Markets Catch Their Breath Post Nvidia

A strong earnings cycle coupled with positive economic indicators makes the case for better breadth in equities.

As we close out a light week from an economic data perspective, what we did get points to a still strong employment picture, with declining Initial and Continuing unemployment claims, a bump in Existing Home Sales to 4 million in January, and a PMI composite that while ticking slightly lower remains above 50, indicating expansion. The Nvidia (NVDA) earnings figures seemed to be the catalyst the market needed to boost all those animal spirits and the question now is can the promise of AI can continue to carry this current rally. We will get a test of sorts today as the market’s reaction to Alphabet’s Google (GOOGL, GOOG) decision to temporarily shut down the image generation capabilities of their Gemini platform following claims of what has been described as inaccurate historical images. It’s not exactly a precursor to the Terminator movie’s Skynet takeover of the world but still something that might give some investors pause.

Despite any AI-related hesitation, the current earnings cycle has also served as a boost to investors as the majority of companies have been providing upside surprises. Despite this, we have yet to see a significant broadening in market participation as evidenced by the YTD 6.77% return of the market cap weighted SPDR S&P 500 ETF Trust (SPY) as compared to the 2.39% result of the Invesco S&P 500 Equal Weight ETF (RSP). Part of this has to do with the influence of beyond mega capitalization companies but some of it also has to do with investors’ lack of focus on the rest of the market.

Block, Inc (SQ) reported quarterly earnings of $0.45, which, while up 109% YoY, came in lower than the $0.58 estimate on revenues of $5.77 billion, which beat the $5.70 billion estimate. The company offered a strong quarter-ahead EBITDA guidance of $580 million as compared to expectations of $515 million. The shareholder letter focused on the company’s Cash App and its goal “to become one of the top providers of banking services to households across the United States which earn up to $150,000 per year” which by the company’s estimate represents “approximately 80% of consumers and 50% of household income.”

Social media sometimes darling, sometimes scourge of the internet Reddit filed its Form S-1 indicating its intent to offer shares to the public. Lead syndicate underwriters include Goldman Sachs (GS), JP Morgan (JPM), Morgan Stanley (MS), and Bank of America (BAC).

For more, be sure to read our Daily Markets column published each day by Nasdaq.

Model Musings

Digital Infrastructure

“Throughout the United States, widespread cellular outages were reported on Thursday morning following the solar flares. According to The Associated Press, tens of thousands of outages were reported by major cellular carriers such as AT&T, Verizon, and T-Mobile.” Read More Here

Consumer Inflation Fighters

“PepsiCo is expanding beyond snacks and beverages by going after more meal occasions and dayparts while continuing towards its nutrient goals outlined in its pep+ agenda, CEO Ramone Laguarta said at the Consumer Analyst Group of New York conference this week.” Read More Here

“J.B. Hunt Transport Services plans to buy retail giant Walmart’s intermodal container and chassis fleets as part of a new multiyear shipping deal with the retailer.

The companies said Thursday that the new agreement on intermodal, in which shipments are moved in combined truck and rail operations, will deepen their ties, increasing the volume and capacity commitments between J.B. Hunt and Walmart. J.B. Hunt said it has worked closely with Walmart for decades.” Read More Here

Space Economy

“Intuitive Machines' IM-1 mission will be the first commercial lunar lander and the first United States spacecraft to land on the Moon since Apollo 17 in 1972. Our spacecraft, Nova-C, will spearhead this trailblazing mission toward creating a commercial lunar economy, delivering commercial and NASA payloads that will pave the way for sustainable human lunar missions.” See More Here

The Strategies Behind Our Thematic Models

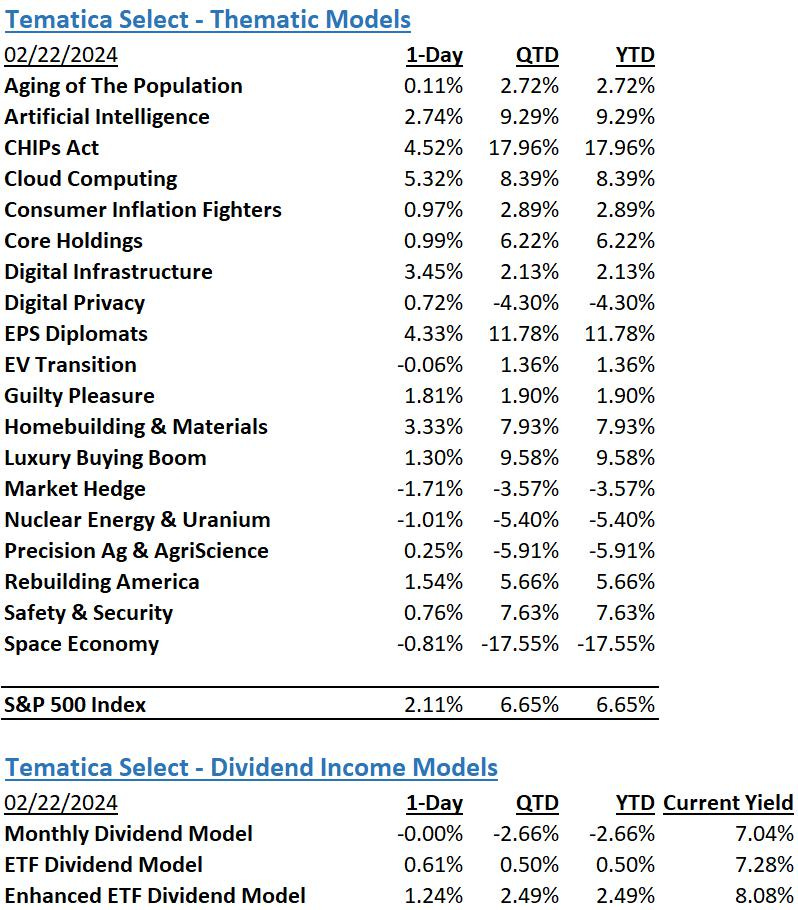

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Consumer Inflation Fighters - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Precision Ag & Agri Science – Companies that look to address shrinking arable land by helping maximize crop yields utilizing technology, science, or both.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The strategies behind our Dividend Income Models:

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed below.