Equity futures suggest the sell-off experienced by the market yesterday, its worst one-day performance since 2002, is poised to continue. Investors will continue to digest the flow of earnings from last night and this morning, including horrible results from Ford Motor (F), but quite good results from Lockheed Martin (LMT), Northrop Grumman(NOC), and ServiceNow (NOW) which are driving Wall Street price targets higher. As they consume those and other reports out this morning, they will be keeping one eye on the S&P 500’s 50-day moving average which clocks in at 5,428.30.

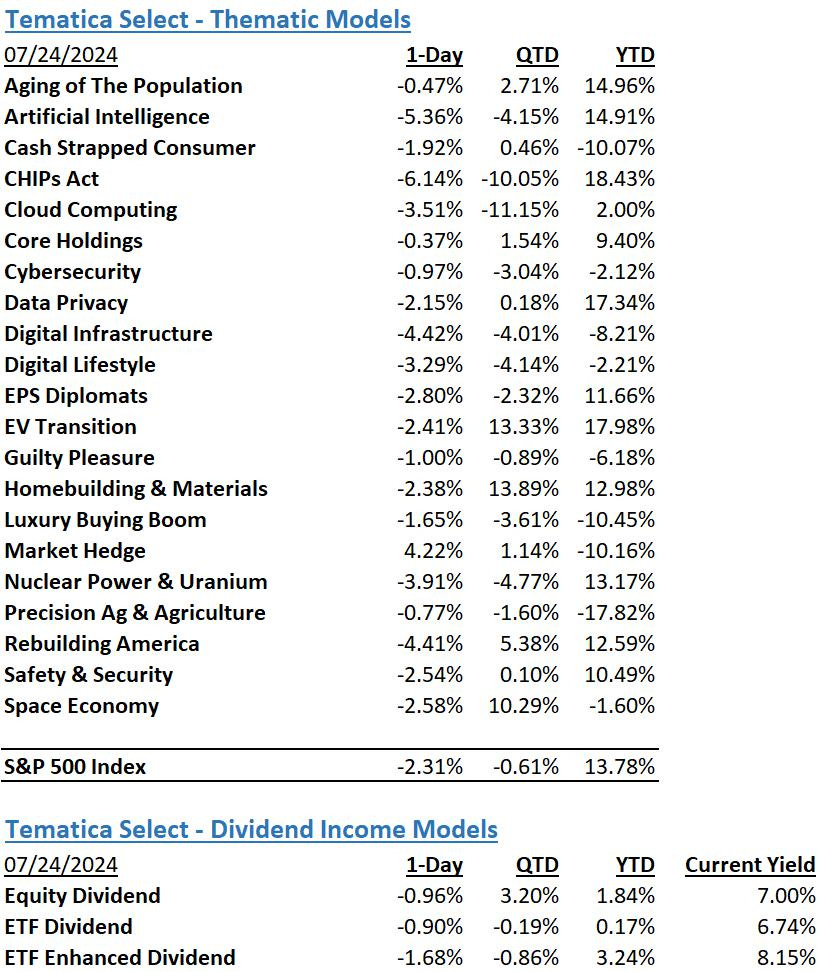

The question to be answered is whether the basket successfully holds that level after falling just over 4% from its recent high at 5,667.20. If not, the next layer of support comes at 5,285.04, roughly another 2.6% lower. If we see the market pull back to that 100-day moving average level, it will equate to the market experiencing one of the 5% or more drawdowns that typically happens a few times each year. Pullbacks of that magnitude tend to be healthy for the market, removing over-exuberance and stretched market valuation multiples. The silver lining is our Market Hedge model (more on that below) has been doing rather well of late.

With an eye toward the potential for the market to pull back further, something that could hinge on today’s initial 2Q 2024 GDP print and tomorrow’s June PCE Price Index, let’s game out next week. We’re doing this because Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), and Meta (META) account for almost 20% of the S&P 500, and their collected quarterly results and guidance will have a strong influence on the market. Because of the market’s reaction this week to Alphabet’s and Tesla’s quarterly results that we touched on above, if those reports and guidance are not pristine, we could see further pressure on the market.

The degree of that pressure, should it emerge, could be tempered by what is found in the Fed’s latest policy statement and Fed Chair Powell’s post-policy decision presser. While the Fed could surprise the market with an unexpected rate cut next week, we see that scenario as having a low probability. The more likely outcome the market will be looking for is more dovish language from the Fed on the topic of rate cuts. If the Fed surprises us with something that suggests it now sees more than one rate cut as likely before the end of the year, such a signal would buoy the market and a number of our models.

While we wait for that potential clarity to appear, readers may want to build their shopping lists for stocks, ETFs, and other strategies like those found in our models below.

Model Musings

Aging of the Population

“With people in the U.S. aging better and living longer, older adults are one of the fastest-growing groups in the country. In fact, by 2030, all Baby Boomers will be age 65+ and by 2040 roughly 78.3 million Americans will fall within that age group.” Read more here

Artificial Intelligence

“A WIRED investigation finds that major players like Activision Blizzard, which recently laid off scores of workers, are using generative AI for game development.” Read more here

Artificial Intelligence, Cloud Computing

“Google’s cloud division hit $10 billion for the first time while also achieving $1 billion in operating profit. During an earnings call on Tuesday, Google CEO Sundar Pichai said the company’s generative AI solutions for Cloud customers “already generated billions in revenues and are being used by more than 2 million developers.” Read more here

“SAP has promoted its cloud business by bundling it with AI tools to incentivize customers to make the shift, moving users to the more lucrative subscription model and away from on-premise licenses. Its current cloud backlog, an indication of future revenue, grew by 28% to €14.8 billion last quarter.” Read more here

Digital Lifestyle

“Mobile wallets are becoming an in-store retail staple. US point-of-sale (POS) transactions made via these wallets will pass the $1 trillion milestone in 2027, per the forecast, with about half of smartphone users making these payments the following year.” Read more here

“… it brings the total of U.S. online retail sales — excluding Amazon — to $14.2 billion during the full Amazon Prime Day 2024 sales event, according to Adobe. That’s both an 11% year-over-year increase and a new record for online sales during the Prime Day event… Almost half of that total came from mobile devices. Mobile commerce drove close to half (49.2%) of online purchases on the second of Amazon’s two-day event. For both days combined, consumers spent $7 billion from their mobile devices. That’s 18.6% year-over-year growth.” Read more here

Guilty Pleasure, Cash Strapped Consumer

“Revenue grew as prices rose in the mid-single-digit percentage range, leaving consumers to pay more for their treats. And Lindt said it would need to hike prices further. Cocoa costs have more than doubled this year due to limited crop supply, and are now higher than many metals.” Read more here

Homebuilding & Materials

“High interest rates have discouraged sellers from listing homes, increasing competition among buyers and driving up prices. However, a growing number of homes on the market could change that. Buyers have protested high prices by sitting out of the market, letting available homes pile up to the highest level since May 2020 and leading sellers to cut their asking prices.” Read more here

Luxury Buying Boom

“Luxury goods giant LVMH’s latest earnings showed resilience with 2% organic growth in the first half of 2024, but the market leader fell short of analyst estimates and last year’s revenue amid a slowdown in luxury fashion… Fashion and leather goods, as well as perfumes and cosmetics businesses, grew 1% and 4% in the second quarter, respectively, thanks to Dior’s Sauvage and J’adore perfumes’ ongoing success.” Read more here

Safety & Security

“Canada will increase defense spending to the NATO target of 2% of gross domestic product by 2032, Prime Minister Justin Trudeau said on Thursday, making a commitment for the first time on when the government would meet the goal as pressure from the United States mounts.” Read more here

“India has announced a 2024–25 defence budget of INR6.22 trillion (USD74.3 billion). The expenditure represents a 4.8% increase compared with the original defence budget for 2023–24.” Read more here

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

Cash Strapped Consumer - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption or destruction of data.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Digital Lifestyle - The companies behind our increasingly connected lives.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Precision Ag & Agri Science – Companies that look to address shrinking arable land by helping maximize crop yields utilizing technology, science, or both.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed below.