Articles 📰

“American personal-finance gurus love to rail against the habit of spending money on coffee: The finance personality Suze Orman once compared buying coffee outside the house to “peeing $1 million down the drain.” But this criticism hasn’t curbed Americans’ love of ordering coffee. Neither has a yearslong stretch of brutal inflation.”

The Extremely Offline Joy of the Board Game Club

“Staring down an epidemic of loneliness, people in their 20s and 30s are gathering to play chess, backgammon and mahjong in hopes that old-fashioned game clubs might help ease the isolation and digital overload that weigh heavily on their generation. Many have already been experimenting with more physical alternatives to doomscrolling like pickleball and running clubs. But organizers like Ms. Kong say that the kind of board games stored in their grandparents’ attics are hot among Gen Z-ers and millennials hungry for less athletic modes of socialization.”

‘Barbie: A Cultural Icon’ Review: A Doll Down the Decades

“There’s very little text in the exhibition “Barbie: A Cultural Icon,” at the Museum of Arts and Design. Born on March 9, 1959—when she had her debut at the New York Toy Fair—Mattel’s “Teenage Fashion Model” doll has figured in the cultural conversation ever since… In a scrapbook-style montage of opening commentary, we learn that Ruth Handler, the co-founder of Mattel, “wanted to create a doll with adult features so girls could play out their futures.” These myriad “futures” are the focus of the show, which was organized by the costume-and-textile curator Karan Feder, in partnership with Mattel Inc.”

Can Gucci Find Its Cool Again?

“Gucci has faced a persistent slump in the luxury goods market. Kering, which relies on the brand for about two-thirds of its earnings, sounded a series of profit warnings to investors in 2024 as demand tumbled. New designs by De Sarno, who joined from Valentino in 2023, haven’t turned around sales or inspired the fashion crowd, despite slick publicity campaigns… Reviews have been mixed, with some critics saying De Sarno hasn’t introduced an exciting new image for the brand.”

Is This Weird Dome the Future of Watching Sports?

“Like a demi-sized version of Sphere, the space-age entertainment venue that opened in Las Vegas last year, Cosm uses streaming technology and vast curving LED screens to deliver views that rival the best seats in arenas, ballparks and stadiums around the world. With outposts in Los Angeles and Dallas and more on the way — including a development set to break ground in downtown Detroit in 2025 — Cosm hopes to provide a destination experience for sports nuts that doubles as a neighborhood anchor.”

The New Science of Controlling Lucid Dreams

“Many people have had lucid dreams. Typically you are immersed in an experience, then something seems “off,” and you realize you are actually dreaming. Often people wake up right after they become lucid, but with practice you can learn how to remain lucid and try to direct what happens.”

Are Wellness Festivals the New Music Festival?

“We book flights to concerts where revelers wear glitter and wide-brim hats and dance in the desert. Research shows that travel has become a top priority in our lives, particularly among younger generations, and many travel to feel better from the inside out (and vice versa). Adults—especially millennials and Gen Z, are preoccupied with wellness, disillusioned with healthcare, and willing to splurge on trips and upgrades. This alchemy has fueled the rise of the wellness festival—events and destinations promising the keys to the elusive state of wellbeing.”

29 Mocktails Worthy of a Second Round

“Call them zero-proof, nonalcoholic, or whatever you please—one thing’s for sure: these spirit-free cocktails are no joke.”

What We’re Streaming 📺📲

The Reading List 📖📚

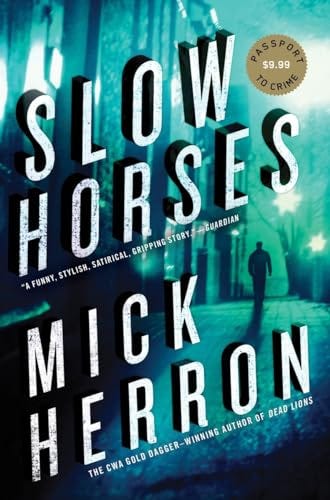

“London, England: Slough House is where washed-up MI5 spies go to while away what’s left of their failed careers. The “slow horses,” as they’re called, have all disgraced themselves in some way to get relegated there. Maybe they botched an Op so badly they can’t be trusted anymore. Maybe they got in the way of an ambitious colleague and had the rug yanked out from under them. Maybe they just got too dependent on the bottle—not unusual in this line of work. One thing they have in common, though, is they want to be back in the action. And most of them would do anything to get there─even if it means having to collaborate with one another.”

Recent Thematic Signals

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed below.

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

Cash Strapped Consumer - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption or destruction of data.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Digital Lifestyle - The companies behind our increasingly connected lives.

Digital Payments - This model focuses on companies benefitting from the accelerating structural adoption of digital payments and financial technology (FinTech).

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.