Digesting More Big Tech Earnings, Waiting for Friday’s January PCE Report

Meta, Microsoft, Tesla, ServiceNow, IBM, Lam Research, Caterpillar, Mastercard, and Check Point Software (to name a few)

Market Wrap

Given a somewhat hectic start to this week, markets, while ending yesterday lower, were soothed somewhat by a Fed that delivered on rate-setting expectations. Also figuring into the calculus/alchemy of market sentiment, were some quick rebuttals from US-based AI developers on the provenance of DeepSeek’s training data set. To be clear, some are attacking the validity of DeepSeek’s data, while others are pointing to savvy hardware configurations and superior coding as the source of the outperformance.

While the big noise of DeepSeek’s weekend announcement has faded, it hasn’t entirely gone away as evidenced by the Technology sector contributing to just over 76% of the S&P 500’s -0.47% result. Of that 76%, 56% was attributable to Nvidia (NVDA) after the company announced it expects shortages of their latest graphics cards due to demand. Once again, the Nasdaq Composite led markets lower, falling 0.51% but this time both the Dow and the Russell 2000 closed down 0.31% and 0.25%, respectively.

Further evidence of the market's calming include the Cboe Market Volatility (VIX) ending the day essentially flat, at 16.56 as well as gold barely moving, at $2,757.70/oz.

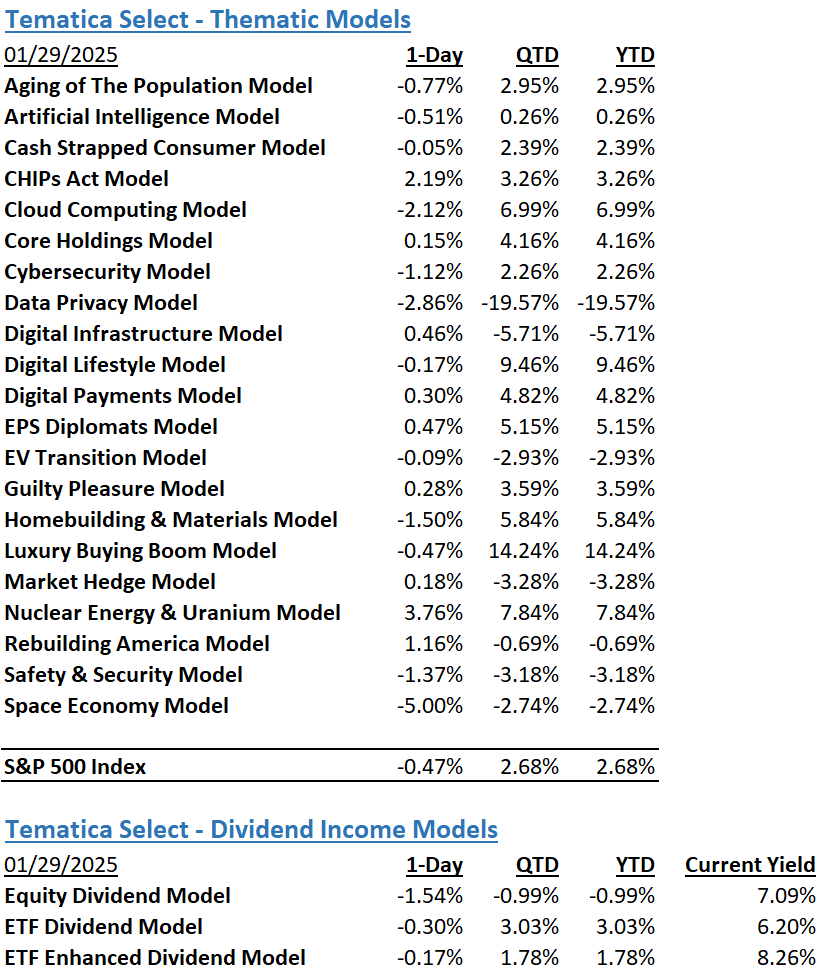

The Tematica Select Model Suite participated in this sentiment strengthening, especially in Nuclear Energy & Uranium and CHIPs Act which, with Rebuilding America sat in slots 1, 2, and 3 in yesterday’s leaderboard. Space Economy took a hit as Apple (AAPL) announced it had enabled Starlink-based satellite service for certain T-Mobile (TMUS) customers, effectively jumping ahead of various network providers that have been working toward a similar solution.

Digesting More Big Tech Earnings, Waiting for Friday’s January PCE Report

With the Fed delivering the message many expected - no rate cut and the need to see further sustained progress on inflation - the market’s attention will shift back to earnings from last night and today before ping-ponging back to inflation Friday morning. That’s when the December Personal Consumption Expenditure (PCE) Price Index will be published, and since the PCE is the Fed’s preferred inflation metric it will likely get a fair share of attention.

Should the core figure come in as expected at 2.8% year over year, it will mark the third consecutive month at that level, keeping it above the Q3 2024 average of 2.7%. But our view may be a tad different because of what we saw in the January Flash PMI report from S&P Global (SPGI):

Inflationary pressures meanwhile intensified in January. Both input costs and average selling prices rose at the fastest rates for four months, the rate of inflation of the latter now having increased for two successive months… Higher costs were passed on to customers, with average prices charged for services rising at the fastest rate since last September. An even larger rise was reported for goods…

That’s not the good progress the Fed is looking for and perhaps that explains Fed Chair Powell’s comment yesterday that inflation is “somewhat elevated.” But looking at the 10-year Treasury yield, which was little changed it’s safe to say the market took the Fed’s policy statement and Powell’s presser comments in stride.

Following the January Flash PMI findings from S&P shared above, our thinking is next week’s January splash of data will be more insightful than Friday’s December PCE figures. But before we get to that report, the market will continue digesting quarterly results last night rom Microsoft (MSFT), Meta (META), ServiceNow (NOW), Tesla (TSLA), Lam Research (LRCX), and others as well as this morning’s reports from Caterpillar (CAT), Mastercard (MA), and Check Point Software (CHKP). We’ll be mining them for comments and other insights as they relate to our targeted exposure models below.

Model Signals

Aging of the Population, Artificial Intelligence

Long-term care in the United States isn’t just for grandma and grandpa anymore. It’s true that when most people hear the words long-term care (LTC), they still think of nursing homes and folks in rocking chairs. The reality is that LTC is a sprawling industry. Estimates put its market size north of $1 trillion. It touches everything from assisted living to at-home health aides, but it comes with a hefty price tag. Read more here

Artificial Intelligence

Recent breakthroughs in robotics and artificial intelligence could enable robots to do much of the work that orchards require, potentially transforming how apples get to a fruit bowl near you. A number of universities and startups are developing specialized robots for each stage of apple production, from pollinating the trees to fertilizing them, pruning them and harvesting the fruit. The push for automation comes as orchards face rising labor costs, and as they’re evolving in a way that would mesh well with robot apple pickers. Read more here

Artificial Intelligence, Cybersecurity

DeepSeek, a new AI platform that has quickly gained attention for its advanced and cost-effective AI model, recently faced a "large-scale" cyberattack. The attack, which forced the platform to disable new user registrations, is believed to be a distributed denial-of-service attack targeting its API and web chat platform. While existing users can still access the platform, this incident raises broader questions about the security of AI-driven platforms and the potential risks they pose to consumers. Read more here

GenAI is being used to protect businesses against threats from attackers, and CISOs use AI in identifying risks (39%) , threat intelligence analysis (39%), and threat detection and prioritization (35%) - as well as outlining the priorities for CISOs… Read more here

Artificial Intelligence, Digital Infrastructure, Safety & Security

The Defense Department has an ambitious vision for using AI across a range of military missions, including data collection, intelligence analysis, campaigning and logistics. But running those tools and applications takes more computing power and space than DOD has access to. Roy Campbell, deputy director of advanced computing in the Office of the Undersecretary of Defense for Research and Engineering, said Thursday that many times, bases outside of the U.S. don’t have the computing power they need to retrain new AI tools. Read more here

Cash-Strapped Consumer

Egg prices have been rising for months, and there isn’t any relief in sight. This could reignite consumer concerns about food inflation, which has been cooling, and spell trouble for President Donald Trump’s administration. Recent outbreaks of highly pathogenic avian influenza (HPAI) has sharply reduced the number of laying hens in the country and shrunk the supply of eggs. Since January 2022, the influenza has led to the killing of more than 145 million domestic poultry across the country. Read more here

CHIPs Act

Global sales of total semiconductor manufacturing equipment by original equipment manufacturers (OEMs) are forecast to set a new industry record, reaching $113 billion in 2024… Semiconductor manufacturing equipment growth is expected to continue in the following years, reaching new records of $121 billion in 2025 and $139 billion in 2026, supported by both the front-end and back-end segments. Read more here

Cybersecurity

Threat reports for December showed a newcomer to the ransomware-as-a-service (RaaS) landscape quickly climbing the ranks. Called Funksec, this group appears to be leveraging generative AI in its malware development and its founders are tied to hacktivist activity. Funksec was responsible for 103 out of 578 ransomware attacks tracked by security firm NCC Group in December, putting it in the top spot for the month… Read more here

Digital Lifestyle

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

Cash Strapped Consumer - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption or destruction of data.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Digital Lifestyle - The companies behind our increasingly connected lives.

Digital Payments - This model focuses on companies benefitting from the accelerating structural adoption of digital payments and financial technology (FinTech).

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.