More Big Bank Earnings, TSM Reports, December Retail Sales Ahead

Plus our market recap from yesterday and a fresh pile of model signals

Market Recap

Traders generally ignored a slightly warmer top-line CPI print yesterday partly because it was driven by the known inflation driver Energy and partly because Core inflation came in line with expectations showing continued signs of moderating. What really got markets going yesterday was strong bank earnings. Financials (2.55%) led sectors, even topping each of the Mag 7 group of Consumer Discretionary (2.54%) [AMZN, TSLA], Technology (1.99%) [MSFT,AAPL, NVDA] and Communication Services (1.64%) [GOOG, META]. The only sector that lost ground yesterday was Consumer Staples (-0.34%) driven mostly by snack and drink maker shares selling off after the FDA announced it would be banning the infamous “Red Dye #3” from the US food supply.

While financials topped sectors, tech was still investors’ friend as evidenced by broad equity market index returns. In order of technology company concentration (greatest to least), the Nasdaq Composite rose 2.45%, the S&P 500 added 1.83% and the Dow closed 1.66%. Further proof that yesterday was a broad rally is that the Russell 2000 gained 1.99%, and we also saw the Cboe Market Volatility Index (VIX) drop just over 13% to return to trading at just over 16.

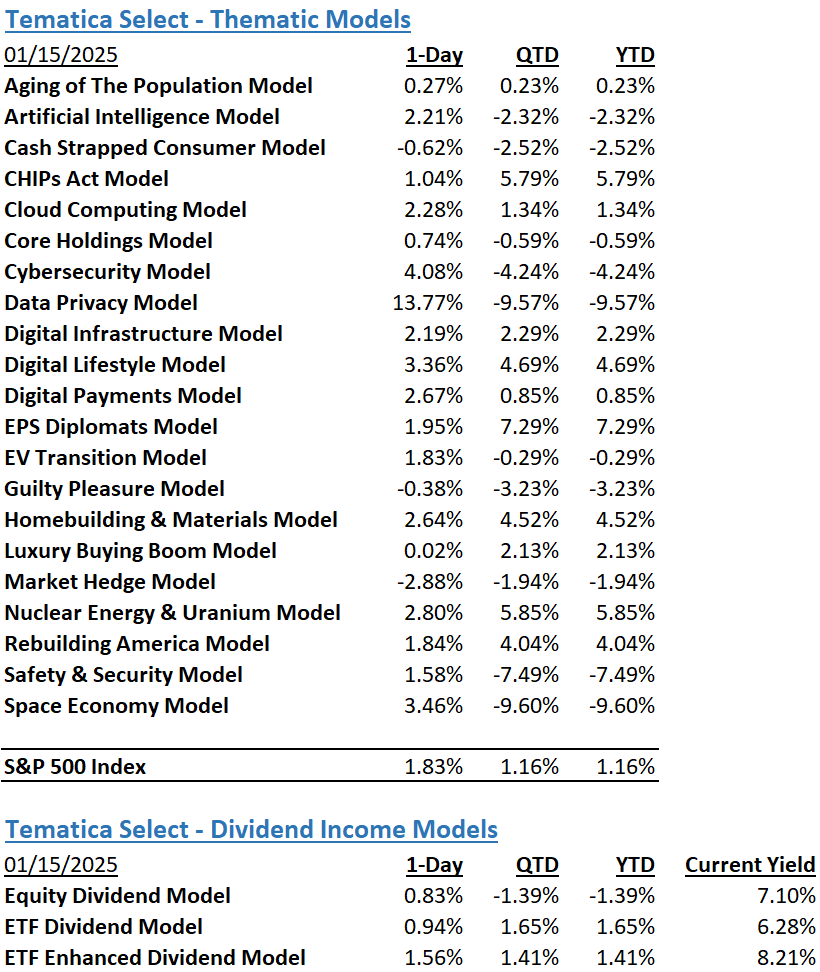

The Tematica Select Model Suite reflected yesterday’s good mood, with the only models to lose ground were Guilty Pleasure, and Cash Strapped Consumer both of which fell in sympathy with Consumer Staples. Luxury Buying Boom also had a slightly negative day as there are still uncertainties surrounding the strength of the Chinese consumer. Data Privacy won the day as BIO-key International saw shares jump almost 70% after it reported the National Bank of Egypt will be implementing the company’s products to manage identity-based access as well as an overarching governance solution.

More Big Bank Earnings, TSM Reports, December Retail Sales Ahead

Early morning futures point to a continuation of yesterday’s move higher for equities, spurred on in part by consensus topping December quarter results from Taiwan Semiconductor (TSM). Moreover, TSM sees demand for AI chips remaining robust while other markets, including new smartphone chips, AI PCs, and WiFi 7 driving demand. That led the company to project March quarter revenue above market expectations and signal its capital spending in 2025 would be as much as 40% higher compared to 2024. We see that as nice positives for the companies housed in our CHIPs Act, Digital Infrastructure, and Digital Lifestyle models.

The flow of big bank earnings will continue this morning, with quarterly results due from Bank of America (BAC), Morgan Stanley (MS), PNC (PNC), and US Bancorp (USB). Results and comments from JPMorgan Chase (JPM), Goldman Sachs (GS), and Wells Fargo (WFC) yesterday paint a favorable picture of what we should hear today. One area that we’ll be watching will be margins amid comments about continued technology and marketing investment. That also means listening for comments about staffing levels, especially following word Citigroup (C) is planning to reserve $600 million for severance payments in 2025 as it continues to trim its workforce and cut expenses.

Today also brings the December Retail Sales report, and the market expects to see a 0.6% sequential increase in the headline figure. As we move deeper into the December quarter earnings season, we’ll be more interested in the line-item details, especially for the trailing three-month data because it will give us a nice base for corporate earnings comparisons. Based on holiday shopping findings, we should see solid performance from the non-store retail category, better known to most as digital shopping. That’s also a component of our Digital Lifestyle investing theme and model, and you can find more on that below. With a nod to our Cash-Strapped Consumer signal below, we’ll also be interested in the breakdown between grocery and restaurants found in the December Retail Sales report as well.

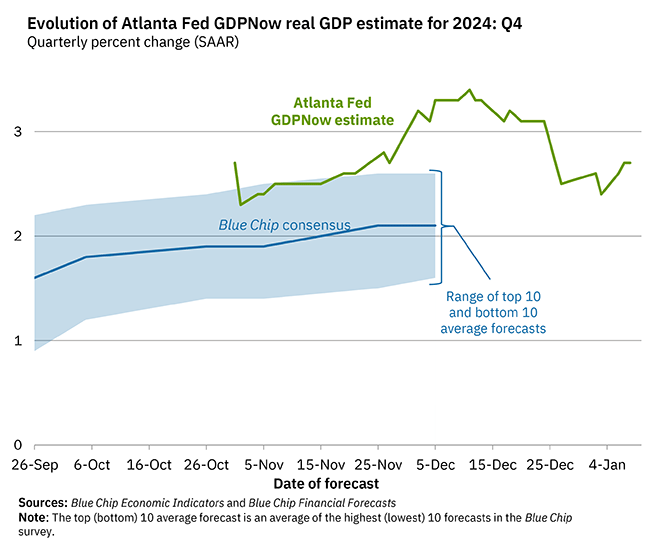

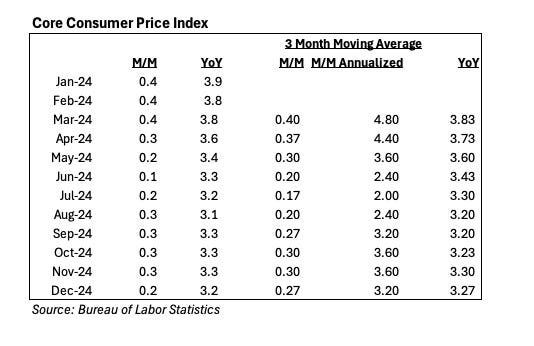

We will also be keeping our eyes open for today’s GDPNow model update from the Atlanta Fed. The last reading of this rolling forecast pegged Q4 2024 GDP at 2.7%, but that figure was published before last week’s blowout December Employment Report and other data since published. Barring a disastrous December Retail Sales report, odds are we’ll see an upward revision in the model, which would be a signal on top of this week’s inflation readings the Fed isn’t poised to deliver another rate cut anytime soon. While yesterday’s core CPI figure for December did come in a tad softer than expected, as you can see in the table below it’s still quite a distance from the Fed’s target on a reported basis and on a three-month moving average, which, per Fed Chair Powell, is how the Fed is looking at the data.

Model Musings

Aging Population

A new study shows that the risk of developing dementia anytime after age 55 among Americans is 42%, more than double the risk reported by older studies. That dementia risk translates into an estimated half-million cases this year, rising to 1 million new cases a year by 2060, according to the new work. Read more here

Two-thirds of Japanese companies are experiencing a serious business impact from a shortage of workers, a Reuters survey showed on Thursday, as the country's population continues to shrink and age rapidly. Read more here

Cash-Strapped Consumer

As for some granular insight into the costs of filling the pantry, the BLS noted that “four of the six major grocery store food group indexes increased in December. The index for cereals and bakery products rose 1.2% over the month, after falling 1.1% November. The meats, poultry, fish, and eggs index increased 0.6% in December.” Eggs were the culprit here, as “index” tied to that staple rose 3.2% in the latest reading. Overall food prices are 2.5% higher than they were when measured against December 2023. Read more here

Cybersecurity, Data Privacy

The Justice Department and FBI today announced a multi-month law enforcement operation that, alongside international partners, deleted “PlugX” malware from thousands of infected computers worldwide. Read more here

Ironically, cybercriminals now use Google search advertisements to promote phishing sites that steal advertisers' credentials for the Google Ads platform. The attackers are running ads on Google Search impersonating Google Ads, showing as sponsored results that redirect potential victims to fake login pages hosted on Google Sites but looking like the official Google Ads homepage, where they are asked to log into their accounts. Read more here

Texas has sued insurance provider Allstate, alleging that the firm and its data broker subsidiary used data from apps like GasBuddy, Routely, and Life360 to quietly track drivers and adjust or cancel their policies. Read more here

Digital Infrastructure

Macquarie will invest up to $5 billion in data centers being built by artificial-intelligence infrastructure company Applied Digital, adding to the Australian bank’s substantial AI-related investments. Read more here

Digital Infrastructure, Artificial Intelligence

This Executive Order will direct the Department of Defense and the Department of Energy to lease federal sites where the private sector can build frontier AI infrastructure at speed and scale. These efforts are designed to accelerate the clean energy transition in a way that is responsible and respectful to local communities, and in a way that does not impose any new costs on American families. Read more here

EV Transition

Outside of EVs, Toyota is doing not only fine, but great. While it has lagged behind even old-school competitors in transitioning its production lines to all-electric models, the past year made that look smart. Demand for electric cars continued to grow, but not as quickly as the $3 trillion auto industry had wagered while pouring untold billions of dollars into their development. Read more here

Homebuilding & Materials

For those in Los Angeles, where the wildfires have killed at least 25 people and destroyed more than 12,300 structures, officials are beginning to discuss what may come next… Even without the current level of political infighting, the rebuilding process for communities affected by past wildfires has been yearslong and could indicate a long road ahead for those in Los Angeles. Read more here

Space Economy

Two moon landers, one from Japan's ispace and another from U.S. space firm Firefly, began their journeys into space on Wednesday with SpaceX's unusual double moonshot launch, underscoring the global rush to examine the lunar surface. Read more here

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

Cash Strapped Consumer - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption or destruction of data.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Digital Lifestyle - The companies behind our increasingly connected lives.

Digital Payments - This model focuses on companies benefitting from the accelerating structural adoption of digital payments and financial technology (FinTech).

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.