After the Dow hit a fresh record high yesterday, futures point to further gains when equity markets open later this morning. Helping provide some of that lift this morning are reports of China’s central bank unveiling a broad package of monetary stimulus measures to jump-start its economy. People’s Bank of China governor Pan Gongsheng announced the bank will cut a key short-term interest rate, the PBOC will open their equivalent Fed Lending window directly to non-bank investors, and unveiled plans to reduce the amount of money banks must hold in reserve to the lowest level since at least 2018.

So far, September has bucked the trend

Despite September’s reputation for being a challenging month, with five trading days left to go in the month, so far the S&P 500 and the Nasdaq Composite are up 1.2% and 1.4%, respectively, month to date. Those gains have once again pushed the market into short-term overbought and stretched the S&P 500’s P/E valuation to 23.6x consensus 2024 EPS. However, 2H 2024 EPS growth levels compared to 1H 2024 have continued to soften and stood at 6.8% coming into this week, down from 11.2% at the end of July.

September Flash PMI: The job market weakened… again

Coming off yesterday’s S&P Global’s Flash PMI report that showed US business activity “remained robust in September… signaling a sustained economic expansion…” However, the report also noted order books moderated, while business expectations softened with survey respondents citing uncertainty ahead of the Presidential Election. The Flash report also showed prices charged rose at the fastest rate in six months as input cost growth hit a one-year high. Notably, Service sector input cost growth hit a 12-month high largely due to wage growth pressures.

That will likely catch the eye of the dozen Fed heads making the rounds this week, including Fed Chair Powell, who speaks on Thursday. The other item central bankers probably noticed in the Flash PMI report was employment fell for the second consecutive month in September. While modest, it points to further softening in the labor market an area of increasing focus for the Fed. Other data next week will bring another take on the jobs market in September. As it’s published, we’ll want to parse central banker comments for clues as to how that data may influence the cadence of future rate cuts and mesh with its forecast for an additional 50 basis points in cuts for this year.

Homebuilding data and Micron’s earnings

In between comments from Federal Reserve Governor Michelle Bowman today at 9 AM ET and Federal Reserve Governor Adriana Kugler at 4 PM ET tomorrow, given our Homebuilding & Materials model, we’ll be digging into quarterly results from KB Home (KBH) and out tonight and tomorrow’s New Home Sales report.

August single-family housing starts moved up nicely month-over-month, but we’ll be looking to see if the recent decline in mortgage rates has started to stir housing fence-sitters. The consensus forecast for August New Home Sales is 700,000 down from 739,000 in July. With KB, we’ll be looking to see if its guidance for 2H 2024 is as strong as the delivery forecast issued by Lennar (LEN) last week which calls for a 21% increase in 2H 2024 home deliveries compared to 1H 2024.

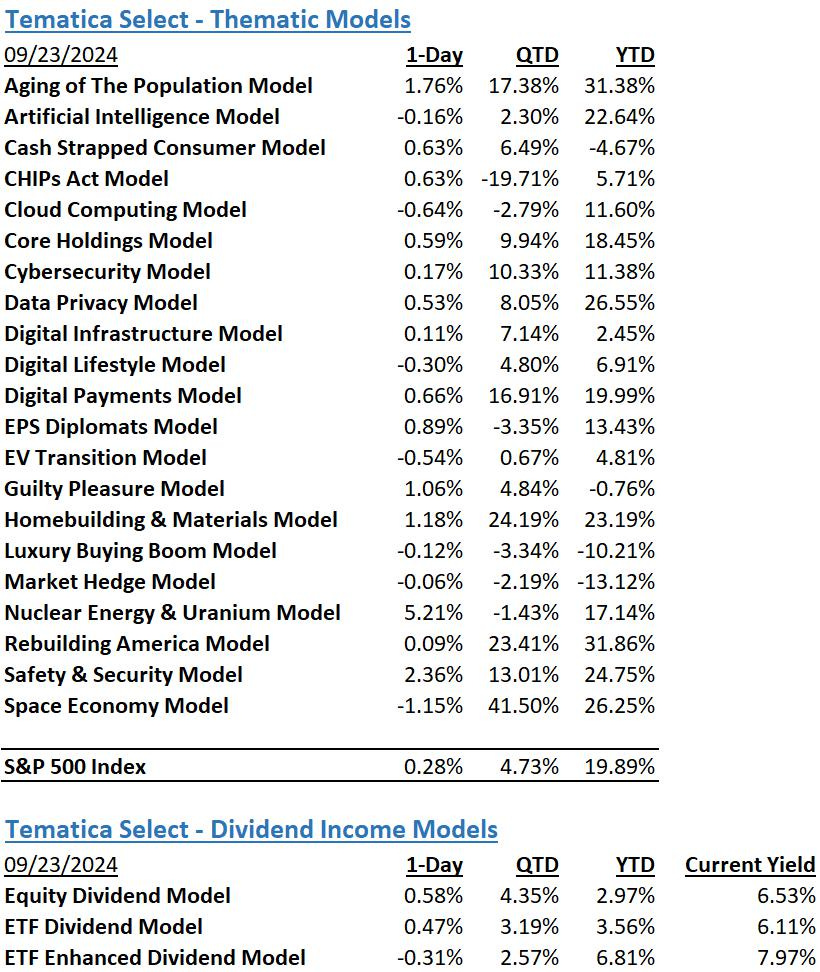

Quarterly results after Wednesday’s market close, we expect Micron (MU) will reiterate prior comments about AI’s impact on memory demand. As it does that, we are interested in the underlying color for the data center, PC, and smartphone markets given our thematic model lineup below.

Model Musings

Artificial Intelligence

“New research from IDC entitled, The Global Impact of Artificial Intelligence on the Economy and Jobs, predicts that business spending to adopt artificial intelligence (AI), to use AI in existing business operations, and to deliver better products/services to business and consumer customers will have a cumulative global economic impact of $19.9 trillion through 2030 and drive 3.5% of global GDP in 2030.” Read more here

“LinkedIn user data is being used to train artificial intelligence models, leading some social media users to call out the company for opting members in without consent. The professional networking platform said on its website that when users log on, data is collected for details such as their posts and articles, how frequently they use LinkedIn, language preferences and any feedback users have sent to the company.” Read more here

Artificial Intelligence, Digital Infrastructure

“As artificial intelligence (AI) continues to be integrated into everything, everywhere, 5G networks are starting to feel the strain—particularly when it comes to uplink traffic. A recent analyst forecast tipped uplink traffic to increase significantly in the coming years. And shifting traffic patterns mean mobile networks must adapt to avoid future bottlenecks.” Read more here

Artificial Intelligence, Safety & Security

“The survey data indicated that public safety usage of AI or smart solutions is far from achieving critical mass, with only a small percentage (14%) of public safety agencies reporting using AI or smart solutions today. There is, however, growing excitement on the role these technologies will play in shaping the future of the industry. In fact, 75% of respondents believe that AI and smart solutions will be important or even a top priority in the future.” Read more here

Cybersecurity

“On Sept. 12, a law firm announced that Lehigh had agreed to pay $65 million to settle the case. As hackers penetrate American health-care firms with alarming regularity, the episode reveals how cyberthieves are exploiting uniquely sensitive data — with devastating human and financial consequences. Data breaches that compromise health information of hundreds of Americans happen on a near-daily basis…” Read more here

Digital Infrastructure

“The U.K. last week became the latest to designate data centers as critical infrastructure. Germany also regulates IT as key infrastructure as does the European Union through The NIS Directive and Digital Operational Resilience Act (DORA). DORA is focused on the financial sector but includes provisions for managing third party ICT risks. The U.S. also classifies data centers as critical infrastructure per a National Security Memorandum signed by President Joe Biden in April…” Read more here

Digital Infrastructure, Nuclear Power & Uranium

“Pennsylvania’s dormant Three Mile Island nuclear plant would be brought back to life to feed the voracious energy needs of Microsoft under an unprecedented deal announced Friday in which the tech giant would buy 100 percent of its power for 20 years.” Read more here

Digital Lifestyle

“YouTube confirms advertisers can broadly target your paused screentime: “As we’ve seen both strong advertiser and strong viewer response, we’ve since widely rolled out Pause ads to all advertisers… YouTube follows Hulu and AT&T in selling pause ads; Sling TV also just introduced pause ads in July…” Read more here

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

Cash Strapped Consumer - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption or destruction of data.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Digital Lifestyle - The companies behind our increasingly connected lives.

Digital Payments - This model focuses on companies benefitting from the accelerating structural adoption of digital payments and financial technology (FinTech).

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed below.