Earnings Continue, Flash July PMI Ahead, Trump to Visit Powell

Market Recap

We’ve said many times that markets don’t like uncertainty, and yesterday was a good example of them responding positively to certainty. Announcements on new tariff deals with Indonesia, Malaysia, and, more importantly, Japan and Europe seemed to lift so-called “animal spirits” even in the face of a 15% increase in wholesale costs for covered products. That being said, both the Nasdaq Composite and the S&P 500 closed on fresh all-time highs, and the Dow crossed 45,000 (not seen since December 4, 2024, and only about 4 points off another ATH). Mag 7 and technology seemed to detract from overall results as evidenced by the Nasdaq Composite gaining 0.61%, the S&P 500 rising 0.78% and the Dow adding 1.14%. Small caps won the day as the Russell 2000 closed 1.53% higher.

Other signs of healthy breadth yesterday include an advance/decline line of 343/160 for holdings of the SPDR S&P 500 Trust ETF (SPY) and seeing only Nvidia (NVDA) and Meta Platforms (META) showing up in the top 10 list of contributors to return for the fund with remaining names coming from a healthy mix of sectors. Speaking of sectors, Utilities was the only one to close lower, down 0.75%. Leadership came from Healthcare, which was buoyed by pharmaceutical and medical device makers like Eli Lilly & Co (LLY), Thermo Fischer Scientific (TMO), and Align Technology (ALGN), which combined to contribute to just over 33% of the sector’s 2.05% result. The remaining sectors saw results ranging from 0.04% (Consumer Staples) to 1.79% (Industrials).

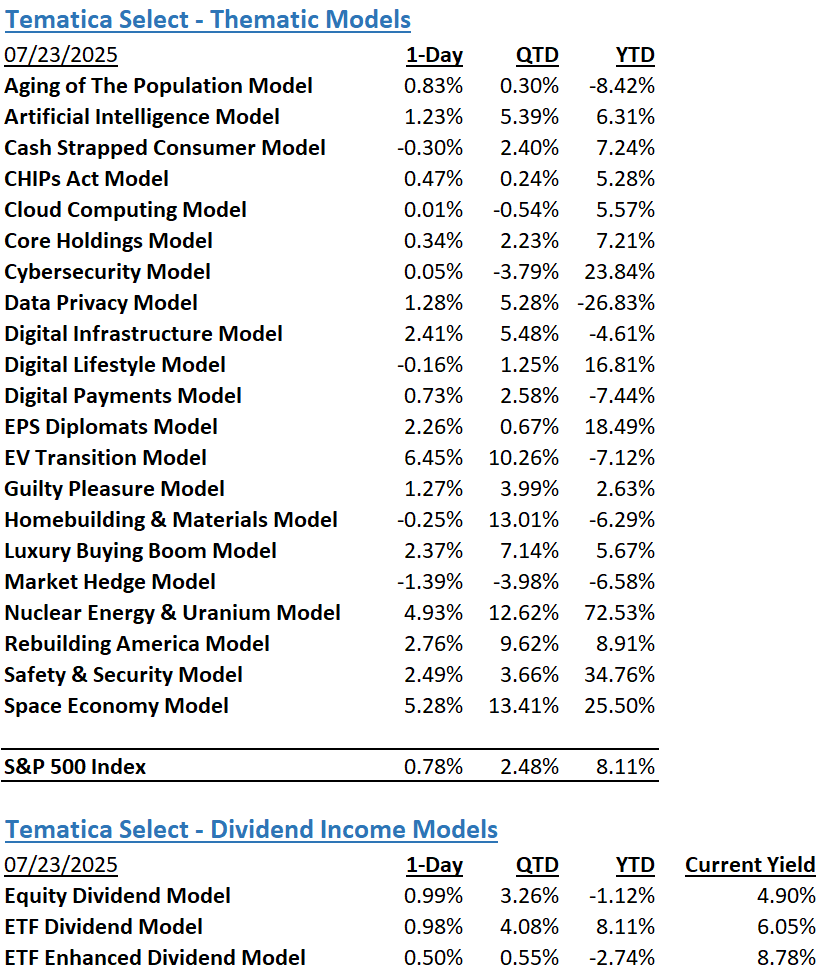

Tematica Select Models saw positive results yesterday, with the exception of Digital Lifestyle (DLIFE), Homebuilding & Materials (HOMES), and Cash Strapped Consumer (PINCH). Leadership came from EV Transition (EVTRANS)as Japanese automakers got a boost from the tariff agreement announcement. Monday’s profit taking in Nuclear Energy & Uranium (NUKE) seemed to be a distant memory as traders once again bid up names in the segment.

Earnings Continue, Flash July PMI Ahead, Trump to Visit Powell

Equity futures are mixed this morning as investors contend with a mixed bag of June quarter earnings results and reports that President Trump will continue his passive-aggressive attack on the Fed. Trump will reportedly visit the Federal Reserve at 4 PM ET today, the first time in nearly two decades that an American president has made an official trip other than the central bank.

While we wait to see what unfolds from that visit and whether there are any additional trade deals announced today, better-than-expected quarterly results last night from the likes of Alphabet (GOOGL), Las Vegas Sands (LVS), T-Mobile (TMUS), and ServiceNow (NOW) are helping lift equity futures. Those gains are being tempered, however, by pre-market declines in the shares of Tesla (TSLA), Chipotle Mexican Grill (CMG), IBM (IBM), and Dow (DOW).

The array of earnings continues this morning, with those from Honeywell (HON), Lazard (LAZ), Textron (TXT),Union Pacific (UNP), and others. Following Alphabet's upsizing of its 2025 capital spending plans last night, we’ll be looking at those from Digital Realty Trust (DLR) when it reports after tonight’s market close. We’ll also be tuning into comments from Intel (INTC) about its June quarter, but also how it sees PC and data center demand shaping up in 2H 2025. Not to be those people, but we suspect that when all is said and done with the June quarter earnings season, we’re likely to see Intel continue to lose market share to the likes of AMD (AMD), Nvidia (NVDA), Marvell (MRVL), and others.

In between today’s rounds of corporate earnings, at 9:45 AM ET, S&P Global (SPGI) will publish its Flash July PMI report, and what it reveals will be a fresh take on the speed of the domestic economy, the pace of hiring, and inflation pressures at the start of the current quarter. We’ll be parsing those comments, looking to see the direction and velocity of those items relative to the last few months of the June quarter. The anecdotal insights from survey respondents and what they say about the impact of tariffs should also be insightful. Interesting timing for this report as Trump heads to visit Fed Chair Powell today.

We are also seeing the latest victories in the IPO market with offerings from Accelerant Holdings (ARX) and McGraw Hill (MH). While Accelerant priced its transaction at $21, above the targeted $18-$20 range, McGraw Hill’s landed at $17, below the expected $19-$22.

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

Cash Strapped Consumers - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

Digital Infrastructure & Connectivity - Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

Digital Lifestyle - The companies behind our increasingly connected lives.

Digital Payments - Companies benefitting from the accelerating structural adoption of digital payments and financial technology (FinTech).

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.