Last Week's Signals and Some Big Model News

Examining recent targeted exposure model confirmation points

Hey everyone,

Good news! Here’s the latest collection of signals and confirmation points for our targeted exposure strategies.

Better news!

After spending some time kicking things around, we are leaning into the power of Substack to roll out our Digital Infrastructure & Connectivity model and our AI & Data Center Ecosystem suite of models, which includes the Digital Infrastructure & Connectivity model.

Digital Infrastructure & Connectivity - Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

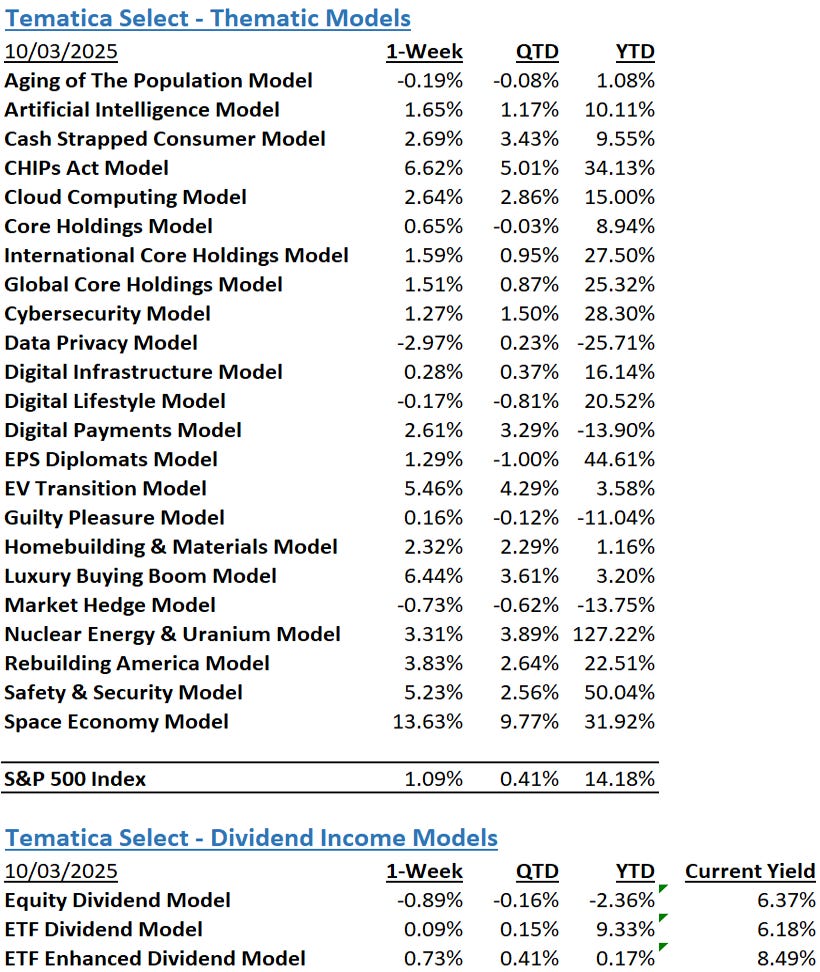

The results for those models, as you can see in the table below, speak for themselves, especially for the Nuclear Energy & Uranium model that is part of the larger suite.

Like all of our models, which are reconstituted and rebalanced on a quarterly basis, these offerings tap into the power of Tematica’s Scorecard and are enhanced by proprietary fundamental, consensus and momentum criteria.

We will share with subscribers to these offerings more in-depth news and analysis, Wall Street commentary (including rating and price target changes), and the like.

If you’re wondering if we may have some new targeted exposure strategies in development, all we’ll say is 🤫.

Now, let’s get to those signals….

Aging Population

A primary risk, as a population ages, is under-investment in children,” she told Newsweek. “As children make up an increasing share of the population, there will be increasing pressure on them to be healthy and productive. But as populations age, there may be pressure to invest more in senior-supporting programs than in child-supporting ones. Read more here

Longer-term trends in commercial real estate are shaped by demographics. When looking out over the next five years, the aging of the population will drive some significant changes in the U.S. commercial property landscape. Read more here

Artificial Intelligence

The artificial-intelligence boom has ushered in one of the costliest building sprees in world history. Over the past three years, leading tech firms have committed more toward AI data centers like the one in Ellendale, plus chips and energy, than it cost to build the interstate highway system over four decades, when adjusted for inflation. AI proponents liken the effort to the Industrial Revolution. Read more here

According to our research, the top four top vertical markets for enterprise AI—financial services/insurance, healthcare, retail, and manufacturing—prefer proprietary AI platforms as a group, though other platforms are popular as well, most notably ChatGPT and other OpenAI models. There are several reasons for this, but as noted above, security and compliance top the list. Companies in healthcare in particular opt for proprietary AI platforms and models to ensure alignment with stringent rules governing confidentiality and patient information in the sector. Read more here

The number of prioritized enterprise AI use cases in production has more than doubled since 2024, as enterprises put proven pilots into production and pursue experiments with business-specific initiatives, according to a new research report from Information Services Group, a global AI-focused technology research and advisory firm. Read more here

Cash-Strapped Consumer

All consumers face rising living costs due to inflation, higher housing prices and elevated interest rates amid an economic landscape defined by uncertainty fueled by the Trump administration’s tariff agenda. PYMNTS Intelligence’s latest research shows that in August 2025, 68% of Americans were living paycheck to paycheck, which can erase the ability to build an emergency fund or invest for the long term. While this rate is slightly lower than the month before, the share of consumers within that group who are struggling to pay their monthly bills climbed to 25% from 24% a month earlier, nearly matching the record-high set a year earlier. Read more here

Subprime auto loans are often regarded as a leading economic indicator, and delinquencies have climbed since the coronavirus pandemic. They rose in August to 9.3 per cent, hovering near the 10 per cent mark that has been surpassed only three times since the 2008 financial crisis, according to Fitch Ratings. Tricolor’s failure was a “potential bellwether for where the economy is going”, said Brett House, an economics professor at Columbia Business School. “Low-income Americans tend to do absolutely everything possible to remain current on auto payments, even when they face substantial financial distress. Having a car is essential to having work in the US.” Read more here

Ford is racing to sell more F-150 pickups this quarter by offering lower interest rates to buyers with the weakest acceptable credit histories. The deal available until the end of the month will allow consumers with shakier credit profiles to pay the lower interest rate offered to those with stellar credit records. Ford is courting these low-credit customers as it looks for a strong close to the quarter for its best-selling pickup, which starts around $39,000 and goes to almost $80,000. Like most automakers, Ford has been largely absorbing the costs of tariffs on imported steel, aluminum and auto parts to keep plants humming and sales volumes high, even as it cuts into profits. Read more here

Cybersecurity, Data Privacy & Digital Identity

Customers of Harrods Ltd., the luxury London department store, had their personal data stolen, the latest in a string of cyberattacks and IT breaches affecting major UK businesses this year. Data including names and contact details for some Harrods customers were taken from the systems of a “third-party provider,” a spokesperson for the store said in an emailed statement. The retailer declined to identify the provider, citing an “ongoing criminal investigation.” Read more here

Cybersecurity researchers have identified a previously undocumented state-sponsored Chinese hacking group dubbed Phantom Taurus. A new report from Palo Alto Networks’ Unit 42 threat intelligence team details a multi-year investigation into Phantom Taurus, revealing a campaign targeting governments and telecoms providers across the Middle East, Africa, and Asia. The group’s primary objective is cyberespionage, with a focus on stealing sensitive, non-public information from high-value targets. Read more here

A ransomware attack at Motility Software Solutions, a provider of dealer management software (DMS), has exposed the sensitive data of 766,000 customers. Motility (formerly known as Systems 2000/Sys2K) is a provider of DMS software used by 7,000 dealerships (automotive, powersports, marine, heavy-duty, and RV retail) across the United States. Read more here

Digital Infrastructure

Microsoft has signed some $33 billion in compute capacity deals with new AI cloud firms (aka neoclouds) to meet AI demand. As reported by Bloomberg, this figure includes the $19.4bn deal signed with Nebius in September, which will give Microsoft access to more than 100,000 Nvidia GB300 chips, according to people familiar with the matter. Outside of Nebius, the company has signed capacity agreements with multiple GPU-as-a-Service providers, including the likes of CoreWeave, Nscale, and Lambda. According to the Bloomberg report, this is part of a strategy to help cope with the shortage of AI capacity, and will enable Microsoft to free up its data centers for use by customers.

A new data center development is being planned outside Frankfurt, Germany. The Frank Cube project is planned on 11 hectares in the Main-Kinzig district of the municipality. The data center is set to provide 200MW, and powered by a combination of on-site gas plant and nearby wind turbines. The facility is scheduled to launch in 2028. Frankfurt is one of the major data center hotspots in Europe alongside London, Amsterdam, Paris, and Dublin (collectively FLAPD). Read more here

Verizon is gathering an alliance of the biggest players in telecoms to map out the capabilities of 6G and the use cases it should enable. The US network giant has pulled back the curtain on its 6G Innovation Forum, an alliance designed to stop 6G from being a chaotic free-for-all and instead shape it collaboratively from the very beginning. For its 6G alliance, Verizon has assembled the companies who build the networks – Ericsson, Samsung, and Nokia – alongside the innovators who create the chips and devices we use every day, like Qualcomm and Meta. Read more here

Digital Lifestyle

The study, which draws on more than 25,000 U.S. consumer responses between 2022 and 2025, finds that Gen Z’s digital footprint is unrivaled. They log 425 digital activity days each month, more than one-third higher than the average consumer… The report finds that 14% of Gen Zers say they regularly make purchases based on influencer recommendations, 20 times more than their parents and grandparents. Read more here

EV Transition

China’s biggest electric-truck maker says it is targeting growth overseas in a fresh challenge to the global auto industry, as Chinese production of high-tech, low-cost, battery-powered heavy goods vehicles booms. Liang Linhe, who leads the electric trucking division of Sany Group, a construction and mining equipment behemoth, expects about half the group’s sales to come from overseas markets by 2030, up from about 10 per cent this year. Read more here

“We knew that with the Sept. 30 deadline, it was now or never, so we did it,” said Mr. McGrath, 38, who works as a transportation planner in Cincinnati. “The car became much more affordable with the tax credit.” Across the country, thousands of people have been making the same calculation, leading to a surge of electric car sales. In August, sales jumped 18 percent, to 146,332 vehicles, and analysts expect another big increase in September. But the demise of the tax credit will probably bring the party to an end. Sales of electric models are expected to plummet in the last three months of the year and then remain sluggish for some time. Read more here

Homebuilding & Materials

Quality affordable housing is essential for economic mobility but remains unattainable for too many in the United States. A severe housing shortage that spans the entire country is fueling the crisis, say Senior Partner Shelley Stewart III and coauthors. The housing shortage nearly doubled between 2012 and 2023, climbing to 8.2 million units. By 2035, the shortage could reach 9.6 million units, further entrenching financial insecurity across the nation. Closing the gap may require $2.7 trillion through 2035 but could potentially boost GDP by $1.9 trillion and create 1.7 million jobs. Read more here

Luxury Buying Boom

Economic trends in key luxury markets have put added pressure on fashion brands as they work to bolster their value propositions and reignite consumer demand. Neither China nor the US, luxury’s primary growth engines for more than a decade, are likely to power a quick rebound for the industry next year. Read more here

Nuclear Energy & Uranium

Unlike intermittent energy from wind turbines and solar panels, whose generation depends on how strongly the wind blows or brightly the sun shines, nuclear plants can supply electricity 24/7 — and also without the planet-warming emissions that come from burning gas and coal. Read more here

Safety & Security

Denmark’s police and military are investigating drone sightings that forced airports in Copenhagen and Oslo to close for several hours, the latest in a string of disruptions to European airspace. Read more here

The global Artificial Intelligence (AI) in Military Market is valued at USD 9.2 billion in 2023 and is projected to reach USD 38.8 billion by 2028, growing at an impressive CAGR of 33.3% during the forecast period. This surge reflects the rapid adoption of AI technologies in defense applications, driven by the need for faster decision-making, autonomous systems, and enhanced situational awareness. Read more here

Body-worn cameras for the Bartow Police Department, pay raises for new and existing city employees and upgrades to the city’s stormwater system and fire services are among the expenditures in the 2025-2026 budget, which takes effect Oct. 1. Read more here

Walmart, Dollar General, and Kroger are among the growing number of retailers testing or rolling out bodycams for employees — especially in locations hit hard by theft or safety incidents. At Walmart stores in Florida and Texas, body-worn cameras are now being used at select checkout counters. TJ Maxx and Marshalls are also deploying them among their loss prevention teams. Even convenience stores like 7-Eleven — often open late or around the clock — have joined the trend in high-crime areas. Read more here

Staff at H&M, Tesco and EE are among the retailers offering their staff the opportunity to don cameras as they work as a deterrent for criminals. In July, H&M said it was using the technology… A spokesperson for H&M says: “We’re testing body-worn cameras in a three-store pilot to assess what beneficial impact it may have, along with staff customer service training, on de-escalating and reducing incidents for the safety of both our colleagues and customers.” Read more here

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

Cash Strapped Consumers - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

Digital Infrastructure & Connectivity - Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

Digital Lifestyle - The companies behind our increasingly connected lives.

Digital Payments - Companies benefitting from the accelerating structural adoption of digital payments and financial technology (FinTech).

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.