Is The Market Facing A Flashing Yellow or Red Light?

Market Wrap

Despite what can be described as an Oprah Winfrey-level amount of tariff announcements coming out of the White House since Friday’s market close, yesterday was relatively muted. Major broad equity indexes ended the day little changed with the Nasdaq Composite rising a mere 0.07%, the Dow gaining 0.16%, and the S&P 500 adding 0.24%. The only exception was the Russell 2000 as small caps shed 0.34% by the close.

Sector leadership came from Healthcare as a federal judge effectively quashed a lawsuit brought by the Federal Trade Commission. The suit alleges that pharmacy benefit managers systematically selected the highest-priced insulin products for customers, unfairly adding additional costs to patients. Gains in CVS Health (CVS), and United Health Group (UNH), among others, helped push the Dow and the S&P 500 higher. The remaining sectors saw results ranging from 0.80% (Consumer Staples) to -1.18% (Materials). Materials was impacted by Celanese Corporation’s (CE) 21.46% decline as markets punished the company following its latest earnings release and guidance.

The Tematica Select Model Suite saw leadership coming from CHIPs Act and Core Holdings while the remaining strategies took a breather with some strategies’ holdings seeing some profit taking.

Is The Market Facing A Flashing Yellow or Red Light?

Following yet another record close for the S&P 500, futures point to equities trading off later this morning. With trading volumes for the SPDR S&P 500 ETF Trust (SPY) over the last few days well below their average trading volume levels and even less than 2024 Christmas week volumes, there seems to be a lack of conviction in the market. Fueling that is what can be described as ballooning risks that include tariff tensions and earnings growth concerns; a Fed that now expects to keep rates elevated for some time and is also worried about the impact of tariffs on inflation; and a market multiple that can once again be characterized as stretched.

Meanwhile, data published by Barclays showed that at the end of January individual investors’ exposure to stocks is in the 96th percentile of data dating back to 1997. To that we can layer in findings from JPMorgan that sentiment across that group has also reached the highest on record, surpassing levels seen during the meme-stock mania of 2021. While the Fear & Greed Index is only flashing Neutral, the Citibank Panic Euphoria Index’s latest reading hit 0.70, up from its prior reading of 0.67. Both of those figures are deep into Euphoria territory, which begins when the indicator hits 0.40.

While we look at the noteworthy year-to-date returns across several of our models, including Luxury Buying Boom(+14.74%), Digital Lifestyle (13.68%), and EPS Diplomats Model (+12.11%) compared to the 4.46% gain for the S&P 500, we have to contemplate if we are at or near at time worthy of employing our Market Hedge Model? See below for a detailed table of our year-to-date model performance.

As we and hopefully you ponder that, the earnings cavalcade continues today, but among the latest throng of reports, the two that Team Tematica will be focused on are from Walmart (WMT) and Rackspace Technology (RXT). With Walmart, we’ll be interested in comments about its grocery business as shoppers contend with sticky inflation for some goods and higher prices for eggs, beef, and other items. We’ll also be listening for Walmart’s comments about Trump tariffs and how that could pressure its supply chain. Finally, we’ll be curious about any discussion on technology investments, including AI, to drive productivity and contain costs. In other words, we’ll be mining for Cash-Strapped Consumer, Artificial Intelligence, and Digital Lifestyle nuggets.

Turning to Rackspace, front and center will be progress on the company’s turnaround strategy but also what it shares about cloud and AI adoption. Part of our focus will be on the company’s bookings as well as end market comments spanning public and private cloud. As you can guess, those comments and others will be the ones we’re collecting for our Cloud Computing, Artificial Intelligence, and Digital Infrastructure models.

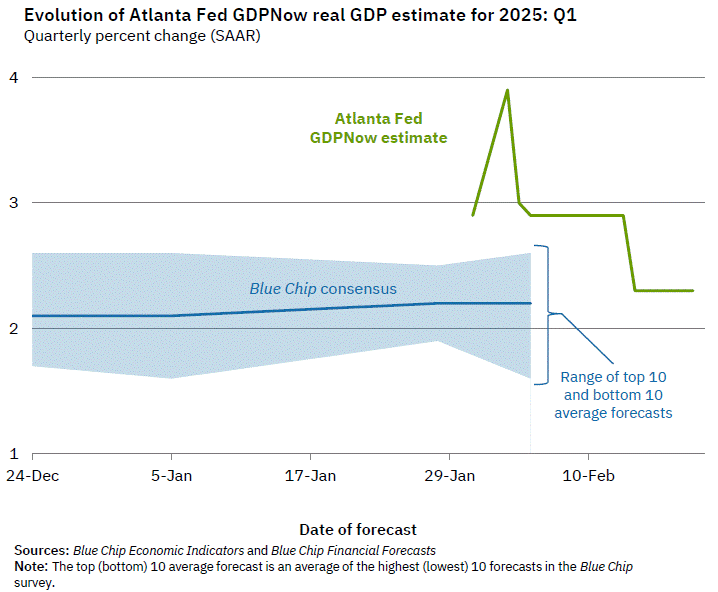

In terms of the economy, folks are puzzling through the potential impact of what is a growing list of forthcoming tariffs. However, following yesterday’s disappointing January Housing Starts print, the Atlanta Fed’s rolling GDP forecast better known as GDPNow remained at 2.3% for the current quarter. Granted, that figure is based on just over a handful of data points, and we’ll see more than a few revisions in the next few weeks as we start to get February data.

The first hard look at that data set comes on Friday with the release of S&P Global’s Flash February PMI report. Coming off recent inflation data, you can bet folks will be pouring over the Flash report’s findings but the two things we’ll be as interested in are what the data shows for the overall Service economy in February and early findings on tariffs. Why the Service economy? For starters, it accounts for nearly 80% of US GDP. Second, headline January Service PMI figures from S&P Global and ISM both showed that part of the economy growing but at a far slower pace compared to prior months. We’ll also be watching to see if the January decline in New Orders, an indicator of future activity, continued in February.

Model Musings

Aging Population, Homebuilding & Building Materials

A selection of lucky baby boomers seemingly have won the housing market, but they haven’t met their final boss just yet—the elusive retirement home. The generation is aging into worn infrastructure, and it appears that senior homes are ill-equipped to deal with the incoming class… If the current rate of development stays the same, just 191,000 new housing units will be added by 2030—short of the 560,000 needed to usher in the aging population, data service NIC MAP tells the Journal. Read more here

Senior housing has been one of the biggest disappointments for commercial real-estate investors. Now thanks to millions of aging baby boomers, that may be about to change. The oldest boomers turn 80 in less than a year. And by 2030, the U.S. population 80 years and older is expected to increase by more than four million people to 18.8 million. History suggests that a growing number of people conclude at that milestone age they can no longer live comfortably or safely at home and seek a senior facility. Read more here

Artificial Intelligence

The European Union pledged to mobilize 200 billion euros, equivalent to $206.15 billion, to invest in artificial intelligence as the bloc seeks to catch up with the U.S. and China in the race to train the most complex models. European Commission President Ursula von der Leyen said the bloc wants to supercharge its ability to compete with the U.S. and China in AI. The plan–dubbed InvestAI–includes a new 20 billion-euro fund for so-called AI gigafactories, facilities that rely on powerful chips to train the most complex AI models. Read more here

Since its integration, Ava Cado has shortened the time it takes for a candidate to complete their application and start the job from 12 days to four days. The system has nearly doubled Chipotle’s application flow and increased its candidate application completion rate to more than 85% from approximately 50% prior. Read more here

Artificial Intelligence, Cybersecurity

The era of “agentic” artificial intelligence has arrived, and businesses can no longer afford to overlook its transformative potential. AI agents operate independently, making decisions and taking actions based on their programming. Gartner predicts that by 2028, 15% of day-to-day business decisions will be made completely autonomously by AI agents. However, as these systems become more widely accepted, their integration into critical operations as well as excessive agency—deep access to systems, data, functionalities, and permissions—make them appealing targets for cybercrime. Read more here

Cash-Strapped Consumer

Americans are opening credit cards and racking up larger balances, pushing the country's credit card debt to a new record high. High interest rates, stubborn inflation and continued consumer spending are among the factors that have lifted collective credit card debt to an all-time high of $1.21 trillion, according to a New York Fed report. That's up from $986 billion two years ago. Read more here

But in recent days, economic data have shown that inflation has proven stubborn and the Fed is struggling to tackle the“last mile” of its quest to get inflation back to 2%, the benchmark that signals price increases are under control. One of the villains of the story is higher egg prices, an everyday item in many households that has become the poster child for the higher costs that American families face. Read more here

As of January, US cattle herds had shrunk 1% from the year before – hitting a 64-year low, according to government data.“On top of all that, demand is still strong,” Camberato told The Post. “When you mix lower supply with high demand, prices go up. It’s that simple.” Read more here

More than half of those informed consumers — 57%, to be exact — think these tariffs will hit their wallets hard. They’re not only worried about the big picture economy (though 40% are concerned about that, too). They’re worried about their own bottom line. That’s because 78% of those consumers anticipate higher prices and 75% expect product shortages. Read more here

Cybersecurity

Newspaper publishing giant Lee Enterprises has confirmed that a ransomware attack is behind ongoing disruptions impacting the group's operations for over two weeks. As a local news provider and one of the largest newspaper groups in the United States, Lee publishes 77 daily newspapers and 350 weekly and specialty publications across 26 states… In a Friday filing with the U.S. Securities and Exchange Commission (SEC), the media giant said the attack triggered a systems outage on February 3. Read more here

CISA and the FBI said attackers deploying Ghost ransomware have breached victims from multiple industry sectors across over 70 countries, including critical infrastructure organizations. Other industries impacted include healthcare, government, education, technology, manufacturing, and numerous small and medium-sized businesses. Read more here

An active campaign from a threat actor potentially linked to Russia is targeting Microsoft 365 accounts of individuals at organizations of interest using device code phishing. The targets are in the government, NGO, IT services and technology, defense, telecommunications, health, and energy/oil and gas sectors in Europe, North America, Africa, and the Middle East. Read more here

Homebuilding & Materials

Sentiment among the nation’s single-family homebuilders dropped to the lowest level in five months in February, largely due to concern over tariffs, which would raise their costs significantly. The National Association of Home Builders’ Housing Market Index, or HMI, dropped a sharp 5 points from January to a reading of 42. Anything below 50 is considered negative sentiment. Last February, the index stood at 48. Read more here

The growing crisis in the insurance industry may make it hard to get a mortgage in parts of the country in the coming decades, Federal Reserve Chairman Jerome Powell said on Tuesday. “If you fast-forward 10 or 15 years, there are going to be regions of the country where you can’t get a mortgage,” Read more here

Nuclear Energy & Uranium

France is making a bid to catch up in the artificial intelligence race by leaning on one of its strengths: plentiful nuclear power. The French government plans Monday to pledge a gigawatt of nuclear power for a new artificial-intelligence computing project expected to cost tens of billions of dollars, according to its private-sector backers and the French government. Read more here

Developers of small modular nuclear reactors have raised at least $1.5bn in funding over the past year, tapping into a surge of investor interest linked to power supply deals agreed with Big Tech. They have also secured pledges of billions of dollars of support from governments, amid a global race to launch new technologies considered critical to powering the artificial intelligence revolution. Read more here

Safety & Security

Denmark will boost its defense spending to more than 3% of economic output as the nation seeks to counter an escalation in security threats from Russia. The AAA rated Nordic country will spend an additional 120 billion kroner ($17 billion) on defense through 2033, Defense Minister Troels Lund Poulsen said at a news briefing on Wednesday. Read more here

European nations talked up the possibility of raising defense spending in the face of US pressure and their exclusion from Ukraine peace talks. In statements given around an emergency summit of European leaders in Paris Monday, France proposed joint Europe-wide bonds to fund increased military expenditure, while Poland’s prime minister pushed fellow European Union nations to ramp up their defense budgets. Read more here

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

Cash Strapped Consumers - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

Digital Infrastructure & Connectivity - Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

Digital Lifestyle - The companies behind our increasingly connected lives.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.