TSM May Revenue Soars, Multiple Models Leading the Market QTD

Investors in a holding pattern waiting for Trade Talk developments and the May CPI report

Market Recap

Lighter China tariff rhetoric helped markets back burner enough looming issues to see broad equity indexes end the day flat to slightly higher. Despite its 13/17 advance-decline line, the Dow ended the day flat as gains in names like Microsoft (MSFT) and Caterpillar (CAT) more than balanced out slides in Travelers Companies (TRV), Visa (V), and others. The S&P 500 eked out a 0.09% gain driven largely by Mag 7 names, especially Tesla (TSLA) and Amazon (AMZN). Meta Platforms (META) and Apple (AAPL) showed up in yesterday’s top 10 detractors from performance, breaking from the pack. The Nasdaq Composite rose 0.31% on Mag 7 and technology optimism and small caps added 0.70% as the Russell 2000 reacted to tariff optimism.

Sectors were mostly lower along Mag 7 exposure meaning Consumer Discretionary and Technology were positive along with Materials and Energy. The remaining sectors fell between 0.05% (Real Estate) and 0.64% (Utilities). Gold ticked higher to $3,327.53/oz, the Cboe Market Volatility Index (VIX) inched up to close at 17.16, and the 10-year treasury dipped below 4.50%.

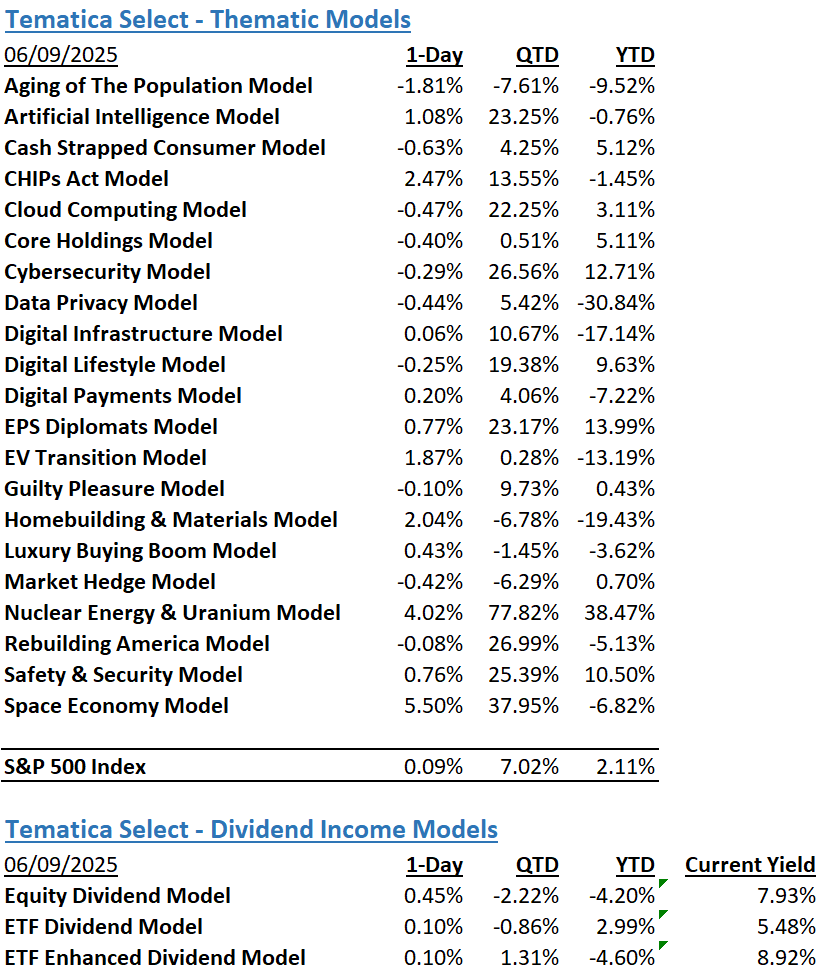

The Tematica Select Model Suite had generally positive results yesterday with leadership coming from Space Economy (SPACE), and Nuclear Energy & Uranium (NUKE). Cash Strapped Consumer (PINCH) led the way lower as Restaurant Brands International (QSR) came under pressure over investor conference comments regarding Burger King franchise profitability and corporate spend on refurbishing locations.

Waiting on Trade Talks and CPI, TSM May Revenue Soars

Equity futures are little changed this morning, suggesting the market at least for now is in a holding pattern. Investors are waiting for more details to emerge from US-China trade talks that are expected to address rare earth elements and technology export controls. While we wait for that, there are no fresh market-moving data points expected save for the NFIB Business Optimism Index for May which surprised to the upside, rising to 98.8 from April’s 95.8 figure, besting the 95.9 market forecast.

The market is waiting for tomorrow’s May CPI report, which we discussed in yesterday’s video. For those that missed that, the market expects the inflation data for the fifth month of the year other tick higher on a sequential basis. Multiple May data reports already received, however, suggest we could see a potentially hotter print vs. market expectations. Should that be the outcome we get tomorrow, we could see the market jostle a bit as investors revisit current Fed rate cut expectations. We continue to see a scenario in which the Fed underwhelms market rate cut expectations when it publishes its updated set of economic projections on June 18. Remember, because we are in the Fed’s pre-policy meeting blackout period, we have no Fed speakers on tap, which means the market is left to its own devices to interpret the May CPI and PPI reports this week.

We did receive Taiwan Semiconductor’s (TSM) May revenue report early this morning, and despite the 8% sequential dip, May revenue rose 39.6% year over year, marking its second-highest monthly revenue figure. April 2025 remains the record keeper, and odds are it benefited from some pull forward in demand given Trump tariff concerns. Quarter to date, TSM’s revenue is up 44% year over year and 21% sequentially, signaling AI and data center demand remains robust. We see that supporting our Digital Infrastructure model as well as Artificial Intelligence. We’ll look for more color when Nvidia (NVDA) and Apple (AAPL) supplier Foxconn (FXCOF) shares its May revenue report.

As the market sifts through TSM’s revenue report, it will do the same with weaker-than-expected guidance from JM Smucker (SJM). For the coming year, Smucker sees its EPS between $8.50-$9.50, well below the market forecast of $10.25, as it contends with “a dynamic and evolving external environment, including tariffs and related trade impacts, regulatory and policy changes, ongoing input inflation, and changes in consumer behaviors that impact its fiscal year 2026 outlook.”

And on the deal front, while we wait for Chime (CHYM) and Voyager Technologies (VOYG) to price their respective IPOs this week, in a filing with the SEC, Walt Disney (DIS) disclosed it has closed a deal to fully acquire Comcast's (CMCSA) stake in Hulu. The transaction of $438.7 million brings Disney 100% ownership in the streaming platform.

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

Cash Strapped Consumers - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

Digital Infrastructure & Connectivity - Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

Digital Lifestyle - The companies behind our increasingly connected lives.

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.

Thank you.

For any1 interested, here are my estimates for May CPI coming out tomorrow:

https://arkominaresearch.substack.com/p/may-2025-cpi-forecast?r=1r1n6n