TSM Earnings, Fed Speakers, Quarterly Results & Guidance

After four days of US equity markets moving lower, this morning’s futures point higher, lifted by quarterly results from Taiwan Semiconductor (TSM) and others reporting early this morning. TSM delivered a beat and raise March quarter fueled by 26% YoY growth in smartphone and 18% YoY growth for its Higher Performance Computing business that contains both data center and AI. For the current quarter, TSM sees its consolidated revenue rising to $19.6-$20.4 billion compared to $18.87 in the March quarter and the market forecast of $19.44 billion.

From a model perspective, TSM’s results, and guidance point to continued strength for Tematica’s Artificial Intelligence and Digital Infrastructure & Connectivity models. TSM reiterating its capital spending for this year between $28-$32 billion also supports the CHIPs Act model.

Turning to today’s economic docket, initial jobless claims and Philly Fed business outlook for April are expected to land at the same time before the bell. For the initial jobless claims, economists predict a rise to 215K, while Philly Fed business outlook is expected to fall to 1.5. Later this morning comes the March Existing Home Sales report, which is expected to show a fall to a rate of 4.20M from 4.38M in February.

In terms of Fed speakers, we have three on tap for today - Fed Governor Michelle Bowman (9:05 AM ET), New York Fed President John Williams (9:15 AM ET), and Atlanta Fed Raphael Bostic (11 AM ET, 5:45 PM ET). Coming off Fed Chair Powell’s remarks on Tuesday icing expectations for rate cuts and yesterday’s Fed Beige Book finding the economy grew slightly faster, businesses adding more workers and little progress on lowering inflation, we should not expect meaningfully different comments from this trio of Fed heads later today.

For those that may have missed them, Powell’s latest message was that "…. recent data have clearly not given us greater confidence and instead indicate that it's likely to take longer than expected to achieve that confidence."

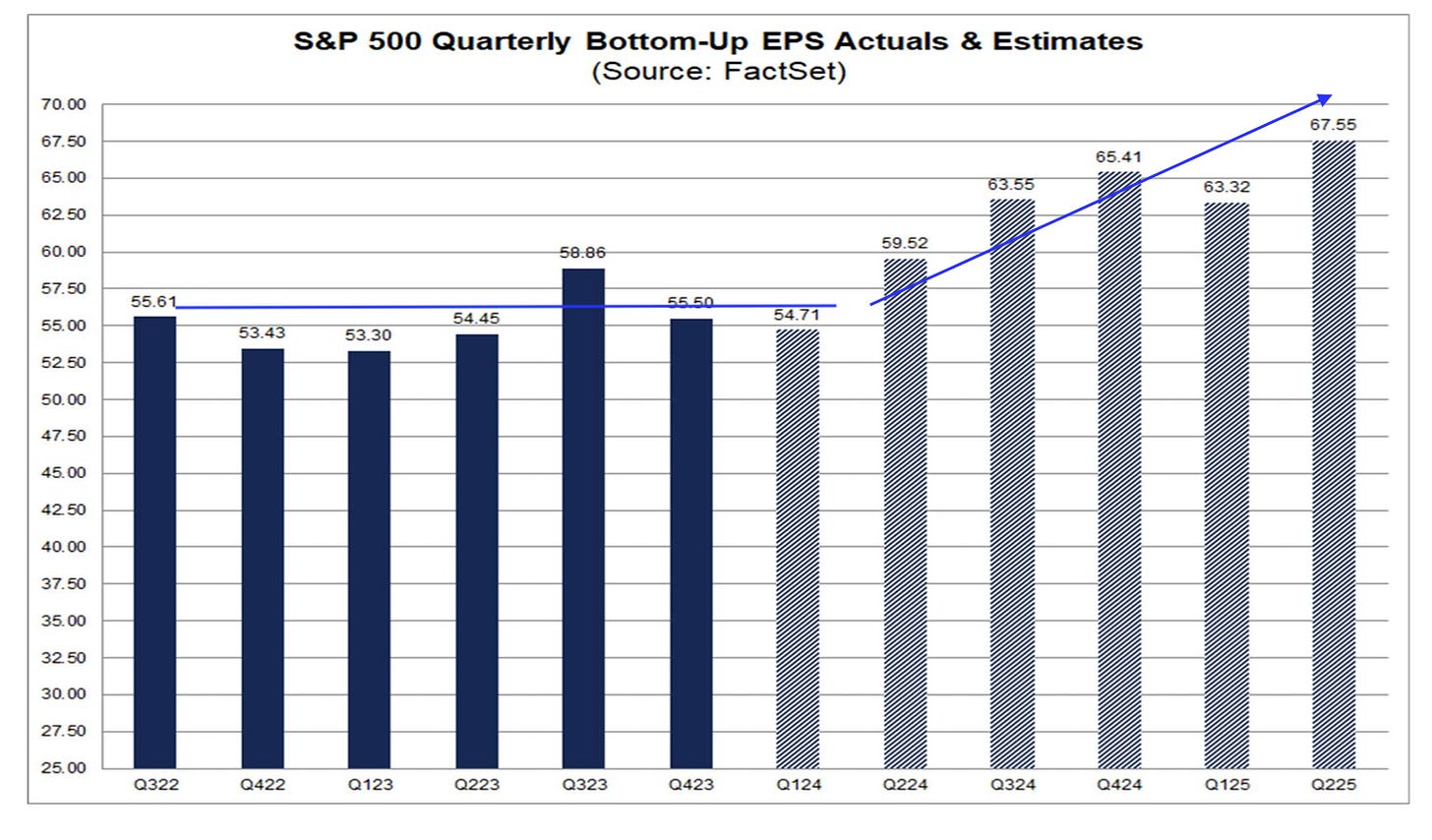

No surprise to those of us who have been eyeing recent inflation data, but other economic data this week led the Atlanta Fed’s GDPNow model to revise its 1Q 2025 GDP expectation to +2.9% up from 2.3% earlier this month. That supports the current market narrative of an improving economy, more folks working with real wage growth occurring, and companies investing alongside infrastructure and other stimulus spending. Such a combination is expected to drive favorable EPS prospects despite monetary policy being restrictive. While it may not be a popular thought, in that environment, imagine what would happen to inflation if the Fed started to cut too soon…

Next week, the pace of quarterly earnings picks up and as we close it out, we’ll have a much better sense of how well March quarter guidance stacks up against market expectations. Our thinking is that will determine the market’s next move.

Model Musings

Aging Population/ Homebuilding & Materials

“Baby boomer empty nesters own twice as many of the country's three-bedroom-or-larger homes, compared with millennials with kids, according to a recent analysis from Redfin. That means those larger homes aren't hitting the market, one factor limiting the supply for the younger generations who could use those extra bedrooms. Some baby boomers, the generation now between the ages of 60 and 78, are happy in their large homes, using the extra bedrooms for hobbies and visiting family. Others say they want to downsize, but it just doesn't make sense financially.” Read more here

Artificial Intelligence

“LinkedIn — the social platform that targets the working world — has quietly started testing another way to boost its revenues, this time with a new service for small and medium businesses. TechCrunch has learned and confirmed that it is working on a new LinkedIn Premium Company Pagesubscription, which — for fees that appear to be as steep as $99/month — will include AI to write content and new tools to grow follower counts, among other features to raise the profiles of the company using them.” Read more here

“Speaking at Fortune’s Brainstorm AI conference in London on Tuesday, van de Laar and other experts warned that generative AI could easily sway enough Americans so long as disinformation was targeted in a handful of key battlegrounds. Van de Laar said fake robocalls could be created using Eleven Labs products with almost no effort for free. Craig Oliver, the former communications director for 10 Downing Street during David Cameron’s premiership, said 95% of the conversation around AI and its impact on politics is around deepfakes.” Read more here

Cloud Computing / Data Privacy

“For some time the EU has been trying to figure out a label to award cloud service providers with strong cybersecurity to be used by governments and organizations within its borders. However, establishing the exact requirements for cloud companies to qualify for this label has been a battle between robust regulations and ease of access.” Read More Here

Consumer Inflation Fighters

“Just a few decades ago, the average family could be fully supported by one income from one parent, while the other could stay at home and raise the kids. And, one income was enough to buy a home. These days, in many places, two incomes might not even be enough to afford a decent apartment, let alone afford a home and the cost of childcare.” Read More Here

“Households are just not changing their spending patterns, but they’ve been changing everything else. During the pandemic, we were all locked in our homes and there wasn’t much spending on services, so there was this forced saving happening. Coming out of the pandemic, households had a lot of this liquidity to spend, particularly on services, so they’ve spent at these elevated rates and that has continued.” Read More Here

Cybersecurity

“The DDoS threat report for 2024 Q1 from Cloudflare found the company's automated defenses mitigated 4.5 million DDoS attacks in the first three months of the year, roughly a third of all attacks mitigated last year. Or, to put it in perspective - this is a 50% increase compared to the same period last year.” Read More Here

Data Privacy

“Senator Maria Cantwell (D) and Congresswoman Cathy McMorris Rodgers (R) are leading this effort known as the American Privacy Rights Act. It would grant Americans the right to digital privacy and would limit what data companies can collect, keep and use.” Read More Here

Digital Infrastructure

“The 6g market size is expected to see exponential growth in the next few years. It will grow to $20.46 billion in 2028 at a compound annual growth rate (CAGR) of 29.3%. The expansion anticipated in the forecast period can be credited to sustainable and green communication, spectrum innovation, concerns about security and privacy, global standardization efforts, and industry-specific requirements.” Read More Here

Digital Infrastructure / Nuclear Energy & Uranium

“Colocation data center giant Equinix has signed an agreement to purchase hundreds of megawatts of nuclear power from Oklo, a California-based company seeking to manufacture small modular reactors that is backed by OpenAI founder Sam Altman.” Read More Here

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Consumer Inflation Fighters - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption or destruction of data.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Precision Ag & Agri Science – Companies that look to address shrinking arable land by helping maximize crop yields utilizing technology, science, or both.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed below.