Rate Cut Expectations, Waiting for Retail and HP Earnings

But we have a bevy of model musings to tide you over

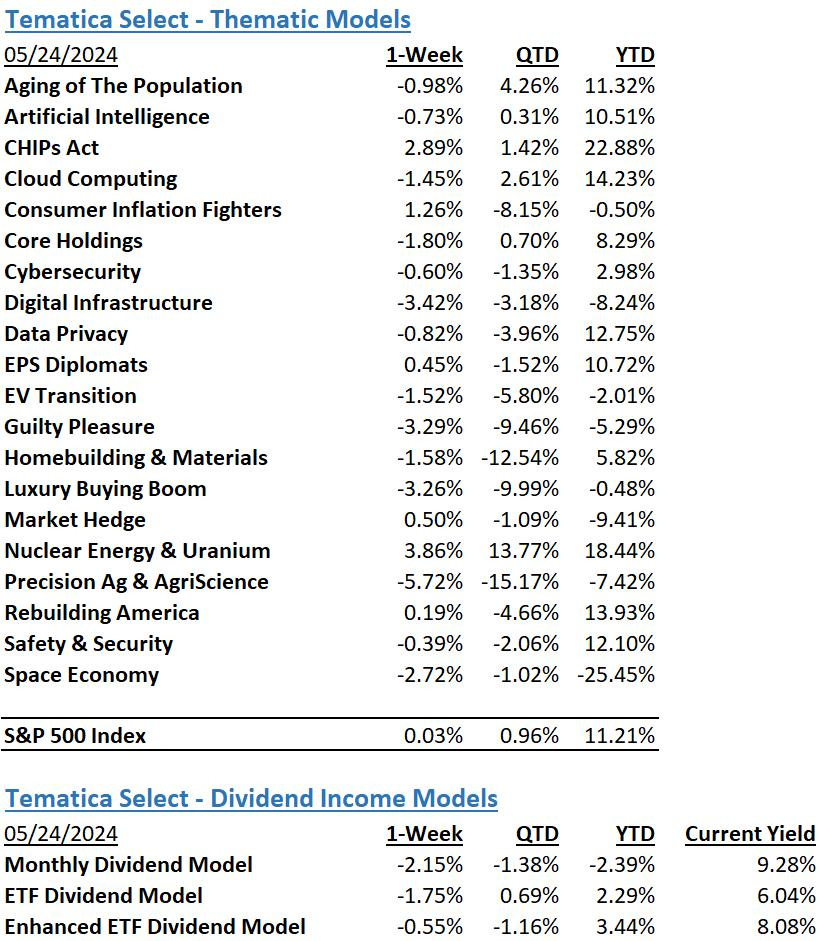

We kick off a compressed set of trading days this week, which will also end May. Month to date, the market regained ground last in April with the S&P 500 up 5.3% and the Nasdaq Composite up 8.1%. AI-related stocks had a strong hand in that following Nvidia’s (NVDA) beat and raise earnings report last week. Quarter to date, those market barometers are up 11.2% and 12.7% respectively, while the Dow and Russell 2000 trail behind, up just 3.7% and 2.1%.

With no market moving earnings reports out before equities start trading today, equity futures point to a positive start to the last week of May trading. Providing some lift are reports Apple’s (AAPL) iPhone shipments in China rebounded 52% amid a flurry of discounts from retail partners. As a reminder, AAPL shares account for ~6.1% of the S&P 500 and ~10.0% of the Nasdaq Composite.

We also have a rather light economic calendar as well, but no shortage of Fed speakers ahead of Friday’s April PCE Price Index data. Last week’s Flash May PMI report from S&P Global showed the manufacturing and services components of the economy re-accelerated with favorable order growth pointing to more of the same in the coming month. Both input costs and output prices meanwhile rose at

faster rates, with manufacturing having taken over as the main source of price growth over the past two months.

Those findings help explain recent comments from Fed officials calling for several more months of data to see further and sustained progress on inflation before cutting interest rates. Early this morning, Minneapolis Fed President Neel Kashkari shared the central bank could potentially even hike rates if inflation fails to come down further. Kashkari will speak again today at 9:55 AM ET with Fed Governor Cook and San Francisco Fed President Mary Daly both speaking at 1:55 PM ET today. Last week we saw September rate cut expectations soften considerably, and odds are today’s comments will have a similar effect.

While tomorrow, Wednesday, May 29, largely brings more of the same the market will chew on another wave of retail earnings, including those from Abercrombie & Fitch (ANF), American Eagle (AEO), and Dick’s Sporting Goods(DKS). Also on the docket will be quarterly results and guidance from HP (HPQ) and Salesforce (CRM). AI will no doubt be a topic of their conversation, but with HP we’ll be listening for its thoughts on the PC market and the looming AI-on-device upgrade cycle.

Model Musings

Artificial Intelligence, Digital Infrastructure & Connectivity

“Manufacturers say these devices process data more swiftly than traditional PCs and can handle a greater volume of AI tasks directly on the device, including chatbots. That means they do not have to rely on cloud data centers that currently power most AI applications, including OpenAI's ChatGPT… Research firm Canalys estimates AI PC shipments will surpass 100 million in 2025, constituting 40% of all PCs shipped.” Read more here

CHIPs Act

“China has set up the country’s largest-ever semiconductor investment fund to propel development of the domestic chip industry, the latest effort from Beijing to achieve self-sufficiency as the US seeks to restrict its growth. The third phase of National Integrated Circuit Industry Investment Fund has amassed 344 billion yuan ($47.5 billion) from the central government and various state-owned banks and enterprises, including Industrial & Commercial Bank of China Ltd., according to Tianyancha, an online platform that aggregates official company registration information. The fund was incorporated on May 24.” Read more here

Consumer Inflation Fighters

“In recent weeks, Target and Aldi have broadcast price cuts on thousands of items, while Walmart unveiled a new private label lineup of quality “chef-inspired food” mostly in the $5-and-under range. The shift comes as U.S. consumers have been signaling their discontent with more subdued spending — threatening retailers’ bottom lines. Read more here

“More pain could be on the way. In a recent report, analysts at S&P Global Ratings said factors including weak demand from low-income consumers is likely to hurt performance at dollar stores like Dollar General and Dollar Tree — though those remain investment-grade — at least through the remainder of the year. “This consumer is still spending, but they’re definitely being more discerning,” said Anthony Chukumba, an equity analyst at Loop Capital Markets.” Read more here

Cybersecurity

“For more than two weeks, thousands of medical personnel have turned to manual methods after a cyberattack on Ascension, one of the nation’s largest health systems with about 140 hospitals in 19 states and the District of Columbia.

The large-scale attack on May 8 was eerily reminiscent of the hack of Change Healthcare, a unit of UnitedHealth Group that manages the nation’s largest health care payment system. The assault shut down Change’s digital billing and payment routes, leaving hospitals, doctors and pharmacists without ways to communicate with health insurers for weeks. Patients were unable to fill prescriptions, and providers could not get paid for care.” Read more here

Data Privacy

“Fake accounts posting about the U.S. presidential election are proliferating on the social media platform X, according to a social media analysis company's report shared with Reuters exclusively ahead of its release on Friday. Analysts from Israeli tech company Cyabra, which uses a subset of artificial intelligence called machine learning to identify fake accounts, found that 15% of X accounts praising former President Donald Trump and criticizing President Joe Biden are fake.” Read more here

“U.S. drug distributor Cencora (COR.N), opens new tab has notified affected individuals that their personal and highly sensitive medical information was stolen during a cyberattack and data breach earlier this year, the company said on Friday.

The company, formerly known as AmerisourceBergen Corp, had disclosed a cybersecurity incident in February, in which data, some of which may have contained personal information, was stolen from its information systems.” Read more here

EV Transition

“Cheap electric vehicles from China are already pushing into Europe, undercutting one of the region’s biggest industries. BYD Co., which overtook Tesla Inc. late last year as the biggest global EV maker, is about to raise the stakes. The Chinese manufacturer announced plans last month to bring its Seagull hatchback to Europe next year.” Read more here

“Starting this coming August, Silicon Valley startup Zūm will provide 74 electric buses to the Oakland school district, making it the first all-electric bus fleet serving a major US school district. These buses will also supply 2.1 gigawatt-hours of electricity to the Bay Area power grid, which is enough energy for 300 to 400 homes.” Read more here

Guilty Pleasure

“For the first time on record, cannabis has outpaced alcohol as the daily drug of choice for Americans. In 2022 there were 17.7 million people who reported using cannabis either every day or nearly every day, compared with 14.7 million who reported using alcohol with the same frequency, according to a study, published on Wednesday in the journal Addiction that analyzed data from the U.S. National Survey on Drug Use and Health.” Read more here

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Consumer Inflation Fighters - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption or destruction of data.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Precision Ag & Agri Science – Companies that look to address shrinking arable land by helping maximize crop yields utilizing technology, science, or both.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed below.