With two last trading days in the second quarter, investors and traders alike will be looking for any surprises in today’s pending home sales figures, which are predicted to have swung back into positive territory to 0.10% after MoM growth plunged to -7.66%, levels not seen since 2022. Also on everyone’s radar will be tomorrow’s PCE Deflator updates for both top-line and core. Expectations are for both measures to have backed off slightly with top-line falling 0.10% to 2.6% and core to have retreated 0.20% to 2.6%. As always, the devil is in the details and we will be among the many parsing through those details to better gauge just how the consumer is doing and where potential pain points might be.

Speaking of the consumer, while Levi Strauss (LEVI) surprised 45% to the upside yesterday, today we’ll see if Nike (NKE) has any surprises in store given analysts’ earnings estimates of $0.85 per share. Also reporting today are Walgreen’s Boot Alliance (WBA) and McCormick & Company (MKC).

While there have been some concerns about bank strength this year, the Fed came out yesterday and revealed that all 31 of the banks and lenders that participated in this year’s stress test were “able to absorb losses while maintaining more than the minimum required capital levels.” The scenario included evaluating capital levels in a hypothetical environment where unemployment spiked to 10%, commercial real estate values fell 40% and housing prices declined 36%.

As we head into vacation season, the outlook calls for more of the same, with the CME’s Fedwatch Tool reporting that fed funds futures traders have priced in a roughly 90% chance the Fed takes no action in its July meeting and only a 56% chance we see a 25 basis point cut in September. Given the Fed’s data-dependent nature, we’ll have to see what unfolds over July and August but for now, the status quo works for us. See you in the third quarter!

Model Musings

Artificial Intelligence

“New generative features let you craft pitches using Salesforce, summarize your employees’ skills in Workday, create images from prompts in Adobe Inc.’s Photoshop, and automatically draft responses to IT requests in ServiceNow. But a year and a half into AI mania, there isn’t much revenue to show for this work. For most big application software companies, AI-related sales won’t appear on the profit-and-loss statements till next year — or the year after that.” Read more here

“… we believe we’re already entering the second wave of AI in the enterprise—an entirely new category of AI usage. Wave 1 lasted a good twelve months, with companies first experimenting with generative AI by tinkering with tools like ChatGPT… The start of Wave 2 was marked by Microsoft releasing CoPilot earlier this year… during this second wave, companies are adopting AI and applying it to practical use cases, often as part of existing workflows that are long engrained into the enterprise.” Read more here

“A consortium of NATO allies has confirmed the first tranche of companies awarded funding as part of the group’s one billion euro ($1.1 billion) innovation fund… The fund is backed by 24 of NATO's 32 member states, including Finland and Sweden, which joined the alliance earlier this year.” Read more here

Artificial Intelligence, Data Privacy

“To provide the new bespoke services, the companies and their devices need more persistent, intimate access to our data than before. In the past, the way we used apps and pulled up files and photos on phones and computers was relatively siloed. A.I. needs an overview to connect the dots between what we do across apps, websites and communications, security experts say… The biggest potential security risk with this change stems from a subtle shift happening in the way our new devices work, experts say. Because A.I. can automate complex actions — like scrubbing unwanted objects from a photo — it sometimes requires more computational power than our phones can handle. That means more of our personal data may have to leave our phones to be dealt with elsewhere.” Read more here

Cybersecurity

“Hackers are exploiting a flaw in a premium Facebook module for PrestaShop named pkfacebook to deploy a card skimmer on vulnerable e-commerce sites and steal people's payment credit card details. PrestaShop is an open-source e-commerce platform that allows individuals and businesses to create and manage online stores. As of 2024, it is used by approximately 300,000 online stores worldwide.” Read more here

Data Privacy

“McAfee report reveals that 30 percent of adults have fallen victim (or know someone who has fallen victim) to online scams while trying to save money on travel… The travel scams we are seeing this summer are not necessarily new, but they are being supercharged by generative AI tools that fraudsters are using to create realistic content… These listings look authentic thanks to AI-generated text and images… But clicking on a link in the fraudulent listing may send you to a fake booking website that collects your credit card details and other personal information.” Read more here

“On every smartphone there sits a stalker’s paradise of location data ready to be shared. This treasure trove is what allows you to watch a food delivery pull up outside your door and check what restaurants are nearby. It can also be used to track you. Location tracking is so precise that it can pinpoint one person in a crowd. And this tech is marketed as convenient, not creepy.” Read more here

Luxury Buying Boom

“Despite inflationary pressures, consumers continue to prioritize leisure travel with the higher-earning demographic still driving growth, according to Hyatt CFO Joan Bottarini. About 50% of the company’s revenue, globally, is leisure-based travel, 20% is business, and about 30% is group travel, Bottarini said. Hyatt’s goal is to attract high-income level consumers with a focus on luxury.” Read more here

EV Transition

“Volkswagen said earlier this year it was sticking with plans to launch 25 EV models in North America across its group brands by 2030, even as it acknowledged slowing growth in the segment. The company's shares are down around 3% so far this year.

Mavka Capital's Golomb said VW is not a big player in the large SUV and pickup segments in the U.S. and it has failed to break through with its crossover electric SUV ID4. But the partnership with Rivian gives the company options, he said.” Read More Here

Nuclear Energy & Uranium

“The dramatic increase in power demands from Silicon Valley’s growth-at-all-costs approach to AI also threatens to upend the energy transition plans of entire nations and the clean energy goals of trillion-dollar tech companies. In some countries, including Saudi Arabia, Ireland and Malaysia, the energy required to run all the data centers they plan to build at full capacity exceeds the available supply of renewable energy…” Read more here

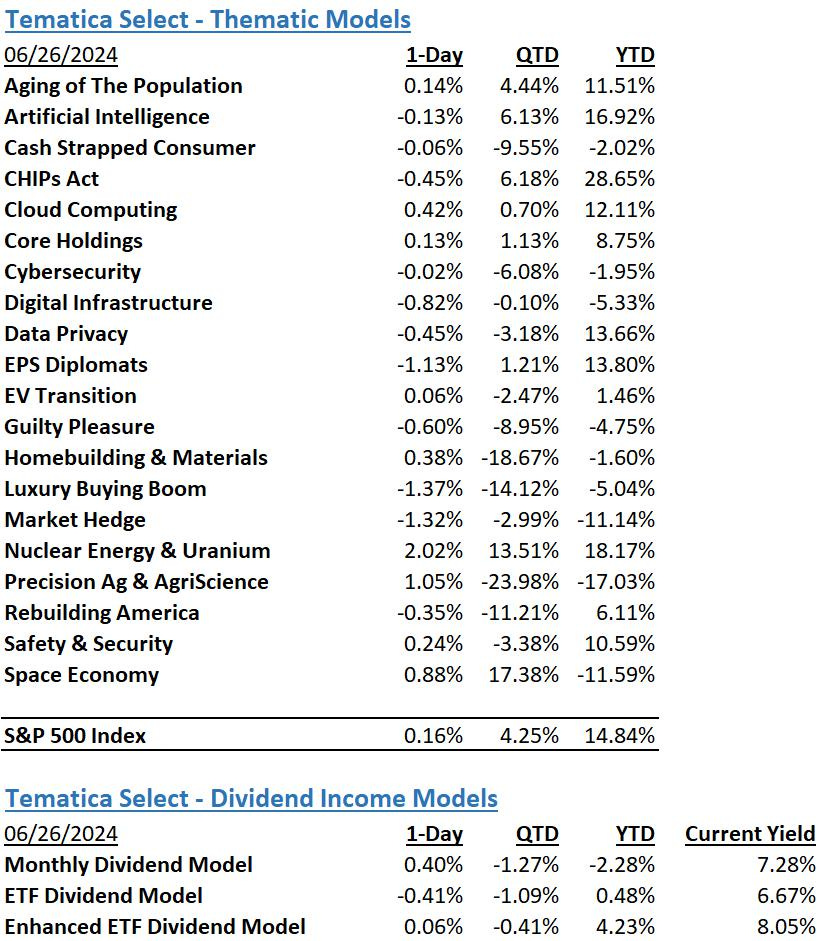

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Consumer Inflation Fighters - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption or destruction of data.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Precision Ag & Agri Science – Companies that look to address shrinking arable land by helping maximize crop yields utilizing technology, science, or both.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed below.