Trump Telegraphs Tariff Intentions, Earnings Accelerate, What to Watch

Market Wrap

Markets got a taste of concentration risk as one of only three companies (formerly) valued over $3 trillion fell out of bed as Nvidia (NVDA) fell 16.86% and took close to $600 billion of market value with it. The issue at hand was the announcement of DeepSeek, a Chinese Chat-GPT competitor that claimed to outpace the incumbent while using less hardware (processors) as well as less power. The prospect of lower GPU sales coupled with lower energy requirements hit Technology (-4.96%) and Utilities (-2.37%) hardest yesterday, with Industrials (-1.40%) and Energy (-1.04%) also feeling some pain. The remaining sectors ranged from a flat Materials (0.02%) to Consumer Staples gaining 2.69%.

Unsurprisingly, the Nasdaq Composite led broad equity indexes lower, dropping 3.07%, followed by the S&P 500 which shed 1.46% with Information Technology names contributing to just under 125% of the day's result, and the Russell 2000, closing 1.03% lower. The Dow was the only broad index left unscathed as it posted a 0.65% gain on the day.

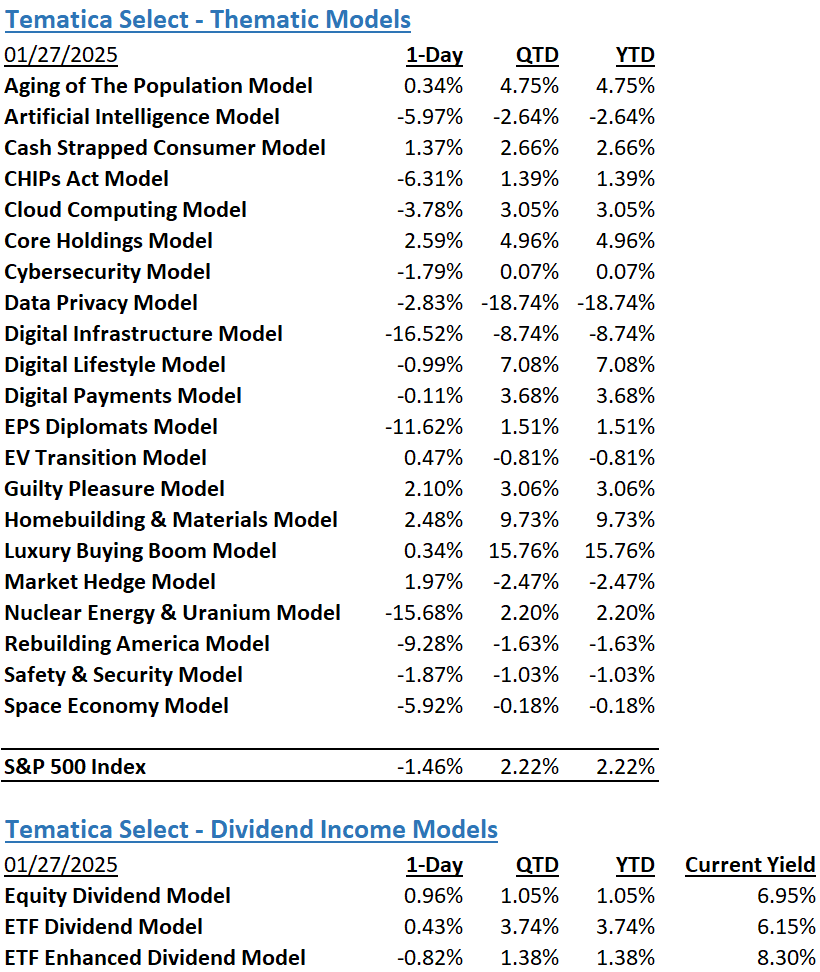

The Tematica Select Model Suite saw some pain in Digital Infrastructure and Nuclear Energy & Uranium yesterday and to a lesser extent, CHIPs Act, AI, and Cloud Computing. Still, the leaderboard saw Core Holdings, Homebuilding & Materials, and Guilty Pleasure fill out the first three slots with positive results and given the Cboe Market Volatility Index’s (VIX) 20% rise, we saw Market Hedge in the fourth slot.

Trump Tariff Indications, Earnings Accelerate, What to Watch

US equity futures point to a rebound following yesterday’s sharp sell off, with shares of Nvidia (NVDA) gaining in premarket trading helping pull the S&P 500 and Nasdaq Composite higher. Other than some rear view facing November housing price data and December Durable Goods Orders, the market will continue to focus on corporate earnings and potential Trump tariffs as it waits for tomorrow’s outcome of the Fed’s latest two-day policy meeting. On the earnings front we have Boeing (BA), General Motors (GM), Lockheed Martin (LMT), SAP SE (SAP), and Synchrony Financial (SYF) report), which should bring fresh data points for our Safety & Security, EV Transition, Artificial Intelligence, Cloud Computing, and Digital Payments models.

Asked about a report yesterday that incoming Treasury Secretary Scott Bessent favored starting with a global rate of 2.5%, Trump said he didn’t think Bessent supported that and wouldn’t favor it himself. Trump went on to say he wanted a rate “much bigger” than 2.5% indicating potential tariffs on semiconductors, pharmaceuticals, steel, copper and aluminum as well as automobiles from Canada and Mexico.

In what has become typical Trump fashion, the president appears to be keeping his options open sharing “I have it in my mind what it’s going to be but I won’t be setting it yet, but it’ll be enough to protect our country…” On the campaign trail last year, Trump indicated tariffs as high as 20%, but that is viewed as an extreme position. Growing speculation calls for a gradual introduction with moderate increases rather than stiff penalties out of the gate.

Our view is Trump and his administration needs to walk and talk tough to bring about new trade deals but not sabotage the economy and the battle against inflation. That’s a high tightrope without a net, and that has us keeping a close eye on the dollar, 10-year Treasury yields, and Fed Chair Powell’s comments tomorrow afternoon.

Model Musings

Artificial Intelligence

In a post on Meta’s official blog, the company said that, in chats with Meta AI on Facebook, Messenger, and WhatsApp for iOS and Android in the U.S. and Canada, users can now tell Meta AI to remember certain things about them, like that they love to travel and learn new languages. In another, perhaps more controversial upgrade to Meta AI, Meta says that the chatbot will now use account info from across Meta’s apps to give personalized recommendations. That info might include the home location on a user’s Facebook profile or recently viewed Instagram videos. Read more here

Cash-Strapped Consumer, Digital Lifestyle

Store closures in the U.S. last year hit the highest level since the pandemic — and even more locations are expected to shutter this year, as shoppers’ dollars increasingly go to a few industry winners, according to an analysis by Coresight Research. Major retailers, including Party City and Macy’s, closed 7,325 stores in 2024, according to the retail advisory group’s data. Read more here

Cybersecurity

Chinese AI platform DeepSeek has disabled registrations on it DeepSeek-V3 chat platform due to an ongoing "large-scale" cyberattack targeting its services. A DDoS attack is when a large amount of traffic is sent to a particular IP address or URL, which uses up the available resources on the devices. This causes the services to no longer function anymore until the DDoS attack is mitigated or stopped. Read More Here

Cybersecurity, Digital Privacy

About a year ago, security researcher Sam Curry bought his mother a Subaru, on the condition that, at some point in the near future, she let him hack it. It took Curry until last November, when he was home for Thanksgiving, to begin examining the 2023 Impreza's internet-connected features and start looking for ways to exploit them. Read More Here

UnitedHealth has confirmed the ransomware attack on its Change Healthcare unit last February affected around 190 million people in America — nearly double previous estimates… The February 2024 cyberattack is the largest breach of medical data in U.S. history and caused months of outages across the U.S. healthcare system. Read more here

Digital Lifestyle

Meta’s X rival Threads said Friday that it is now testing ads with select brands in the U.S. and Japan. Instagram head Adam Mosseri said that the company will listen to feedback before expanding this experiment in other markets. Read more here

Elon Musk’s X has started expanding the rollout of its dedicated vertical video feed to users around the globe just days after its debut in the U.S., TechCrunch has exclusively learned and confirmed with the company… In addition to providing entertainment, the new video feature also allows X to display ads after users scroll through a few short videos. This helps the company generate additional revenue by keeping users engaged with the video content — a strategy common across social networks, including Instagram, TikTok, and others. Read more here

EV Transition

Hyundai and Kia have high hopes for 2025 with new electric SUVs arriving. The IONIQ 9, Hyundai’s first three-row electric SUV, and the smaller Kia EV5 and EV3 models are expected to lift sales this year… Kia will introduce several new EVs in 2025 as it expands its mass-market lineup. The EV5 will launch in Europe, Korea, and other global markets. It has been on sale in China since late 2023, starting at around $20,500 (149,800 yuan). Read more here

Nuclear Energy & Uranium

NextEra Energy Inc., one of the world’s biggest suppliers of wind and solar power, is moving to expand its natural gas and nuclear generation in a bid to meet the surging demand for electricity sparked by artificial intelligence. The company has partnered with gas turbine manufacturer GE Vernova Inc. to build power generation for data centers and factories, Chief Executive Officer John Ketchum said on an earnings call Friday. NextEra has also taken the first step to restarting its shuttered Duane Arnold nuclear plant in Iowa. Read more here

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

Cash Strapped Consumer - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption or destruction of data.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Digital Lifestyle - The companies behind our increasingly connected lives.

Digital Payments - This model focuses on companies benefitting from the accelerating structural adoption of digital payments and financial technology (FinTech).

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.