Now for January Retail Sales and Manufacturing Data

Q: What did Target introduce today? A: dealworthy

Welcome to Thursday, February 15. As we get ready for the day ahead, European markets are up across the board in midday trading and US equity futures are up modestly.

Folks will want to revisit those equity futures after the January Retail Sales report is published at 8:30 AM ET. The market expectation is headline retail sales for the month fell 0.1% compared to December but the innards will give far more insight as to where consumers are opening their wallets and tapping their smartphones. Interesting timing that Target (TGT) chose today to introduce its new dealworthy brand.

Alongside that report, we will get our first look at manufacturing activity during February courtesy of the New York Empire Manufacturing Index and the Philadelphia Fed Index. Both of those February figures are expected to improve compared to January but remain in negative territory, suggesting continued slowing. They will also be sized up relative to findings inside the January Industrial Production report about manufacturing activity during the month. That report will be out at 8:15 AM ET.

That data will be baked into the Atlanta Fed’s GDPNow model when it updates that rolling forecast for the current quarter later today. On February 9, that model forecasted GDP for the current quarter at 3.4%. Should this morning’s data lift that model figure, something that would be positive for the economy and select market sectors, it would be another reason for the Fed to continue to slowly walk its way toward rate cuts.

While Cisco’s (CSCO) January quarter results came in ahead of market forecasts, the company issued downside guidance and announced a restructuring plan to cut ~5% of the company’s global workforce. For the current April quarter, Cisco sees EPS of $0.84-$0.86 compared to the $0.92 consensus on revenue in the range of $12.1-$12.3 billion, below the $13.09 billion consensus. Its 2024 outlooks call for $51.5-$52.50 billion in revenue and EPS of $3.68-$3.74, below the $54.41 billion and $3.86 consensus forecasts. On its earnings call, Cisco shared it is being cautious with its forecast given uncertainties in the macro environment and customer caution.

For more, be sure to read our Daily Markets column published each day by Nasdaq.

Model Musings

Consumer Inflation Fighters

“Target Corporation (TGT) today introduced its new low-price owned brand, dealworthy, designed to give consumers incredible value on nearly 400 everyday basics. With dealworthy, Target is offering more options at lower prices, starting at less than $1, while strengthening its portfolio of owned brands.” Read more here

Digital Identity & Data Privacy

“Screenshots shared with TechCrunch show that the exposed data included private keys for BMW’s cloud services in China, Europe, and the United States, as well as login credentials for BMW’s production and development databases. It’s not known exactly how much data was exposed or how long the cloud bucket was exposed to the internet. “Unfortunately, this is the biggest unknown in public bucket problems,” Yoleri told TechCrunch. “Only the bucket owner can see how long it has actually been open.” Read more here

Guilty Pleasure

“Anheuser-Busch can’t just blame the culture wars for a tepid year. Customers appear unwilling to pick up the tab on increasing beer costs, which rose nearly 6% from April 2022 to 2023 as beer companies struggled to keep up with the increased cost of packaging and transportation caused by inflation. Other brewers experienced a similar sales slump to Anheuser-Busch. Heineken’s stock dropped over 6% on Wednesday after the brewer forecasted a modest single-digit profit growth. Heineken raised prices by over 10% in the first half of 2023, and continued price hikes into the second half of the year as volumes declined. Pricing has impacted volumes, that’s obvious.” Read more here

“The makers of Hershey and Cadbury chocolates are planning more price hikes to cover a fresh record-setting surge in cocoa prices, even as inflation-hit consumers curb their purchases and company profits face a hit. Cocoa prices have roughly doubled over the past year, hitting a series of record highs in recent weeks due to shrinking supplies. Chocolate makers had been passing the rising costs on to consumers without losing much demand. But shoppers are cutting back to a greater degree than they did last year, Hershey and Cadbury maker Mondelez (MDLZ), opens new tab disclosed in recent quarterly earnings calls, hurting their outlooks for sales.” Read more here

Space Economy

“Intuitive Machines is looking to succeed where past ventures have failed with its inaugural lunar lander mission, which would mark the first time a private company has landed a spacecraft on the moon — ever.” Read more here

Don’t be a stranger

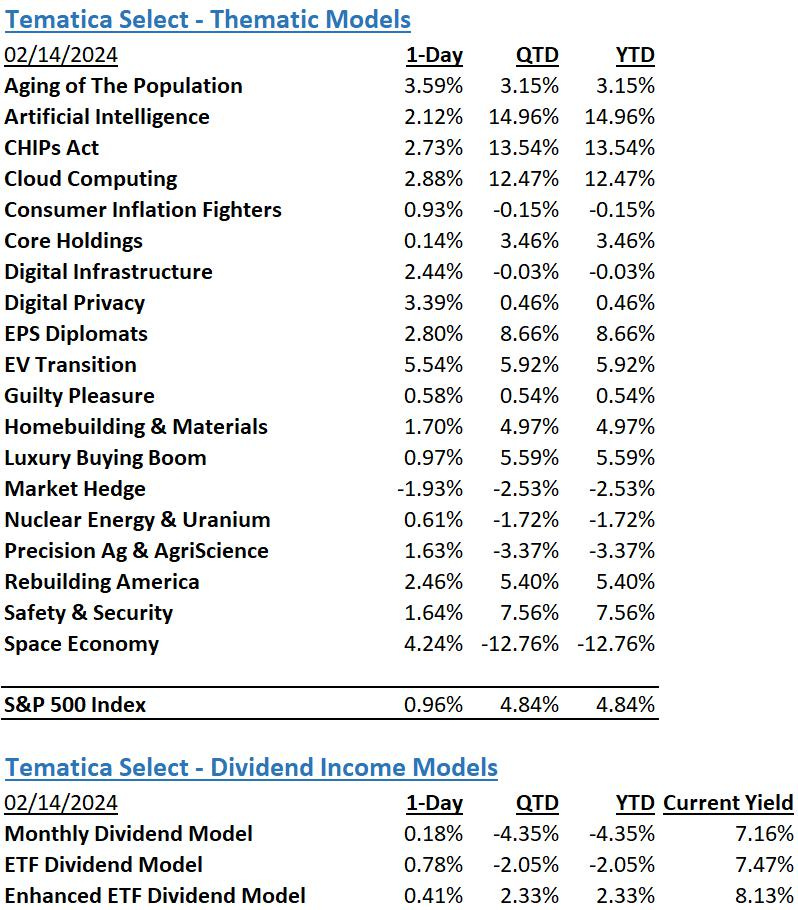

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed below.

The strategies behind our Thematic Models:

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Consumer Inflation Fighters - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Precision Ag & Agri Science – Companies that look to address shrinking arable land by helping maximize crop yields utilizing technology, science, or both.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The strategies behind our Dividend Income Models:

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.