Today’s Menu - Retail Earnings and Fed Head Appetizers

Powell's comments and earnings from Macy's, Target, and TJX are yet to come

It is said that even the Lord rested on the seventh day. The S&P 500? It continued to push higher for an eighth day in a row yesterday, marking the longest day-over-day rally of 2024. Odds are today will make nine after retailer Lowe’s Companies (LOW) reported a sales miss and lowered expectation this morning, mirroring some of the consumer weakness its rival Home Depot (HD) reported last week.

These reports and others like them that have pointed to softer consumer spending and a slowing of the economy have thrown fresh logs on the rate cut expectation fire, driving the recent market meltup. Helping those economic concern logs catch fire were recent layoff announcements from Intel (INTC), Cisco (CSCO), Mastercard (MA), General Motors(GM), Stellantis (STLA), and others.

What this means is the ongoing rally has more to do with speculation on the Fed’s reaction to the cumulative effect of such weakness and the implications on 2H 2024 GDP. The fix for all of this? Rate cuts, of course.

Today, we are back in familiar territory with what is essentially a holding pattern until the next wave of earnings from Macy’s(M), Target (TGT), and TJX Companies (TJX) are reported tomorrow morning. We will get some additional color on the consumer today through quarterly results and guidance from Lowe’s (LOW) and Coty (COTY), but earnings from Home Depot (HD) and Estee Lauder (EL) set those tables. The guidance from those companies as well as others this week will help the market reformulate its thinking about consumer spending in 2H 2024. That collective guidance will also reframe 2H 2024 EPS expectations for the S&P 500 and could raise some flags about the market’s recent string of up days that have it no too far from its 2024 high. It’s not lost on us that historically September has been the poorest-performing month for the stock market.

Wednesday also brings the next iteration of Fed meeting minutes, which because of more recent economic data and Fed official commentaries, are more likely to be a non-event. The big event the market is building toward this week is what Fed Chair Powell will say on Friday from the Jackson Hole Economic Symposium. Some, like Evercore ISI, think Powell will outline a flexible approach to rate cuts, including the central bank being open to a 50 basis point rate cut. We may get some clues today from Atlanta Fed President Raphael Bostic and Fed Chair for Supervision Michael Barr but it’s Powell the market is waiting for.

Our thinking is that while Powell will recognize further inflation progress and reiterate the Fed is closely watching the employment market, we do not see him definitively tipping the Fed’s hand. Powell may say the Fed is increasingly comfortable with starting rate cuts, but with just under four weeks until the September policy statement and a raft of data coming before then he’s going to keep his cards as close to his vest as he can. Even if it is increasingly obvious what the Fed is likely to do. The risk isn’t that Powell will be more hawkish than expected, but that he may not be as dovish as the market expects.

As we wait for the Fed chief, we will continue to keep a close eye on the Canadian National Railway (CNI) and Canadian Pacific Kansas City (CP) plan to lock out workers from the early hours of Thursday. Potential work stoppages would not only bring billions of dollars of economic damages, but it would also disrupt rail trade across North America. It’s the impact of those ripple effects on the economy and particular companies we and others will be attempting to determine. Like any other work stoppage or strike, the longer it goes on, the greater the disruption.

Model Musings

Aging Population

“As the Lewiston-Clarkston Valley’s population ages, the strain on medical providers locally will be especially impactful in primary care, said TriState Health CEO Kym Clift… Primary care shortages are being felt across the country in every population, Clift said, but especially in rural areas. The Valley’s high senior population also increases the need for access to specialty care, she said. Read more here

Artificial Intelligence

“Agents come in many forms, many of which respond to prompts humans issue through text or speech. Yet as organizations figure out how generative AI fits into their plans, IT leaders would do well to pay close attention to one emerging category: multiagent systems. In such systems, multiple agents execute tasks intended to achieve an overarching goal, such as automating payroll, HR processes, and even software development, based on text, images, audio, and video from large language models (LLMs).” Read more here

“As businesses have become more complex and computing more ubiquitous, ERP platforms have grown into aggregated tech stacks or suites with vertical extensions that track data from supply chain, logistics, asset management, HR, finance, and virtually every aspect of the business. But adding all those facets—and their attendant data streams—to the picture can clutter the frame, hampering the agility of an ERP platform. Generative AI helps restore clarity. Read more here

“General Motors is cutting around 1,000 software workers around the world in a bid to focus on more “high-priority” initiatives like improving its Super Cruise driver assistance system, the quality of its infotainment platform and exploring the use of AI.” Read more here

“Worldwide spending on artificial intelligence (AI), including AI-enabled applications*, infrastructure, and related IT and business services, will more than double by 2028 when it is expected to reach $632 billion, according to a new forecast from the International Data Corporation (IDC).. Software will be the largest category of technology spending, representing more than half the overall AI market for most of the forecast. Two-thirds of all software spending will go to AI-enabled Applications and Artificial Intelligence Platforms while the remainder will go toward AI Application Development & Deployment and AI System Infrastructure Software.” Read more here

Cash-strapped Consumer

“Home Depot Inc. lowered its forecast of a key sales metric for the year on expectations that consumers will continue to hold back spending in the coming months. The retailer said it now sees comparable sales falling 3% to 4% for the year versus the previous expectation for a 1% decline across online sales and stores open at least a year.’ Read more here

Data Privacy & Digital Identity

“Flight tracking site FlightAware has blamed a “configuration error” for exposing a raft of personal information of its customers, including some of their Social Security numbers. The company, which claims to be one of the largest aggregators of flight data, said in a notice on its website that it identified the unspecified error on July 25, which exposed names, email addresses, and more, depending on what information users provided to the company.” Read more here

“As it stands today, only four states have launched support for digital IDs via Apple Wallet on your iPhone and Apple Watch: Arizona, Colorado, Maryland, and Georgia… According to data compiled by the Secure Technology Alliance, over 20 states are in the process of adopting mobile digital licenses. While this doesn’t necessarily mean they will go on to support Apple Wallet’s implementation of the feature, it means they are exploring the idea.” Read more here

Digital Infrastructure, Nuclear Energy & Uranium

“AWS, Microsoft, and Google are going nuclear to build and operate mega data centers better equipped to meet the increasingly hefty demands of generative AI. Earlier this year, AWS paid $650 million to purchase Talen Energy’s Cumulus Data Assets, a 960-megawatt nuclear-powered data center on site at Talen’s Susquehanna, Penn., nuclear plant, with additional data centers planned — pending approval by the Nuclear Regulatory Agency. Microsoft, Google, and Nucor, a steel manufacturer, released a request for information (RFI) about clean energy, and Baltimore-based energy company Constellation responded “to the RFI with our points on advanced nuclear being a fit at existing nuclear sites,” says a spokesperson for Constellation, one of the nation’s largest nuclear power providers.” Read more here

Digital Lifestyle

“Canalys’ latest forecast predicts that an estimated 48 million AI-capable PCs will ship worldwide in 2024, representing 18% of total PC shipments. But this is just the start of a major market transition, with AI-capable PC shipments projected to surpass 100 million in 2025, 40% of all PC shipments. In 2028, Canalys expects vendors to ship 205 million AI-capable PCs, representing a staggering compound annual growth rate of 44% between 2024 and 2028.” Read more here

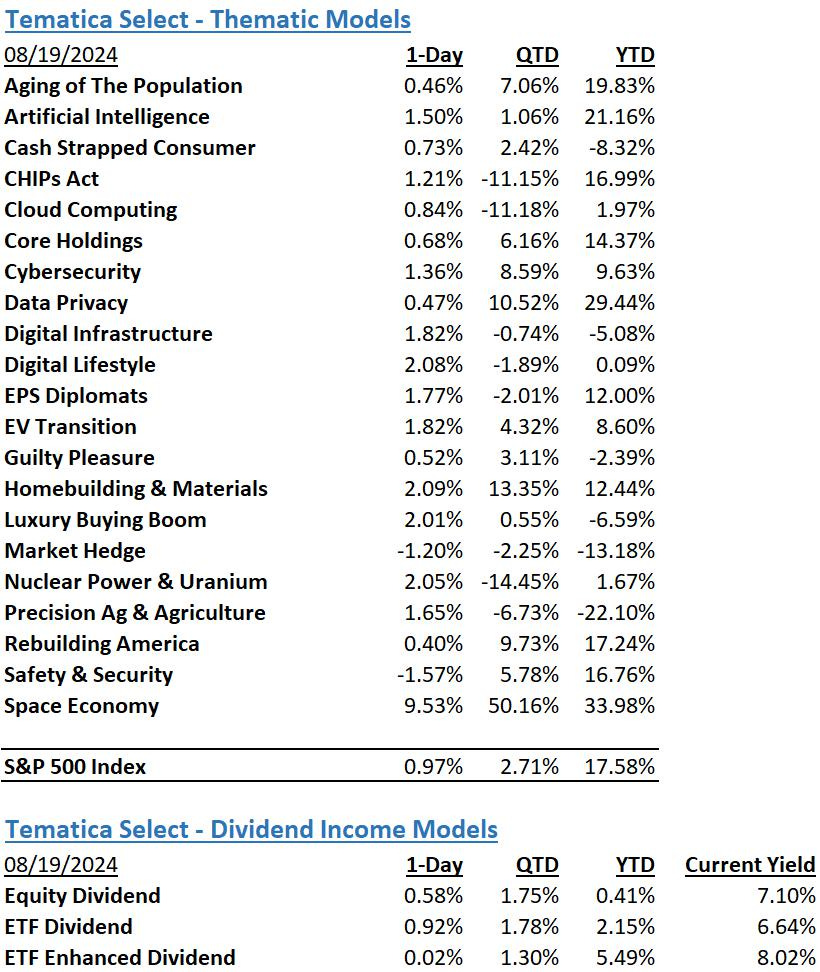

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

Cash Strapped Consumer - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption or destruction of data.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Digital Lifestyle - The companies behind our increasingly connected lives.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Precision Ag & Agri Science – Companies that look to address shrinking arable land by helping maximize crop yields utilizing technology, science, or both.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed below.