Why a Cautious Market Will Eye Key S&P 500 Support Levels

And Nvidia will need to deliver a big beat and raise report on Wednesday

Market Wrap

Despite forecasts seeing anywhere from 200,000 to 300,000 workers dropping off federal government payrolls, markets were focused on technology to start the week. This put pressure on not just the Technology sector but also Utilities, which have increasingly become tied to tech due to the forecasted data center/AI electricity generation supply/demand imbalance. Technology led sectors lower, down 1.43%, followed by Utilities, which gave back 0.50%. The remaining sectors ranged from Healthcare, which gained 0.81% as drug makers remained buoyed by the absence of the FDA’s price-fixing lawsuit, to Industrials which fell 0.45%, led by Uber (UBER) contributing to just under 30% of that sector’s move.

Broad equity indexes followed their expected path, given the various levels of technology exposure. The Nasdaq Composite fell 1.21%, the S&P 500 dropped 0.50% and the Dow ended the day 0.08% higher. Small caps, as they often do, marched to their own drummer but still ended the day down 0.78%.

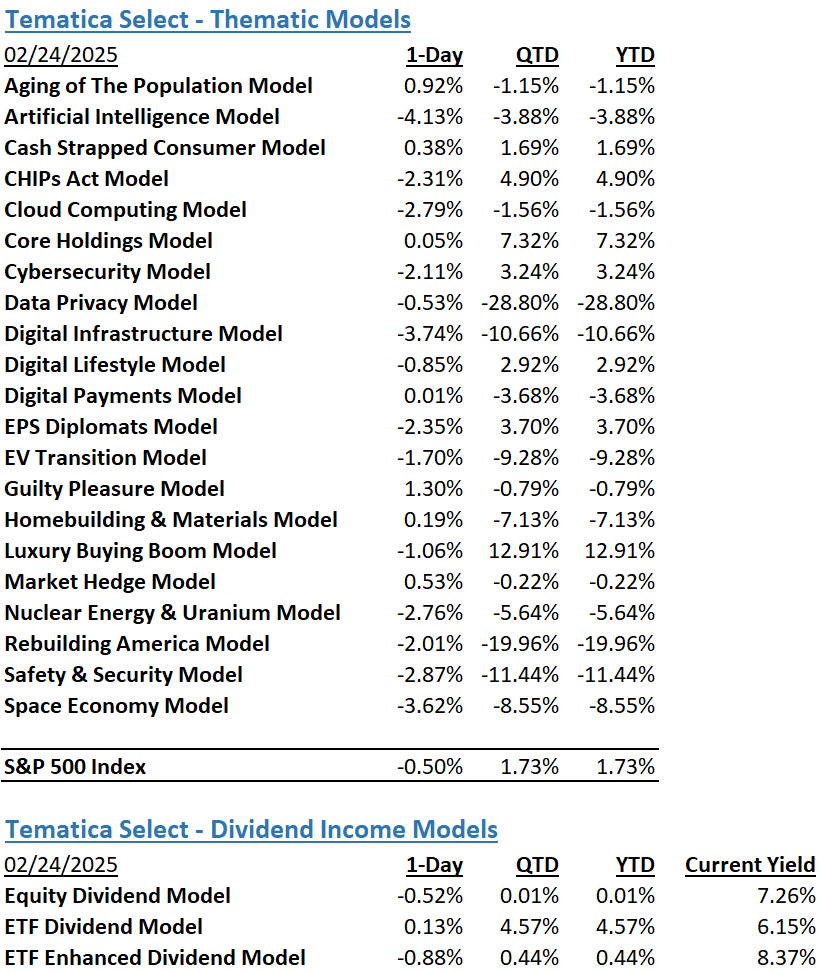

The Tematica Model Suite saw Market Hedge beat by only one other model, Guilty Pleasure. Shake Shack’s (SHAK) 6.35% gain helped push that strategy ahead as food delivery provider Just Eat Takeaway.com announced it will be acquired by Prosus, potentially expanding Shake Shack’s distribution footprint. Overall, Monday wasn’t as bad a day as Friday, but there are those wondering if Friday was an isolated event or the start of something else. Volatility ended the day higher as the VIX neared a 19 handle which is higher than near-term levels but not in flashing signal territory just yet.

Why a Cautious Market Will Eye Key S&P 500 Support Levels

Futures indicate another weak start to the trading day, but readers will want to revisit those figures once Home Depot (HD), Dillard’s (DDS), and other consumer facing companies have reported their latest quarterly results. Following weaker than market consensus guidance from Walmart (WMT), you’ll want to be mindful of Home Depot’s outlook, including the split between new construction and repair & remodel spending, but also what it says about tariffs. Its comments could be rather timely given comments from President Trump in the last 24 hours that scheduled to hit Canada and Mexico on March 4 were “on time” and “moving along very rapidly.”

Last week’s Flash February PMI data from S&P Global and the University of Michigan year ahead inflation expectations reading for February showed the initial impact of tariffs and related concerns on the US economy. Should we see those proposed tariffs on Mexico and Canada do go into effect, investors will be bracing for an even greater impact when March data is published in April. Recognizing we have a bit of a ways to get there, today we’ll be looking to see if the February Consumer Confidence data echoes the findings in last week’s Michigan inflation data. Those reports will frame the comments from Fed speakers making the rounds this afternoon and tomorrow ahead of Friday’s January PCE Price Index report. Given the developments described above, we continue to think those findings will be viewed more rear-view-mirror-ish than not.

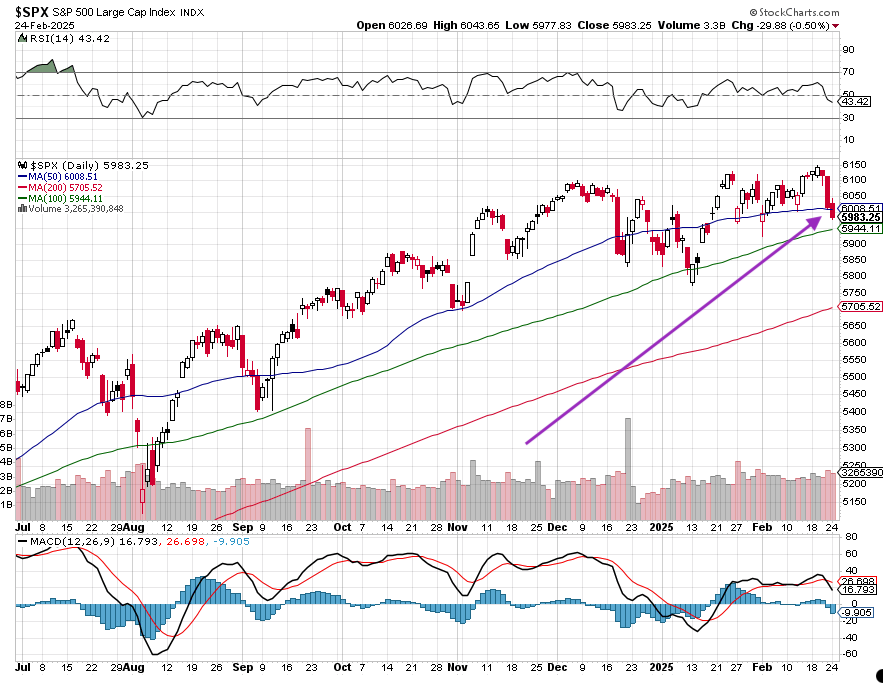

Turning to the market, we can’t help but notice the S&P 500 closed last night below its 50-day moving average. Traders are likely to see that as a signal for caution, and looking to see if the S&P 500 rallies and successfully tests that support line or trend even lower toward the 100-day moving average. Should the February Consumer Confidence figures come in much lower than expected and confirm tariff as well as inflation concerns, traders will be looking to see if the S&P 500 breaches the 100-day support level at 5,955.11.

With that in mind, barring developments out of Washington and the Trump administration, the next focal point for the market will be Nvidia’s (NVDA) latest earnings report and guidance after Wednesday’s market close. Given recent DeepSeek headlines and speculation that Microsoft (MSFT) may be dialing back its data center expansion plans, something Microsoft pushed back on last night, Nvidia will need to deliver results that re-assure the market a robust AI driven ramp remains ahead. Because we are once again in an environment when even a modest weakness in a company’s results or guidance can punish its shares, Nvidia will need other deliver a meaningful beat and raise quarter. If not, because NVDA shares are the second largest holding in the S&P 500 and Nasdaq Composite, a disappointing report could be a catalyst for the market to continue its move lower.

Market Hedging model anyone?

Model Musings

Artificial Intelligence

Today Apple has officially announced the next phase of its rollout of AI features under the Apple Intelligence umbrella. In April, the company will release iOS 18.4 and iPadOS 18.4, just as rumored. With these versions, the EU will finally get access to Apple Intelligence features for the first time. Read more here

Fogel expressed his belief GenAI will be a game-changer — driving not just personalized travel planning but enabling seamless and frictionless journeys and connected experiences for travelers. Booking.com is leveraging GenAI to enhance its customer experience, introducing new features like the Smart Filter tool. This allows travelers to describe their ideal accommodation in their own words, and GenAI scans Booking’s inventory to provide tailored results. Read more here

Walmart and Amazon are doubling down on AI investments to drive efficiency, enhance customer experiences and fuel business growth, with both companies making significant strides in expanding their AI capabilities across multiple divisions. Read more here

Central to Carvana’s continued success, according to the shareholder letter, is its investment in AI and digital transformation. The company has leveraged machine learning and advanced technology to streamline the car-buying experience, providing consumers with faster, more personalized options. Read more here

Artificial Intelligence, Cybersecurity

High-uncertainty firms were more likely to have turned to advanced technologies to efficiently deal with cyber threats, according to the report. To that end, 44% of the most uncertain firms had invested in technologies such as artificial intelligence-driven threat detection. AI is also starting to emerge as a possible source of online threats, according to cybersecurity firm AppSOC, which dubbed the DeepSeek AI model a “Pandora’s box of security risks” after a round of tests on the technology. Read more here

The risks posed by LLMs, a form of generative artificial intelligence that communicates through language in a humanlike way, are already manifold. There is, for example, a danger that sensitive corporate or personal information inadvertently or deliberately will be exposed to models widely accessible to the public. There is also a possibility models can bring unsafe code or data into a company. Such threats are bound to multiply as LLMs are commoditized… Read more here

Cash-Strapped Consumer

Consumer sentiment saw a 9.8% month-over-month decline and a 15.9% year-over-year decline, according to the survey’s final results for February released Friday (Feb. 21). While all five components of the index deteriorated during the month, the trend was “led by a 19% plunge in buying conditions for durables, in large part due to fears that tariff-induced price increases are imminent,” Read more here

Cybersecurity

Crypto exchange Bybit said it was hacked, resulting in what analysts estimate was the loss of almost $1.5 billion worth of tokens in the biggest theft ever committed in the industry. Researchers believe North Korean hackers were likely responsible. Read more here

Data Privacy & Digital Identity

Italy's data protection watchdog has blocked Chinese artificial intelligence (AI) firm DeepSeek's service within the country, citing a lack of information on its use of users' personal data. The development comes days after the authority, the Garante, sent a series of questions to DeepSeek, asking about its data handling practices and where it obtained its training data. Read more here

Digital Payments

The European Central Bank wants to establish a blockchain-based payment system that allows financial institutions to settle transactions in central-bank money, a potential step toward introducing a wholesale central bank digital currency, or CBDC. Read more here

Luxury Buying Boom

The top 10% of earners—households making about $250,000 a year or more—are splurging on everything from vacations to designer handbags, buoyed by big gains in stocks, real estate and other assets. Those consumers now account for 49.7% of all spending, a record in data going back to 1989, according to an analysis by Moody’s Analytics. Three decades ago, they accounted for about 36%. Read more here

Consumers keep spending on travel, shrugging off higher prices for everything from hotel rooms to dinners out to indulge on vacations, according to Booking Holdings Chief Executive Glenn Fogel. The head of the travel-booking company said that the strong demand from recent months isn’t likely to let up… One factor helping stretch travel budgets is a stronger dollar. Read more here

Nuclear Energy & Uranium

The U.S. Department of Energy has been working for years to resuscitate the American nuclear sector, advancing the development of new reactors to meet the enormous incoming electrical demands of big new industrial facilities, from data centers and Bitcoin mines to chemical plants and desalination facilities. Leaders in Texas, the nation’s largest energy producer and consumer, have declared intentions to court the growing nuclear sector and settle it in state. Read more here

A volunteer advisory group told the utility that serves Colorado’s second-largest city that it should look at adding a small nuclear reactor for additional power generation. Colorado Springs Utilities (CSU) said it is reviewing the recommendation from the Utility Policy Advisory Committee (UPAC). That committee, which is not affiliated with the utility, in June of last year began researching the feasibility of nuclear energy for CSU. Read more here

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

Cash Strapped Consumers - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

Digital Infrastructure & Connectivity - Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

Digital Lifestyle - The companies behind our increasingly connected lives.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.