Oh My! Trump Tariffs, State of the Union, ISM Services Data

What will Fed Chair Powell say on Friday?

Market Recap

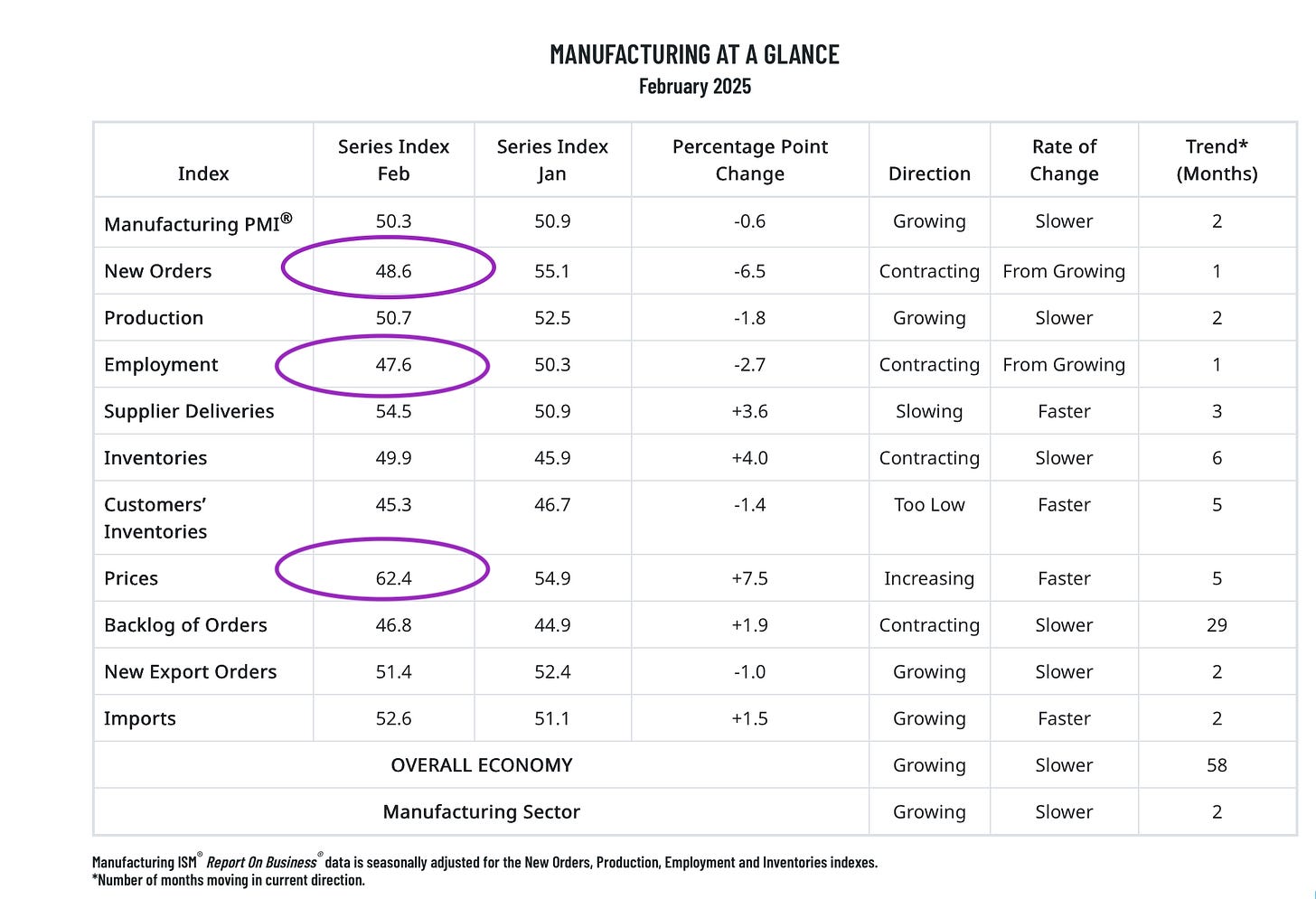

While we were waiting for yesterday to see how markets would react to the Atlanta Fed’s Friday GDP forecast of -1.5%,their forecasters had a “hold my beer” moment yesterday morning, almost doubling down and pulling the forecast lower, to -2.8%. Playing in to this seemed to be the “New Orders” component of ISM’s PMI Manufacturing release. While ISM PMI manufacturing came in slightly under consensus (but still above 50), “New Orders” fell considerably, to 48.6 as compared to January’s 55.1 print. Given this forecast double hit and President Trump confirming 25% tariffs on Mexico and Canada would go into effect, it’s no wonder market sold off. Trump also moved forward with an additional 10% tariff on Chinese goods,

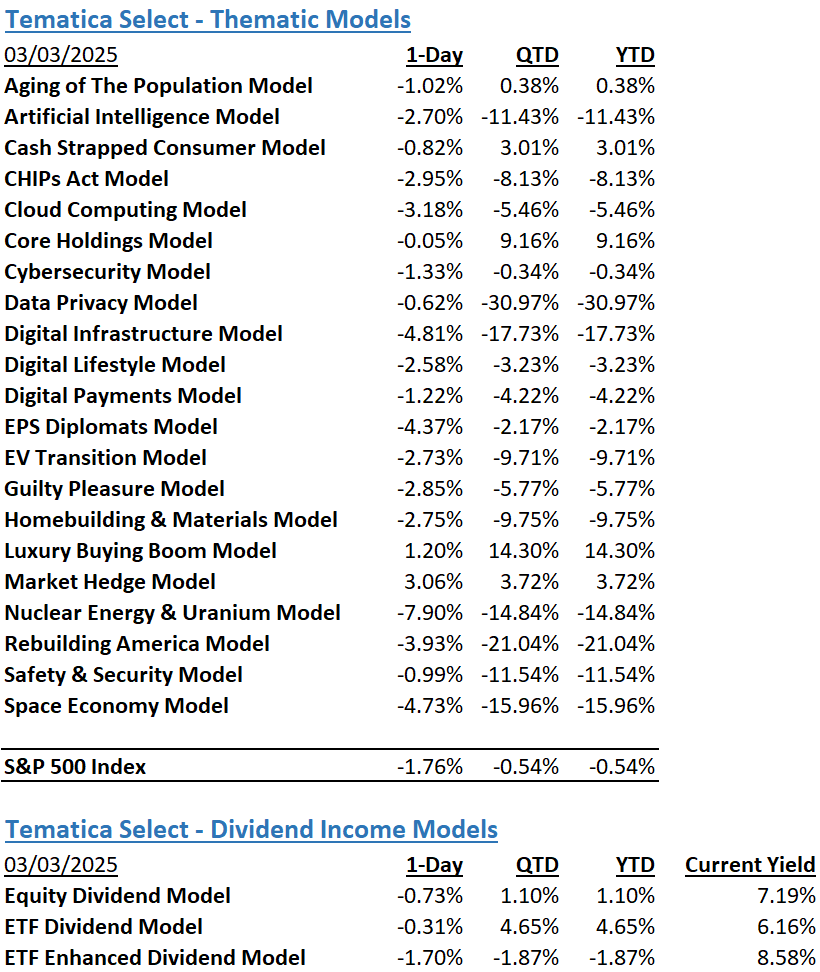

The Dow took the least heat, courtesy of its relatively low technology weight, falling 1.48% followed by the S&P 500 dropping 1.76%, and the Nasdaq Composite shedding 2.64%. Small Caps led the race to the bottom as the Russell 2000 closed 2.81% lower. Sectors did see some daylight as Real Estate (0.86%), Consumer Staples (0.53%), Healthcare(0.44%) and Utilities (0.14%) ended the day higher but the remaining groups saw results ranging from -0.84% (Financials) to -3.94% (Technology). Mag 7 names featured in the top ten detractors from performance for the SPDR S&P 500 ETF Trust (SPY) which also included Broadcom (AVGO) and Exxon Mobil Corp (XOM). Nvidia (NVDA),the second largest holding in the S&P 500 and the Nasdaq Composite, accounted for just over 30% of SPY’s 1.75% decline. With the SPY advance/decline line at 168/335, the market reacted but it wasn’t a wholesale selloff.

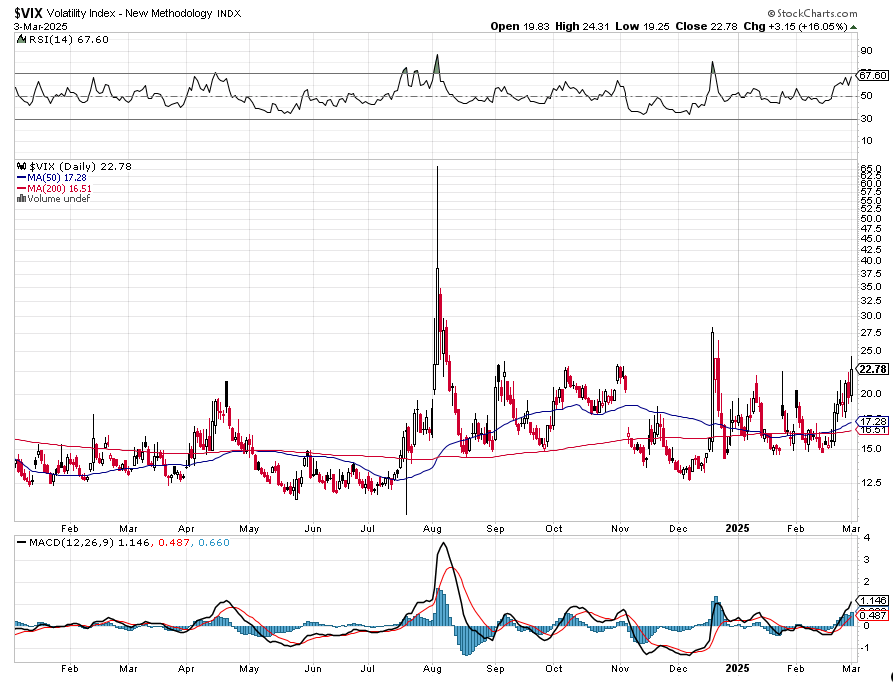

Looking at the Tematica Select Model Suite it should come as no surprise that Market Hedge did its job yesterday as that strategy not only captured the inverse move on equities but also benefitted from a 16% rise in the Cboe Market Volatility index (VIX). What might have been a surprise was Luxury Buying Boom breaking into positive territory as Capri Holdings (CPRI) saw shares rise as one of it’s brands (Versace… no the other one) was tipped as a potential purchase by rival Prada (PRDSF).

Oh My! Trump Tariffs, State of the Union, ISM Services Data

While they pointed higher earlier this morning, as of this writing, futures across the board are in the red suggesting a continued move lower in equities when the US stock market begins trading later this morning. The Budget Lab at Yale modeled the total effect of the planned 25% Canada & Mexico tariffs and the 10% China tariffs, as well as the 10% China tariffs already in effect finding it to be the equivalent of a 7 percentage point hike in the US effective tariff rate, raising it to the highest since 1943. The lab also found those tariffs will increase average price levels by 1.0-1.2%, the equivalent of an average per household consumer drag of $1,600–2,000 in 2024. If you’re thinking that’s fodder for our Cash-Strapped Consumer model, we are right there with you.

However, in response to Trump moving forward with tariffs, China retaliated with additional tariffs of up to 15% on some US products. Canadian Prime Minister Justin Trudeau said his country would also put a 25% levy on U.S. goods. No word as yet on how Mexico will respond, but this certainly ups the ante, and markets will be looking to see how Trump responds. That likely means folks will be on edge today, as they wait to say what tonight’s State of the Union address brings.

What we learn will no doubt shape the direction of equity markets tomorrow morning, just as we get the February ISM Services PMI report. Similar to yesterday’s February Manufacturing equivalent, should the Services data also show a drop in new order activity, a gap up in price pressures, and slower employment, odds are it will raise investor anxiety levels even more. This anxiety will be reflected in the Market Volatility Index (VIX), and will have investors waiting anxiously for Fed Chair Powell’s Friday comments. We say this because so far the Fed has been mum on the potential impact of Trump tariffs as it focuses on its dual mandate.

Back to today, there will be modest “distractions” in part because we have no fresh economic data on tap and only two Fed speakers scheduled for this afternoon. We do have earnings from Best Buy (BBY) and Target (TGT), and we will be interested in their comments about the consumer but also the expected impact of tariffs on their respective businesses.

Because they will be among the first retailers to report following Trump’s tariffs going into effect, those comments could set the tone for what will be said by Nordstrom (JWN), Ross Stores (ROST), Abercrombie & Fitch (ANF), Foot Locker (FL), Macy’s (M), and others this week. More than likely the impact of tariffs will lead to weaker than expected guidance, but between those tariffs and the consumer, how the companies get there will be far more telling.

If you need a respite from the above, we’d suggest perusing the IPO filing for AI hyperscaler Coreweave (CRWW),whose lead customer is Microsoft (MSFT), but it also serves IBM (IBM), Meta (META), Nvidia, Mistral and others. We’ve already read the document and it has a much to say for our Artificial Intelligence and Digital Infrastructure models.

The Tematica Model Suite

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

Cash Strapped Consumers - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

Digital Infrastructure & Connectivity - Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

Digital Lifestyle - The companies behind our increasingly connected lives.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.