Last week was the worst week in the market since October and is being chalked up to profit-taking following its stellar run. Tipping the scales for that decision is the growing realization that while the Fed still expects to cut rates this year, the timing for the start of that process continues to slip. The hope is this week’s February Consumer Price Index and Producer Price Index will help the market pin down that timing. If those figures surprise to the upside as their January reports did, it will reinforce not only the Fed’s measured pace to rate cuts but could mean it wants to see that much more data confirming a sustained move closer to the Fed’s 2% inflation target. Should rate cut expectations get pushed out to the middle or back half of 2H 2024, investors will begin to question 2H 2024 GDP and EPS forecasts more carefully.

Goldman Sachs (GS) now expects S&P 500 companies to repurchase $925 billion in 2024, up 13% year over year and higher than the initial forecast of 4% growth. The firm sees buyback usage rising another 16% in 2025 to $1.075 billion.

Linde plc (LIN) will become a component of the Nasdaq-100 Index (NDX) replacing Splunk (SPLK) in that index as well as in the Nasdaq-100 Ex-Tech Sector Index, and the Nasdaq-100 ESG Index before the market open on Monday, March 18.

For more, be sure to read our Daily Markets column published each day by Nasdaq.

Model Musings

Artificial Intelligence

“Meta’s development of a new AI model, designed to enhance video and user Feed recommendations, marks what could be a significant shift in the online commerce landscape. The new AI model could benefit advertisers by directing viewers to more relevant results, experts say. Meta’s progress unfolds amid a widespread industry effort to improve online search outcomes through the application of AI.” Read more here

Consumer Inflation Fighters

“As ongoing economic pressures shrink the middle class, retailers are being challenged to either cut prices and step up their deals and discounts or make a play for high-income consumers. Indeed, years of financial challenges are eating away at the middle class’s spending power. A PYMNTS Intelligence study from October found that middle-income consumers had seen their readily available savings in real terms plummet by 18% in the last year. Against this backdrop, middle-tier retailers are taking a hit.” Read more here

“These pricing trends likely explain why nearly 58% of today’s consumers across nearly every income level say they are cutting back on nonessential spending because of rising grocery costs. Nearly half of U.S. consumers earning north of $100,000 each year say they decrease nonessential spending whenever possible. Sixty-one percent of consumers earning less than $50,000 annually and nearly two-thirds of those earning between $50,000 and $100,000 each year do the same.” Read more here

Homebuilding & Materials

“The company also forecast a 2% to 3% drop in sales for the years ahead, as consumers step back from do-it-yourself (DIY) home repairs and remodeling projects amid higher inflation and a slowing real estate market… That meant a decrease in demand for big-ticket items for kitchen and bathroom projects, along with appliances and flooring.” Read more here

The Strategies Behind Our Thematic Models

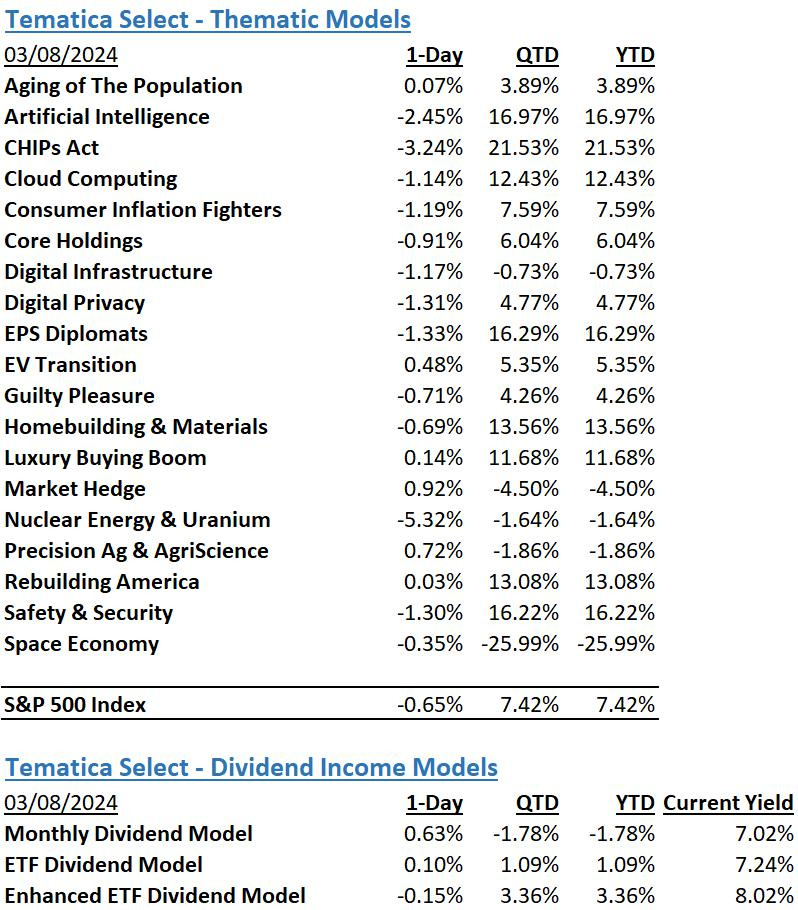

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Consumer Inflation Fighters - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Precision Ag & Agri Science – Companies that look to address shrinking arable land by helping maximize crop yields utilizing technology, science, or both.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The strategies behind our Dividend Income Models:

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed below.