Equity futures point to a weak start when the stock market opens later this morning, following a string of weaker-than-expected guidance that in some cases includes higher spending relative to market forecasts. The standout example was Meta (META), which saw its shares sink double-digits in after-market trading last night. From our perspective, Meta indicated it would increase its spending levels for the year by up to $10 billion to support infrastructure investments to support its AI investments. This confirms the thought we are in the midst of an AI-arms race and our AI and Digital Infrastructure & Connectivity models are well positioned. Other companies that came up short relative to market expectations included ServiceNow (NOW) and IBM (IBM).

It wasn’t all bad news last night. During its earnings conference call, Lam Research (LRCX) discussed several tailwinds for our CHIPs Act model - “To conclude, the proliferation of AI, the global push for localized chip manufacturing capacity and the ubiquity of semiconductors in new consumer and commercial products represent powerful, secular drivers for Lam and the rest of the semiconductor equipment industry in the years ahead.”

Before the stocks begin trading this morning, we’ll get the initial look at 1Q 2024 GDP, which the market sees coming in at 2.5%, down from 3.5% in the prior quarter. We expect more than a fair amount of brain power will break down the line items that culminate in the headline in the headline figure. Two that could get more attention than others are the 1Q 2024 PCE and core PCE indices.

We say this for two reasons. First, the PCE and core PCE data are favored inflation metrics for the Fed. Second, the March figures for those two data sets won’t be released until this Friday, which means savvy investors will be parsing the 1Q 2024 for implications on the March data. What they’ll be looking for is how it stacks up against the market forecasts for the core PCE Price index to fall to +2.6YoY in March from +2.8% the month before, while the headline PCE rises to 2.6% from 2.5% in February.

Should that data come in ahead of those forecasts, it would be the latest in a growing string of inflation data supporting what is shaping up to be just one or maybe two rate cuts later this year. Even if the March PCE and core PCE data surprises to the downside, our thinking is the Fed will not hang its hat on any one metric but look to see a variety of inflation metrics all moving toward its intended target level. And as Fed watchers know, Friday’s March PCE and core PCE price indices will be the last formal inflation data points before the Fed concludes its next policy meeting on the afternoon of May 1. That means we are still in the Fed’s quiet period as we close out this week, and begin next week.

Inside quarterly results this morning from heavy equipment company Caterpillar (CAT), we’ll be mining its earnings conference call for comments on North American construction activity and the impact of large projects tied to infrastructure spending that is helping fuel our Rebuilding America model. With an eye toward our AI, CHIPs Act, Cloud Computing, and Digital Infrastructure & Connectivity models, after today’s market close we’ll be following quarterly results, guidance, and other comments from Alphabet (GOOGL), Microsoft (MSFT), Intel (INTC), and KLA Corp. (KLAC).

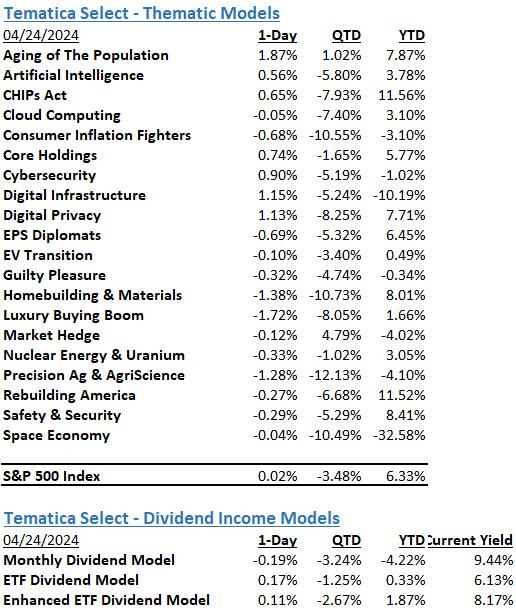

Model Musings

Artificial Intelligence

“Nvidia is acquiring Run:ai, a Tel Aviv-based company that makes it easier for developers and operations teams to manage and optimize their AI hardware infrastructure… Nvidia says that it’ll continue to offer Run:ai’s products “under the same business model” and invest in Run:ai’s product roadmap as part of Nvidia’s DGX Cloud AI platform, which gives enterprise customers access to compute infrastructure and software that they can use to train models for generative and other forms of AI.” Read more here

“This is Meta’s response to OpenAI’s ChatGPT, the chatbot that upended the tech industry in 2022, and similar bots including Google’s Gemini and Microsoft’s Bing AI. The Meta bot’s image generator also competes with A.I. imaging tools like Adobe’s Firefly, Midjourney and DALL-E. Unlike other chatbots and image generators, Meta’s A.I. assistant is a free tool baked into apps that billions of people use every day, making it the most aggressive push yet from a big tech company to bring this flavor of artificial intelligence — known as generative A.I. — to the mainstream.” Read more here

“Artificial intelligence-powered cameras are being installed on Los Angeles Metro buses to help ticket cars parked in bus lanes. Testing is planned for this summer and the program is expected to go live by the end of 2024…” Read more here

Cybersecurity

“American telecom provider Frontier Communications is restoring systems after a cybercrime group breached some of its IT systems in a recent cyberattack. Frontier is a leading U.S. communications provider that provides gigabit Internet speeds over a fiber-optic network to millions of consumers and businesses across 25 states. After discovering the incident, the company was forced to partially shut down some systems to prevent the threat actors from laterally moving through the network, which also led to some operational disruptions.” Read more here

“The Hospital Simone Veil in Cannes (CHC-SV) has announced that it was targeted by a cyberattack on Tuesday morning, severely impacting its operations and forcing staff to go back to pen and paper… With a capacity of 869 beds, it handles 150,000 outpatient and 50,000 emergency room visits, performs 9,000 surgeries, and assists in 1,500 births annually. The Hospital announced that it was forced to take all computers offline earlier this week due to a cyberattack, leaving only telephone systems available for communication.” Read more here

Digital Infrastructure & Connectivity

“Data center space failed to keep pace with demand last year, despite the building boom fueled by the industry’s largest customers. According to new research from commercial real estate services firm CBRE, there was 601MW of take-up across the 14 largest markets in Europe in 2023. However, just 561MW of new supply was delivered during the same period - the second time in five years that take-up has exceeded new supply in Europe… “ Read more here

“Data center demand in North America shows no sign of slowing over the next 12 months, with pricing approaching record levels according to reports from JLL and CBRE. In the report by JLL, the company’s managing director of data center markets, Andy Cvengros, said “Demand continues to be at all-time highs, and data center growth is rapidly expanding from core markets in search of power.” Read more here

Rebuilding America

“Southern Californians can expect to board a high-speed train as soon as 2028 for a two-hour ride to Las Vegas, officials on the $12-billion project said when construction ceremonially broke ground Monday in Sin City… To get the L.A.-to-Vegas idea off the ground, the federal government awarded Brightline West $3 billion from the 2021 Infrastructure Investment and Jobs Act , which authorized up to $102 billion for rail improvements. The rest of the project will be privately funded, although taxpayers are contributing there as well; the Biden administration has enabled the project to borrow $3.5 billion through tax-exempt bonds.” Read more here

Safety & Security

“President Biden signed a $95.3 billion package of aid to Ukraine, Israel and Taiwan on Wednesday, reaffirming U.S. support for Kyiv in the fight against Russia’s military assault after months of congressional gridlock put the centerpiece of the White House’s foreign policy in jeopardy.” Read more here

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Consumer Inflation Fighters - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption or destruction of data.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Precision Ag & Agri Science – Companies that look to address shrinking arable land by helping maximize crop yields utilizing technology, science, or both.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed below.