Israel-Iran Escalates, September ISM Services PMI Data & Jobs

Why the market may once again need to recalibrate Fed rate cut expectations

Equity futures point to another decline when the US stock market opens later this morning. Tension in the Middle East escalated further as Israel vowed a “very strong” response to Iran’s recent attack with Iran warning of broader strikes if Israel responds. We are also seeing the shine from China’s recent remarks about further stimulus start to fade as investors get ready for Friday’s September Employment Report.

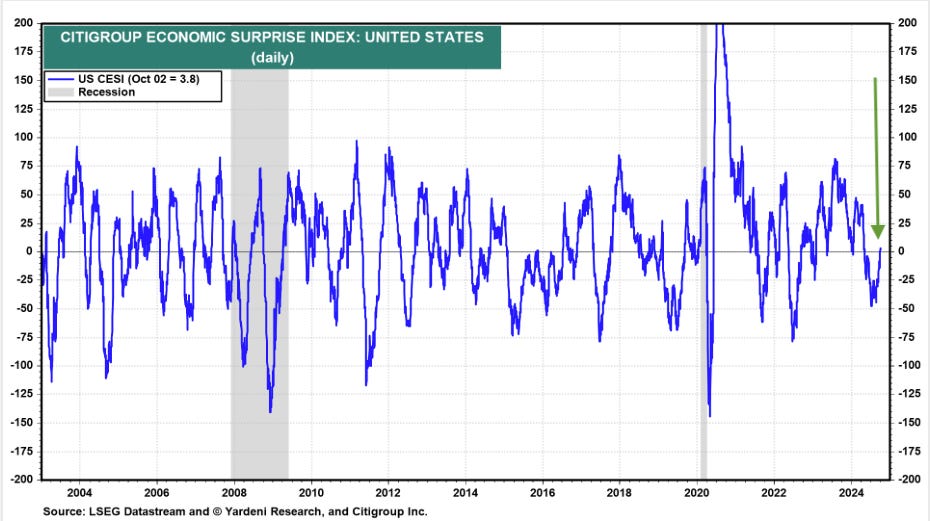

With ADP’s (ADP) September Employment Change Report and the August JOLTs report showing more life in the jobs market than some expected, market expectations for another 50-basis point rate cut in November are fading. Adding to a potential re-think on the pace of upcoming rate cuts, the Citibank Economic Surprise Index (CESI) has turned positive, telling us the recent data has been stronger than expected.

That sets the stage for today’s September Service PMI reports from ISM and S&P Global and what they say about that part of the economy that has been driving the overall US economy. ADP’s September job findings showed the vast majority of job growth during the month was tied to the service sector, suggesting today’s Service PMIs should signal continued growth in that part of the economy.

We will also be focusing on what ISM’s Service PMI data reveals about inflation and job creation ahead of tomorrow’s September Employment Report. Should the findings show continued progress on inflation and a jobs market that is performing better than expected, it would suggest the market may have once again gotten ahead of itself with rate cut expectations.

Should that be the case, it would be another reason for investors to be wary of an overbought, valuation-stretched market with rising geopolitical tensions.

In addition to current geopolitical concerns, while we are only a couple of days into the longshoreman’s strike, earlier comments by the International Longshore and Warehouse Union president Willie Adams are starting to sink in as the union received some support from the White House.

Our view on the port strike continues to be focused on its duration - the longer it goes the greater the risk to the economy, the holiday shopping season, and the undoing of recent inflation progress. Already, long lines of container ships are queued up outside major US ports as the biggest dockworker strike in nearly half a century entered its third day preventing unloading and threatening shortages of everything from bananas to auto parts.

Model Musings

Artificial Intelligence

“The global market for AI-related products is ballooning and will hit as much as $990 billion in 2027, as the technology’s quick adoption disrupts companies and economies, Bain & Co. said. The market, including artificial intelligence-related services and hardware, will grow 40% to 55% annually from $185 billion last year… The growth will be fueled by bigger AI systems and larger data centers to train and run them, driven by companies and governments using the technology to boost efficiency.” Read more here

Artificial Intelligence, Digital Infrastructure

“Alphabet Inc.’s Google plans to invest $1 billion to build data centers in Thailand, joining global tech companies in adding cloud and AI infrastructure in Southeast Asia. The company will add facilities in Bangkok and Chonburi, a province southeast of the capital. The outlay could help add $4 billion to Thailand’s economy by 2029 and support 14,000 jobs annually over the next five years, Google said Monday, citing a Deloitte study.” Read more here

“When AI starts to talk to AI, we really think that's going to represent another fundamental shift in the volume of data required to run businesses that represents another step function change in terms of opportunity for this company,” Lumen CEO Kate Johnson told Fierce in a recent interview for the Five Nine podcast. Digital Realty CTO Chris Sharp agreed that once machines start talking to machines, we’ll be “in that next era of AI capabilities.” Read more here

Cybersecurity, Digital Payments

“Chubb’s newly released global survey, “The Impact of Cyber Scams on Trust in Digital Payments,” underscores the growing influence of cyber fraud on consumer behaviour and trust in digital payment platforms. As cyber breaches continue to escalate, the survey reveals a significant shift in how consumers interact with digital payment methods, highlighting widespread misconceptions regarding cyber protections and a pressing need for improved security measures… 61% of respondents have either reduced their usage or changed their behaviour regarding digital payment platforms due to concerns over cyber scams.” Read more here

Data Privacy & Digital Identity

“As more of Americans’ everyday activities move online, the lack of digital identity solutions becomes more of a problem. Countries around the world have forged ahead in offering digital ID, leaving the United States in the dust. Here at home, a handful of states have risen above the rest by offering mobile driver’s licenses (mDLs), but these efforts are uncoordinated and unavailable in most of the country.” Read more here

Digital Lifestyle

“Amazon has reportedly surpassed its goal of drawing $1.8 billion in ad spending commitments for its video streaming services after introducing ads on its Prime Video earlier this year. That total includes ads on the company’s live sports telecasts, including the NFL’s Thursday Night Football…” Read more here

Digital Payments

“hen the U.S. Feds cut interest rates by half a percentage point last week, it was a dash of good news for venture capitalists backing one particularly beleaguered class of startups: fintechs, especially those that rely on loans for cash flow to operate their businesses.” Read more here

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

Cash Strapped Consumer - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption or destruction of data.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Digital Lifestyle - The companies behind our increasingly connected lives.

Digital Payments - This model focuses on companies benefitting from the accelerating structural adoption of digital payments and financial technology (FinTech).

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed below.