Equities found a bounce in their step yesterday, except for Energy which traded off 1.16% after it was reported that the Supreme Court refused to hear a motion to move an environmentally focused case brought against Exxon Mobil (XOM)and the American Petroleum Institute from state to federal court. Leadership came from Technology (2.51%), Consumer Discretionary (1.70%), and Communication Services (1.55%) as the so-called Magnificent Seven made their first appearance in 2024, lifting these sectors above all others. Materials (0.43%) and Financials (0.64%) lagged. Broad indexes all posted gains as the Dow rose 0.58%, the S&P 500 added 1.41%, the Russell 2000 advanced 1.94%, and the Nasdaq Composite closed 2.20% higher.

Negative Earnings Announcements, More Fed Pushback on Rate Cuts

Following yesterday’s tech-led pop in the market, negative earnings pre-announcements last night and this morning from Samsung (SSNLF), Extreme Networks (EXTR), Microchip (MCHP), The Container Store (TCS), and BioNTech (BNTX) are leading investors to re-think prospects for the upcoming 4Q 2023 earnings season.

The market is also facing further pushback on the expected pace of Fed rate cuts later this year. Yesterday, while Atlanta Fed head Raphael Bostic shared that inflation has come down more than he expected and is on a path today to reaching the Fed's 2%, he repeated his expectation for two rate cuts this year, and that he expects the first cut in the third quarter. Federal Reserve Governor Michelle Bowman joined Bostic in throwing some cold water on the market’s rate cut expectations and we will see if Michael Barr, Vice Chair for Supervision of the Board of Governors of the Federal Reserve, joins them later today.

We’d call out that even though it’s still way off its October high, the yield on the 10-year Treasury has quietly climbed back above 4% and the market still sees a better than 50% probability the Fed will begin cutting rates in March. It would appear some may need to re-learn an old Wall Street lesson - don’t fight the Fed.

For more, be sure to read our Daily Markets column published each day by Nasdaq.

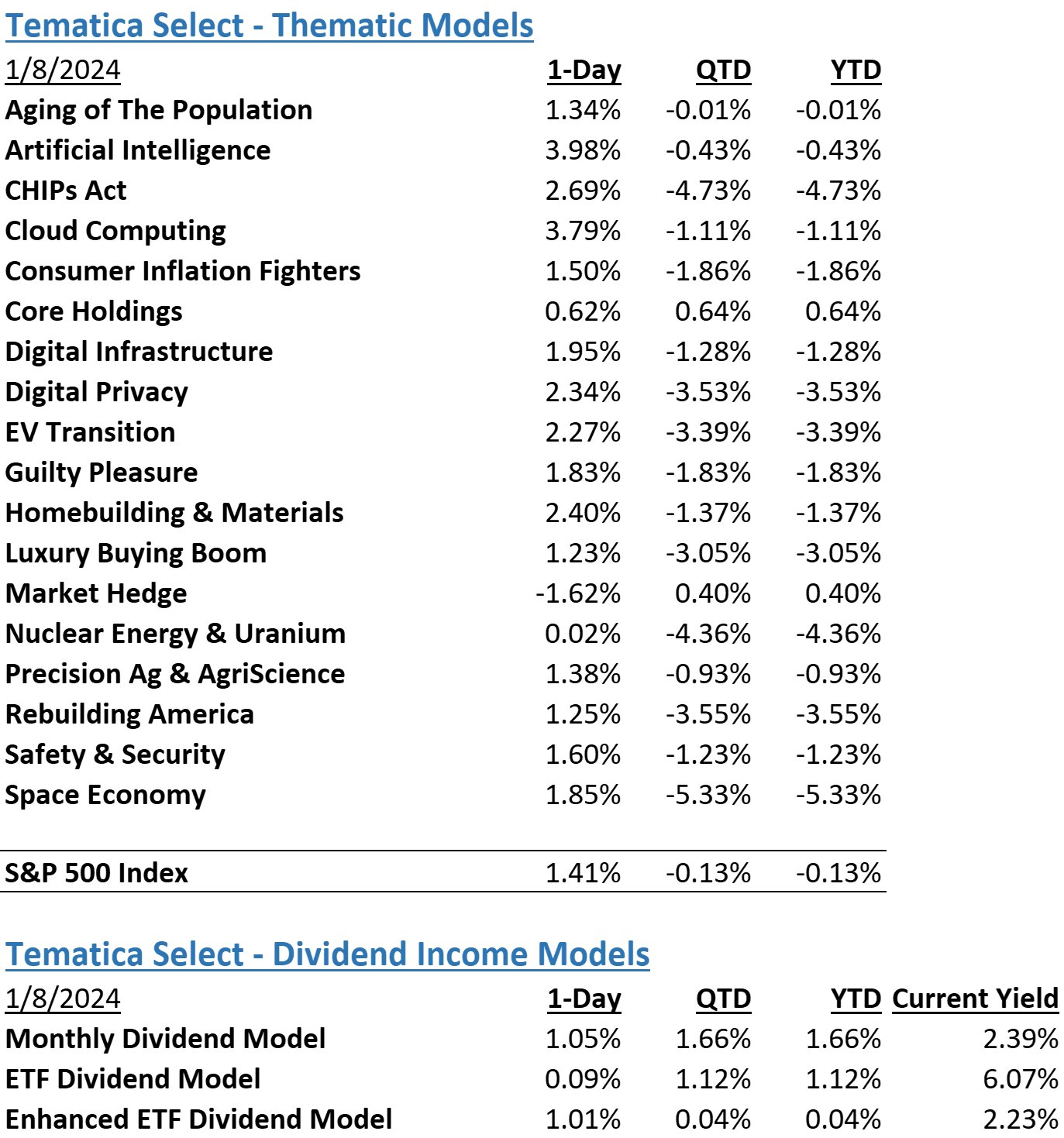

The strategies behind our Thematic Models:

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Consumer Inflation Fighters - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Precision Ag & Agri Science – Companies that look to address shrinking arable land by helping maximize crop yields utilizing technology, science, or both.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The strategies behind our Dividend Income Models:

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.