Earnings Bring Consumer Health Updates

Does McDonald's (MCD) double patty earnings miss set the stage for more tough news for the consumer? Proctor & Gamble (PG) doesn't seem to think so.

In our latest Week Ahead Video, we talked about how this week’s slow economic calendar is going to leave investors and traders alike parsing through this week’s earnings releases for trading guidance.

That first signal dropped, and it was a bit of a potential wake-up call as McDonald Corp (MCD) posted a miss on both top and bottom lines. CEO Chris Kempczinski talked about how they warned of “ a more discriminating consumer, particularly among lower-income households.” He went on further, stating that “those pressures have deepened and broadened.” The company noted that guest counts were lower but the impact of those lower counts was offset somewhat by higher prices. This gets to the meat of the conversation, which is, given that the consumer represents about 70% of GDP, do they have enough left in their checking account to make it through this part of the cycle?

There’s been a fair amount of ink spilled on the resilience of consumer. The reality is that while inflation has slowed considerably we are still dealing with prices that are at all-time (and for many, unreasonable) highs. Outstanding credit card debt has been hitting new highs regularly but looking over the long-term trend the pace of that growth has been moderating over the past year or so, so its something we’re keeping an eye on but it’s not a bona fide worry.

The rest of this busy earnings week will give us a lot more data points on the consumer, starting with today’s Proctor & Gamble (PG) pre-market release. The company posted a beat but warned about increased commodity input costs and foreign exchange headwinds in 2025. Other consumer staples names like Philip Morris (MO), and Anheuser-Busch Inbev (BUD) will report, and for the well-heeled among us, Ferrari (RACE) will announce on Thursday. We will get a more comprehensive consumer update as Amazon (AMZN) kicks off the back half of summer with earnings, expected to come in at $1.03, a full $0.40 over the previous year’s result.

Tying into the consumer picture will be a number of payment processing and consumer finance names like PayPal (PYPL), SoFi (SOFI), Mastercard (MA), Block (SQ), and Coinbase (COIN).

Updates on the consumer are great to get but given that the Fed meets tomorrow and the Fed Funds Future curve is pricing in a 95% chance of no move, it’s not clear that a handful of companies posting a soft quarter will be enough to sway the Fed into changing their overall outlook.

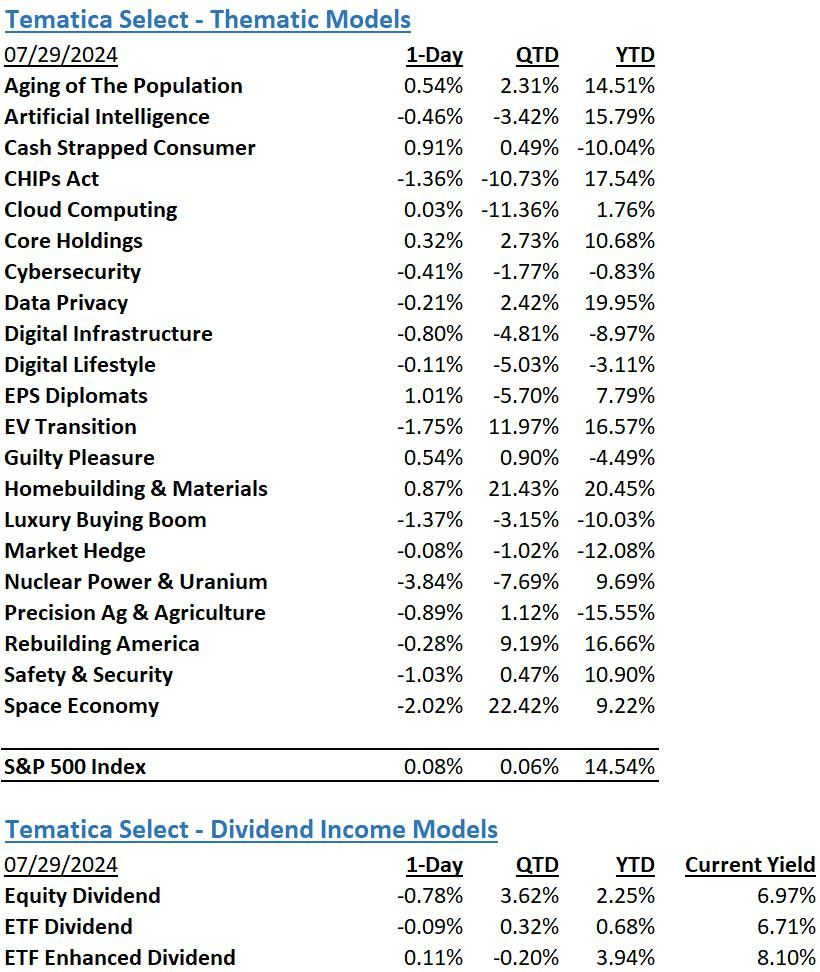

Model Musings

Cybersecurity

“As athletes from around the world vie for gold at the 2024 Olympics and Paralympics in Paris, cybercriminals are fine-tuning their own game plans to hack, attack, and exploit the largest event on the planet, making the 30th Olympiad potentially the greatest cybersecurity risk in history.” Read More Here

Cash Strapped Consumer

“From food producers to airlines, automakers to luxury houses, evidence of the impact is piling up. Whether it’s US grocery shoppers tapped out after a period of punishing inflation or wealthy Chinese customers postponing their next splurge, the effects are rippling across the corporate landscape.” Read More Here

Luxury Buying Boom

“Luxury goods giant LVMH’s latest earnings showed resilience with 2% organic growth in the first half of 2024, but the market leader fell short of analyst estimates and last year’s revenue amid a slowdown in luxury fashion.” Read More Here

EV Transition

“Volvo CEO Jim Rowan told analysts the automaker may turn to hybrids and PHEVs, softening its plans for full-electrification by 2030, according to Automotive News.

This follows the growing trend of global automakers realizing that EV transformation will take time to scale. Rowan said that hybrids ‘could form a solid bridge for our customers that are not ready to move to full electrification.’” Read More Here

“Stellantis is ready to ‘fight’ for its place in Europe's electric vehicle market against strong competition from Chinese carmakers, its CEO Carlos Tavares said on Monday, as the group presented its new EV production line in Serbia.” Read More Here

“The implications of this shift are profound. Cadillac and Rivian’s success signals a more diversified EV market, challenging Tesla’s long-standing dominance. For consumers, this means more choices, better technology, and competitive pricing. For Tesla, it’s a wake-up call to innovate and adapt or risk losing its crown.” Read More Here

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

Cash Strapped Consumer - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption or destruction of data.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Digital Lifestyle - The companies behind our increasingly connected lives.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Precision Ag & Agri Science – Companies that look to address shrinking arable land by helping maximize crop yields utilizing technology, science, or both.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed below.