Trump’s WEF Address, Earnings Season Continues

January Flash PMI data coming up and how it may impact next week's Fed policy meeting

Market Recap

The second full day of trading following Monday’s inauguration didn’t seem to bring too many surprises, for investors at least. Trump’s announcement of the Stargate program injected new life into the AI strategy and with it, Cloud Computing, Digital Infrastructure, as well as what seems to be on track for another strong year, Nuclear Energy & Uranium. With this announcement, Technology (2.26%) and Communication Services (1.00%) names posted the only sector gains for the day. The hardest hit yesterday was Utilities (-2.16%), as one of the many executive orders signed on Monday was a very long titled one that effectively shuts down any further offshore wind energy development.

Those two positive sectors were enough to push most broad market equity indexes higher with the Nasdaq Composite gaining 1.28%, the S&P 500 rising 0.61% and the Dow adding 0.30%. The Russell 2000 was the only broad index to falter, dropping 1.61%. To give you an idea of just how distorting mega-cap names can be to an index like the S&P 500, the top 3 contributors to the index’s performance yesterday were Nvidia (NVDA), Microsoft (MSFT), and Amazon (AMZN) but they show up in 12th, 15th, and 39th place in terms of absolute return. Further proof of this is that those top 3 names contributed to just over 110% of S&P 500 index returns yesterday.

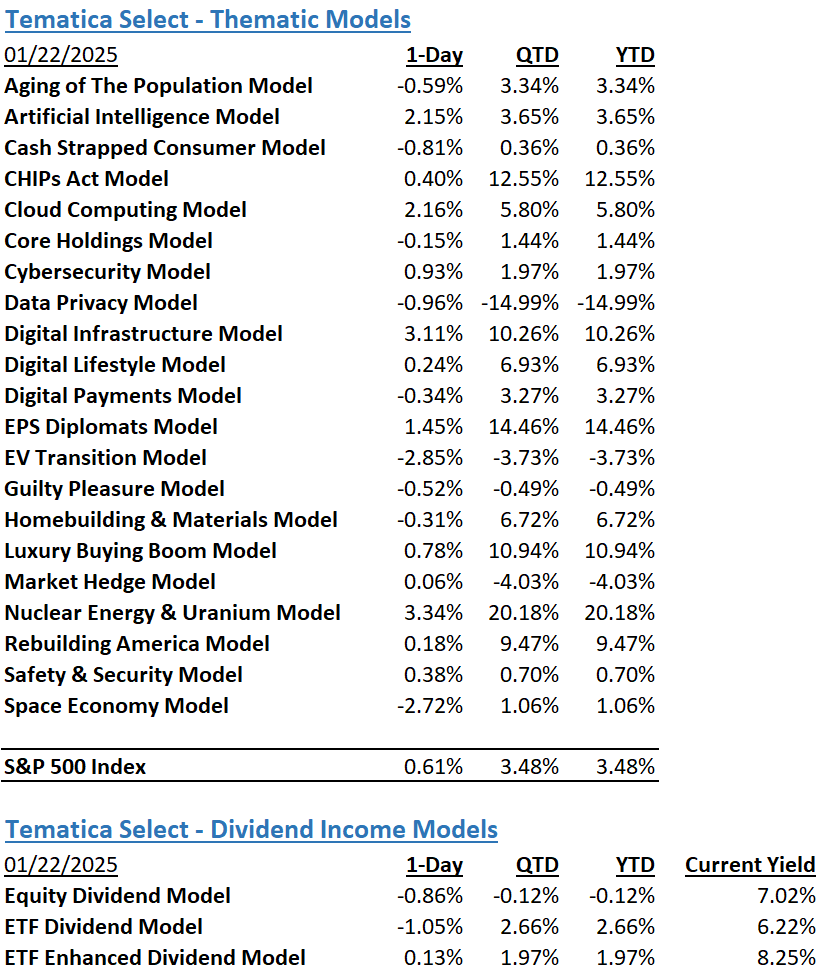

While technology-focused strategies fared well yesterday, the Tematica Select Model Suite also saw modest gains from EPS Diplomats, Luxury Buying Boom, Safety & Security, and Rebuilding America. Month-to-date results for the suite show Nuclear Energy & Uranium, EPS Diplomats, CHIPs Act, Luxury Buying Boom, and Rebuilding America as early first-quarter favorites.

Trump’s WEF Address, Earnings Season Continues, Jan Flash PMI Coming Soon

Following the stock market chugging higher over the last three trading sessions, with the S&P 500 setting a new intra-day high yesterday, equity futures point to a mixed market open. We have no Fed speakers ahead of next week’s policy meeting and little in the way of fresh economic data until Friday’s Flash January PMI report from S&P Global (SPGI).This means the two forces that have been responsible for the market over the last few days will continue to dictate the market’s action. We’re referring to December quarter earnings and the unveiling of Trump policies and other actions.

In that regard, Trump has started to talk more about tariffs, including those for Canada, Mexico, China, and now Russia. Those comments were ahead of Trump’s address to the World Economic Forum at 11 AM ET. During that address, we and other market watchers will be listening for indications and conditions for tariffs on goods imported into the US, the new administration’s stance on Russia-Ukraine, Israel-Palestine, and relations with the EU and China. How Trump walks the tightrope between his pledge to put America first while continuing to foster economic and geopolitical relations with its allies will be in focus.

Our thinking is the response during the remainder of the WEF to Trump’s address is likely to be as important as the address itself. So too will be the comments from management teams that have yet to report their December quarter results. The odds of Trump injecting uncertainty into the geopolitical equation are high, after all the president is rather comfortable in the grey, but as we know from history the stock market is not.

When we dissect tomorrow’s Flash January PMI report, which will give us a hint as to the speed of the US economy starting the new year, we’ll be focused on its insights for inflation, job creation, and new order strength. Should those findings show the economy remaining on vibrant footing, barring a dramatic drop in inflation, which is unlikely, it will give the Fed that much more of a reason to reiterate its cautious stance on further rate cuts. Our suspicion is that will reignite the public second-guessing of the Fed by Trump, adding another layer of uncertainty into the mix.

While we keep one eye on those developments, we’ll also heed the confirmation points for our targeted exposure strategies, including the ones below.

Model Musings

Artificial Intelligence

McDonald’s has announced a multi-year extension of its partnership with artificial intelligence company Cognizant, which was first signed in 2017. According to the companies, McDonald’s will leverage Cognizant’s technology to enhance labor and operational efficiencies by supporting the chain’s global finance systems and human capital management, including payroll processing, franchisee management, data management, and legal applications. Read more here

Goldman Sachs is rolling out a generative AI assistant to its bankers, traders and asset managers, the first stage in the evolution of a program that will eventually take on the traits of a seasoned Goldman employee, according to Chief Information Officer Marco Argenti. Read more here

Google has agreed to a new investment of more than $1 billion in generative AI startup Anthropic… The fresh funding builds on Google’s past investments of $2 billion in Anthropic and 10% ownership stake in the startup, as well as a large cloud contract between the two companies. Anthropic is most well known for its Claude AI chatbot. Read more here

Artificial Intelligence, Digital Infrastructure, Rebuilding America

President Trump announced Tuesday billions of dollars in private sector investment to build artificial intelligence infrastructure in the United States, although Elon Musk soon cast doubt on the size of the investment.

OpenAI, Softbank and Oracle are planning a joint venture called Stargate, Mr. Trump said in a White House briefing… Executives from the companies are expected to commit $500 billion into Stargate over the next four years… In the briefing, Ellison said 10 data centers for the project were already under construction in Texas, and that more were planned. Sources previously told CBS News that Stargate would start with a data center project in Texas, and eventually expand to other states. Read more here

Artificial Intelligence, Digital Lifestyle

Samsung unveiled how SmartThings, its smart home platform, will introduce AI features that allow users to simplify their everyday life through ambient sensing technology and generative AI… Samsung shared that SmartThings will use advanced sensor technology, like millimeter-wave (mmWave) and sound sensor devices in users homes, to understand customers’ daily activities like cooking or sleeping and create the ideal environment. Read more here

Samsung Electronics Co. is banking on an artificial intelligence overhaul and tweaked hardware designs to sell its new line of Galaxy S25 smartphones. The company launched three new devices at an event Wednesday in San Jose, California: the S25 starting at $799, a larger S25+ and the top-tier S25 Ultra priced from $1,299 and up. Read more here

Cash-Strapped Consumer

Consumer stress has intensified, with an escalating share of credit card holders making only minimum payments on their bills, according to a Philadelphia Federal Reserve report. In fact, the share of active holders just making baseline payments on their cards jumped to a 12-year high, data through the third quarter of 2024 shows. Read more here

Luxury Buying Boom

“A growing number of companies, including a seller of vintage goods and a budget hotel chain, are poised for a strong 2025 as increased demand from foreigners boosts earnings outlooks. Japan welcomed almost 37 million inbound visitors in 2024, data released last week by the Japan National Tourism Organization showed. That’s almost a third of the country’s population. Those numbers are set to increase to 40.2 million this year, driven by the weak yen and the World Expo 2025 in Osaka, travel agency JTB Corp. predicts. Read more here

Nuclear Energy & Uranium

In the 2010s, US nuclear plants were struggling to compete against cheap natural gas and renewable energy sources. But the intensifying threat of climate change and the rise of AI have changed the conversation. To bridge the gap to a carbon-free future, America is debating whether or not to build out its atomic power industry. Read more here

Space Economy

Voyager Technologies Inc., a company working on a space station that will travel to orbit aboard Elon Musk’s giant Starship rocket, has initiated the process to go public. Voyager submitted a draft registration statement with the US Securities and Exchange Commission, with the number of shares to be sold and the price range for the proposed offering not yet been determined… Read more here

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

Cash Strapped Consumer - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption or destruction of data.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Digital Lifestyle - The companies behind our increasingly connected lives.

Digital Payments - This model focuses on companies benefitting from the accelerating structural adoption of digital payments and financial technology (FinTech).

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.