Treading Water, Solar Eclipse, Earnings Pre-Announcements

With no major economic data points being released today, no corporate earnings on deck, and only one Fed speaker being interviewed - Chicago Fed President Austan Gooldsebee at 1 PM ET - the market will tread water, waiting for Wednesday’s March CPI report. Trading volumes could be a bit lighter than usual this afternoon as folks check out the total solar eclipse that will cross the US today. Tomorrow brings some earnings, but by and large, it will be a repeat of today sans the solar eclipse.

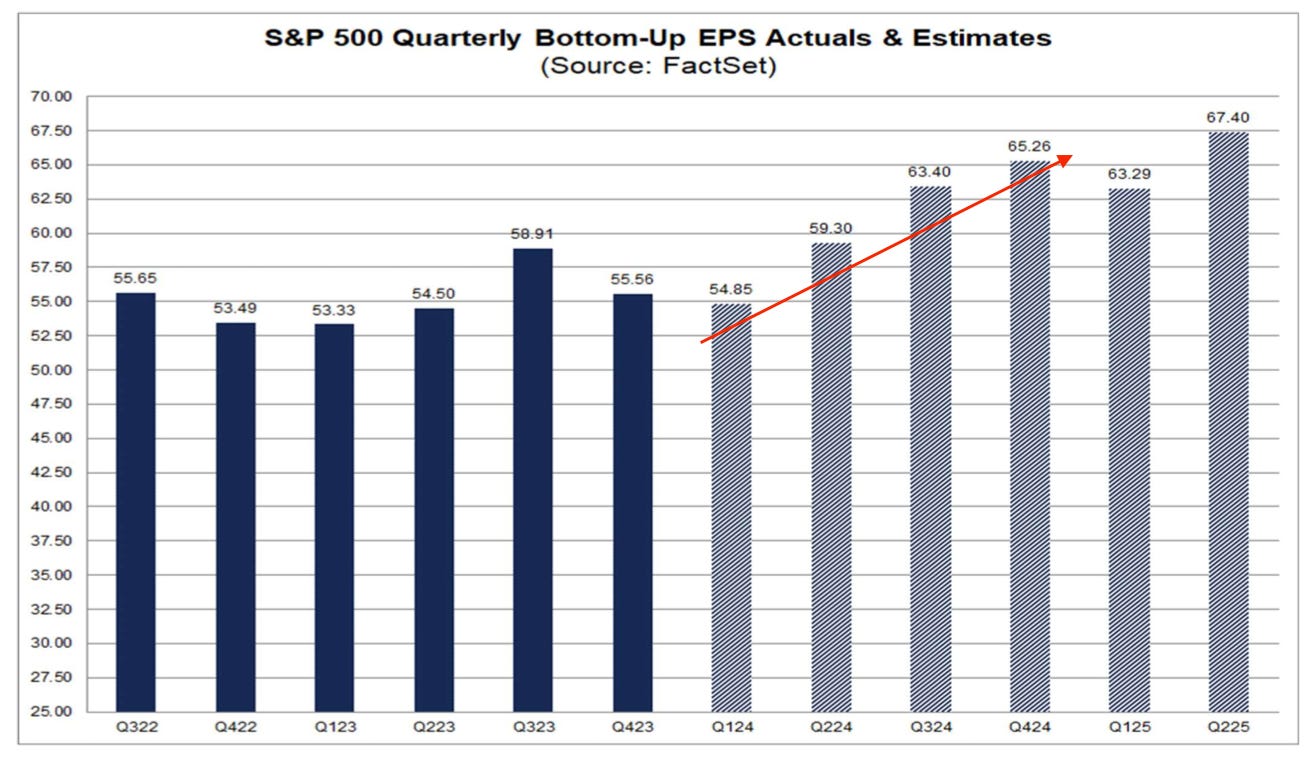

With companies having closed their quarterly books recently, we will be watching for earnings pre-announcements, both good and not-so-good. Our thinking is because of the market forecast for earnings growth to accelerate in the current quarter, earnings guidance will be a key factor in determining the market’s next move.

Helping fill the void, is the 2023 JPMorgan Chase & Co.'s (JPM) shareholder letter penned by Jamie Dimon, which much like Warren Buffett's annual shareholder letter, is always worth a close read. Those interested can find it here.

Model Musings

Artificial Intelligence

“Canada is launching a fund to boost its artificial intelligence sector and creating a new AI safety institute as Prime Minister Justin Trudeau continues to roll out spending announcements in advance of a new budget. The government unveiled a C$2.4 billion ($1.8 billion) package of measures related to artificial intelligence on Sunday. The centerpiece is C$2 billion for “computing capabilities and technological infrastructure” that can accelerate the work of AI researchers, startups and other firms, according to a statement.” Read more here

CHIPs Act

“The U.S. Commerce Department said on Monday it would award Taiwan Semiconductor Manufacturing Co's (TSM)U.S. unit a $6.6 billion subsidy for advanced semiconductor production in Phoenix, Arizona and up to $5 billion in low-cost government loans. TSMC agreed to expand its planned investment by $25 billion to $65 billion and to add a third Arizona fab by 2030, Commerce said in announcing the preliminary award. The Taiwanese company will produce the world's most advanced 2 nanometer technology at its second Arizona fab expected to begin production in 2028, the department said.” Read more here

Cybersecurity

“The Cyber Security Agency of Singapore's (CSA) Cybersecurity Health Report 2023 polled 2,036 small, medium, and large organizations, across 23 sectors, about various aspects of their cybersecurity — breaches faced, business impacts, measures implemented, and the like. It found that, on average, organizations have implemented just over 70% of the requirements necessary to obtain a "Cyber Essentials" certification. The certification includes five categories of national cybersecurity standards: "Assets," "Secure/Protect," "Update," "Backup," and "Respond." Seventy percent is far from perfect, CSA emphasized, and some of its other results were a cause for further concern. But if graded on a curve, Singapore's organizations are doing quite well compared with the rest of the world.” Read more here

Data Privacy & Digital Identity

“The leaders of two key congressional committees are nearing an agreement on a national framework aimed at protecting Americans’ personal data online, a significant milestone that could put lawmakers closer than ever to passing legislation that has eluded them for decades, according to a person familiar with the matter, who spoke on the condition of anonymity to discuss the talks.” Read more here

Homebuilding & Building Materials

“The housing market is likely to continue to face the dual affordability constraints of high home prices and elevated interest rates in 2024,” said Doug Duncan, senior vice president and chief economist at Fannie Mae, in an emailed statement. “Hotter-than-expected inflation data and strong payroll numbers are likely to apply more upward pressure to mortgage rates this year than we’d previously forecast.” Despite ongoing affordability hurdles, Fannie Mae forecasts an increase in home sales transactions compared to last year. Experts also anticipate a slower rise in home prices this year compared to recent years, but price fluctuations will continue to vary regionally and depend strongly on local market supply.” Read more here

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Consumer Inflation Fighters - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption or destruction of data.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Precision Ag & Agri Science – Companies that look to address shrinking arable land by helping maximize crop yields utilizing technology, science, or both.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed below.