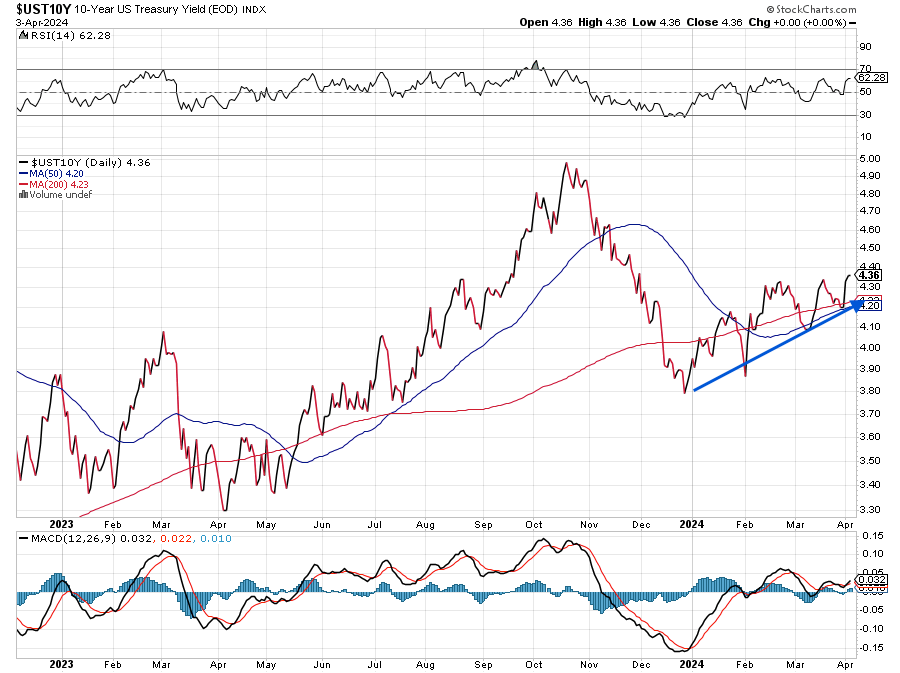

Fed Speakers, 10-Year Treasury Yield, and the Dollar

All that and eyes open for earnings pre-announcements

We are in a bit of no person’s land today as we are in between key economic data points for March and only a handful of less-than-market-moving earnings reports on deck today. Coming off yesterday’s big data dump, it will be a day of catch-up for the Atlanta Fed’s GDPNow model, which rose to 2.8% for the March quarter on April 1.

Given what we saw yesterday with the shares of Ulta Beauty (ULTA), we will want to keep our eyes and ears open for earnings pre-announcements during the current quiet period. But odds are the Fed will continue to have a large presence as the market grapples with rate cut questions. Following comments from Fed Chair Powell yesterday that policymakers will wait for clearer signs of lower inflation before cutting interest rates - no surprise if you’ve been following the data as we have, the market will likely focus on comments from the six Fed officials today.

10:00 am - Philadelphia Fed President Patrick Harker

12:15 pm - Richmond Fed President Tom Barkin

12:45 pm - Chicago Fed President Austan Goolsbee

2:00 pm - Cleveland Fed President Loretta Mester

2:00 pm - Minneapolis Fed President Neel Kashkari

7:30 pm - Fed Governor Adriana Kugler

While Powell set the tone, we will want to see if any of those six have altered their views following this week’s economic data, joining a more outspoken Atlanta Fed President Raphael Bostic. Yesterday, he shared that he sees only one rate cut occurring in the December quarter - a very different picture compared to what we see in the CME FedWatch Tool.

With the data published so far this week and what it showed for inflation, at a minimum the Fed has to be contemplating fewer rate cuts than the three it penciled in with its March economic projections. What the market will be looking to see is if the potential figure is closer to one or none. Given its unofficial role as a cheerleader for the economy, the Fed is likely to tow the party line of needing to see more “good data”, letting the market down slowly if that doesn’t happen.

As each of the five Fed officials who speak during trading hours today make their comments, watching the 10-year Treasury yield and dollar could give us a read on the market’s reaction.

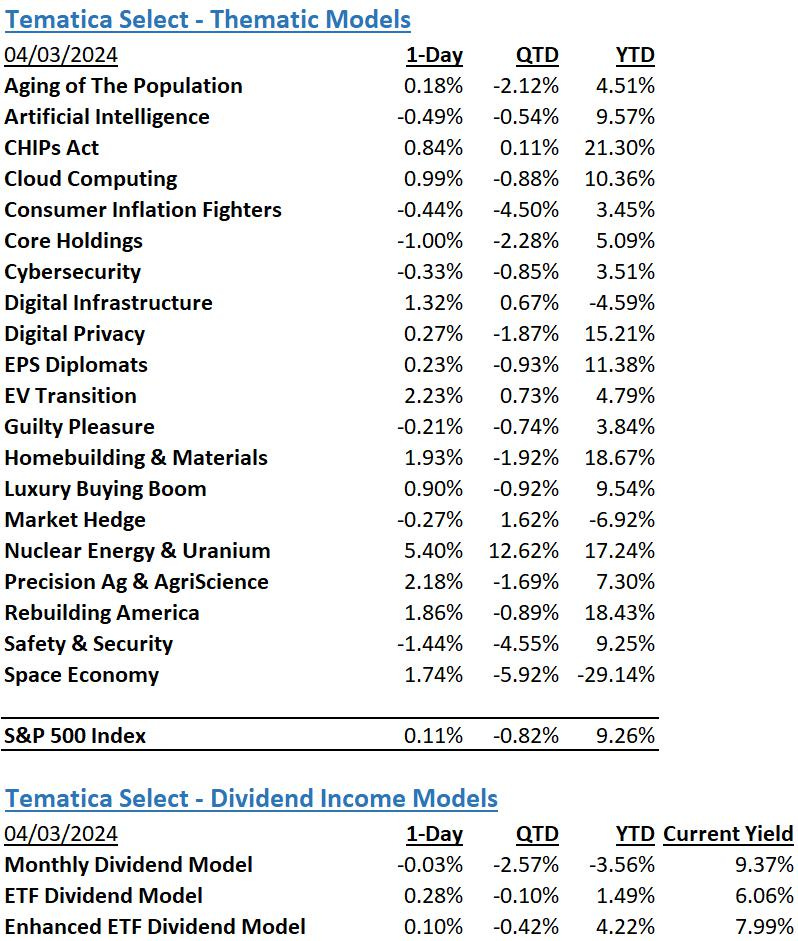

Model Musings

Artificial Intelligence, Digital Infrastructure

“Amazon.com Inc. plans to spend almost $150 billion in the coming 15 years on data centers, giving the cloud-computing giant the firepower to handle an expected explosion in demand for artificial intelligence applications and other digital services. The spending spree is a show of force as the company looks to maintain its grip on the cloud services market, where it holds about twice the share of No. 2 player Microsoft Corp.” Read more here

Digital Infrastructure

“The wireless telecommunications industry witnessed a year of unprecedented growth and innovation, propelled by the unstoppable momentum of 5G technology. In 2023, adoption of 5G connections accelerated, reaching 1.76 billion globally by adding 700 million, according to 5G Americas, the voice of 5G and beyond in the Americas, and data from Omdia… Global 5G connections are projected to skyrocket to 7.9 billion by 2028, with North America forecasted to boast an impressive 700 million 5G connections by the same year.” Read more here

Digital Privacy & Digital Identity

“Experts envision an array of trusted digital identity credentials and platforms — mobile driver’s licenses, digital passports, electronic birth certificates, information verification services from the IRS and Social Security Administration, and more — that would help us prove our identity during remote transactions. These credentials would reduce identity theft — which siphons billions of dollars annually from the nation’s economy — while protecting consumers’ privacy and pocketbooks. Not only would better digital identities safeguard the current economy, they may expand it. One study from the McKinsey Global Institute estimated adoption of digital IDs could unlock economic value equal to 4% of the nation’s GDP.” Read more here

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Consumer Inflation Fighters - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption or destruction of data.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Precision Ag & Agri Science – Companies that look to address shrinking arable land by helping maximize crop yields utilizing technology, science, or both.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed below.