Tariffs and Uncertainty Take Their Toll on Corporate Guidance

What will Bessent say at 8:30 AM ET today?

Market Recap

Markets took a bit of a break yesterday, evidenced by the muted results from broad equity indexes. Mag 7 and technology stocks detracted from returns given the 0.10% decline in the Nasdaq Composite, the 0.06% gain in the S&P 500, and the 0.28% rise in the Dow. Small caps set the pace, closing 0.41% higher. Among Mag 7 names, Apple (AAPL) and Meta Platforms (META) were the only to show up in the top ten contributors to return for the SPDR S&P 500 ETF Trust(SPY). Apple saw gains on news of the company planning to manufacture all US-bound iPhones in India, avoiding China tariffs and Meta bulls lifted offers in hopes of the company prevailing in its antitrust lawsuit with the Federal Trade Commission.

Sectors closed higher except for Technology and Consumer Staples which fell 0.16% and 0.33%, respectively as tariff expectations and overall consumer health weighed on both. The remaining sectors post gains ranging from 0.04%(Consumer Discretionary) to 0.70% (Energy), despite crude dropping 1.51% (BRENT) to 1.61% (WTI).

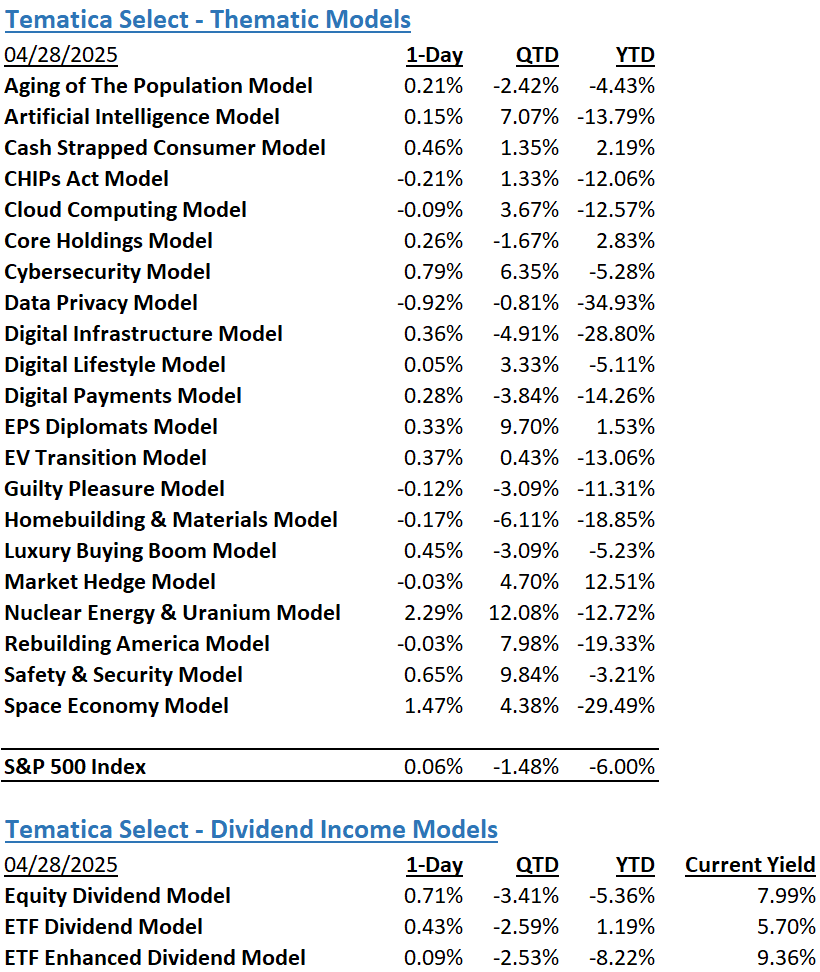

The Tematica Select Model Suite saw mixed results, with 5 strategies ending the day essentially flat. Leadership came from Nuclear Energy & Uranium and Space Economy, and laggards included the CHIPs Act and Data Privacy.

Tariffs and Uncertainty Take Their Toll on Corporate Guidance

With the current Fed quiet period, the likely factors driving the market this week will be the rapid-fire pace of quarterly earnings, developments on the trade and policy front from the White House to drive market action, and the start of April economic data. In keeping with those three forces, we will want to revisit equity futures closer to the opening bell following downside guidance issued this morning from Polaris Industries (PII), Hilton (HLT), Volvo Cars (VLVOF), Electrolux, and others as well as pulled guidance from NXP Semiconductors (NXPI) last night and UPS (UPS) and General Motors (GM) this morning. As of this writing, we have yet to hear from the likes of Coca-Cola (KO), Corning GLW), JetBlue (JBLU), Sherwin Williams (SHW), SoFi Technologies (SOFI), and Smithfield Foods (SFD).

As those results pour in, the market will continue to update how it sees equity markets starting today. Factoring into that thinking will be what is learned from this morning’s 8:30 AM ET White House briefing that will include Treasury Secretary Scott Bessent. Recent comments from Bessent point to potential trade deals with India and Japan, while others indicate a long road to a trade deal with China. At the same time, stern comments yesterday from Chinese Foreign Minister Wang Yi that appeasement will only embolden the “bully” diminish the prospects for a quick trade deal with China.

We could also see Bessent discuss more of President Trump’s economic agenda and its reported Fourth of July soft deadline. The “megabit” includes trade, a multi-trillion tax cut package, and deregulation seems like a tall order with Senate Majority Leader John Thune calling the deadline “aspirational”. House Speaker Mike Johnson has set an end-of-May goal for the House to pass legislation that includes a renewal of Trump’s first-term cuts and a fresh round of levy reductions, partly paid for by curbing federal spending.

We’ll know more after this morning’s White House briefing but barring any meaningful developments on trade deals and tariffs, investors should brace for more downside guidance to come during this busiest week of the March quarter earnings season. While we are not ones to pat ourselves on the back much if ever, we will say the earnings season so far is playing out largely as we expected. Recent comments from Amazon (AMZN), Nvidia (NVDA), and Alphabet (GOOGL)confirm demand for AI and data center chips remains strong. Earnings from SAP SE (SAP) and ServiceNow(NOW)confirm AI adoption is accelerating. We continue to read of fresh cyber-attacks and cybersecurity companies embracing AI to fend off bad actors while consumers feel the pinch of economic uncertainty and inflation.

Those data points and other signals support the corresponding Tematica models listed below, but the prospect of more companies slashing or pulling their guidance and the S&P 500 staring down its 50-day moving average are reasons to revisit the Market Hedge model.

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

Cash Strapped Consumers - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

Digital Infrastructure & Connectivity - Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

Digital Lifestyle - The companies behind our increasingly connected lives.

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.