustments and the impact of U.S. restrictions on advanced AI chips for China.

Samsung is viewed to be losing share to SK Hynix and Micron (MU) in high-bandwidth memory (HBM) chips. For its May quarter, Micron reported a nearly 50% sequential growth in HBM revenue as its data center revenue more than doubled year-over-year, hitting a quarterly record. Lending support to that outlook, yesterday Foxconn (FXCOF) shared it saw record second-quarter revenue driven by strong demand for AI products and expects its Cloud and Networking segment to continue to benefit from AI products demand and maintain a strong growth trend in the current quarter. We see those comments as very supportive for our Artificial Intelligence and Digital Infrastructure models.

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

Cash Strapped Consumers - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

Digital Infrastructure & Connectivity - Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

Digital Lifestyle - The companies behind our increasingly connected lives.

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.