US equity futures point to a mixed market open later this morning with the earnings rubber will start to hit the road today as the December quarter reporting season moves into a higher gear.

Setting the stage for what could be the start of a sobering period for the market, the Dow Jones Industrial Average closed above 38,000 for the first time and the S&P 500 hit a new record high. Despite that new record, as of last night’s market close, the Nasdaq Composite was outperforming both of those market benchmarks. Throwing potential flags on the field, the equal-weight version of the S&P 500 is down 0.8% so far this year and the small-cap heavy Russell 2000 is off 2.2%.

What investors are looking to determine is how realistic are consensus expectations that call for the S&P 500 to grow its EPS by more than 11% this year compared to 2023. Several factors, including the ongoing disruptions in the Red Sea and its impact on supply chains, point to that rate of growth being rather unlikely. Several firms have already warned about that disruption to supply chains because at least 2,300 ships are taking lengthy detours to avoid Houthi militants’ attacks in the Red Sea — a waterway that normally handles over 12% of global sea trade.

Investors will be trying to determine the likely rate of that EPS growth for that market barometer and assess if it supports further gains following the continued market melt-up over the last 13 weeks. We would not be surprised to see the market gyrate based on the latest high-profile batch of earnings reports as that more realistic EPS growth rate is determined. The odds of it being higher than the currently expected 11% is rather low in our view, and based on what we know as of today a much more likely figure is in the 5%-7% range.

Now to see how right that thinking is…

For more, be sure to read our Daily Markets column published each day by Nasdaq.

Model Musings

Artificial Intelligence

“The ability of AI algorithms to identify potential risks by analyzing historical financial data, transactional behavior and customer profiles is the reason that a significant number of fintech companies have already implemented the technology for fraud detection.” Read more here

Consumer Inflation Fighters

“Nearly half of consumers say they are carrying credit card debt, according to a new survey from Bankrate. The personal finance firm found that 49% of credit card users carry a balance from one month to the next. That's up a full 10 percentage points from 2021. Of those who revolve their balances, 58% — 56 million people — have been in debt for at least one year, according to Bankrate.” Read more here

Data Privacy & Digital Identity

“In the year ahead, the use of biometrics — an individual’s unique physical identifiers, such as fingerprints and faces — will be expanded at airports in the United States and abroad, a shift to enhance security, replace physical identification such as passports and driver’s licenses, and reduce the amount of time required by travelers to pass through airports. Biometric technology will be seen everywhere from bag drops at the check-in counters to domestic security screening.” Read more here

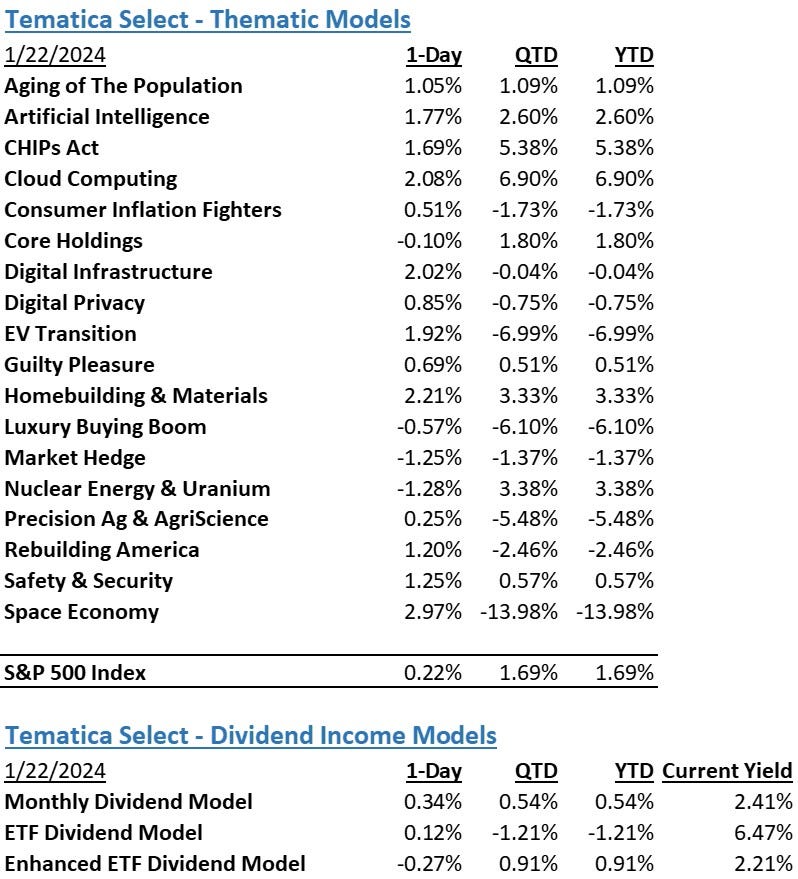

The strategies behind our Thematic Models:

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Consumer Inflation Fighters - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Precision Ag & Agri Science – Companies that look to address shrinking arable land by helping maximize crop yields utilizing technology, science, or both.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The strategies behind our Dividend Income Models:

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.