Housekeeping! - Because US equity markets will be closed on Thursday for the Independence Day holiday, the next edition of Thematic Signals will be published on Monday, July 10.

What We’re Contemplating with This Week’s Data Deluge

Today puts the spotlight back on Fed Chair Powell for the first time since the June FOMC press conference. Recent data has shown further inflation progress, but gnawing in the back of our mind is the upward revisions to April’s core PCE figure that kept it unchanged at 0.3% for the third consecutive month. Our thinking is Powell will recognize the dip to 0.1% in the May core PCE figure and other improvements. However, concerns about being head faked by the data like many were last fall’s core CPI figures, Powell will reiterate the need to see more “good data”. He’ll most likely stick to the Fed dot plot as well, repeating that the Fed sees one rate cut late this year ahead of the central bank's next policy meeting that concludes on July 31.

What we’ll be looking for in the coming months is not only further movement in the hard and soft inflation data but also a shift in the Fed language. Because Powell and crew have been careful with their words and as best they can have telegraphed their actions, we expect to see them adopt a more dovish language ahead of the first rate cut. This means the market will continue to dissect upcoming Fed head appearances, especially those that will follow data-filled weeks like the one ahead of us.

Today we have the May JOLTs Job Openings and Quits report, and tomorrow brings the June Service PMIs from ISM and S&P Global (SPGI). Alongside those two reports and what they reveal about activity, inflation, and job creation in that part of the economy, ADP will publish its June Employment Change Report and its lesser-followed monthly Pay Insights report. Bookending those reports will be the June Challenger Job Cuts reports, which for those who read it to the very end know it also provides a look at hiring plans.

Late morning tomorrow, the Atlanta Fed’s GDPNow model will publish an update that includes data out today and tomorrow morning. The rolling forecast for the June quarter has steadily fallen to 1.7% as of yesterday from its mid-June high of 3.2%. While some may be ready to sound the alarm, what we learn in tomorrow’s data could buoy that estimate. If not, it could fan economic growth concerns with some using it to argue for the Fed needing to cut rates before the December quarter.

While US equity markets will close early tomorrow at 1 PM ET ahead of the Independence Day holiday that has those markets closed on Thursday, the Fed will publish its most recent policy meeting minutes at 2 PM ET. Because of recent data, to some extent this will be a rear-view report but recalling Fed Chair Powell’s press conference comment that many Fed officials did not update their dot plot forecasts to reflect the May CPI report, we’ll be interested in what they did say about that data.

The data filled week culminates with the June Employment Report. Expectations as of today call for slower job and wage growth compared to May, but the data published today and tomorrow could result in some changes to that line of thinking. While the market will no doubt close out the week based on what that report shows, we’ll be as interested in the subsequent update to the Atlanta Fed’s GDPNow model, one that will provide an even clearer picture of June quarter GDP.

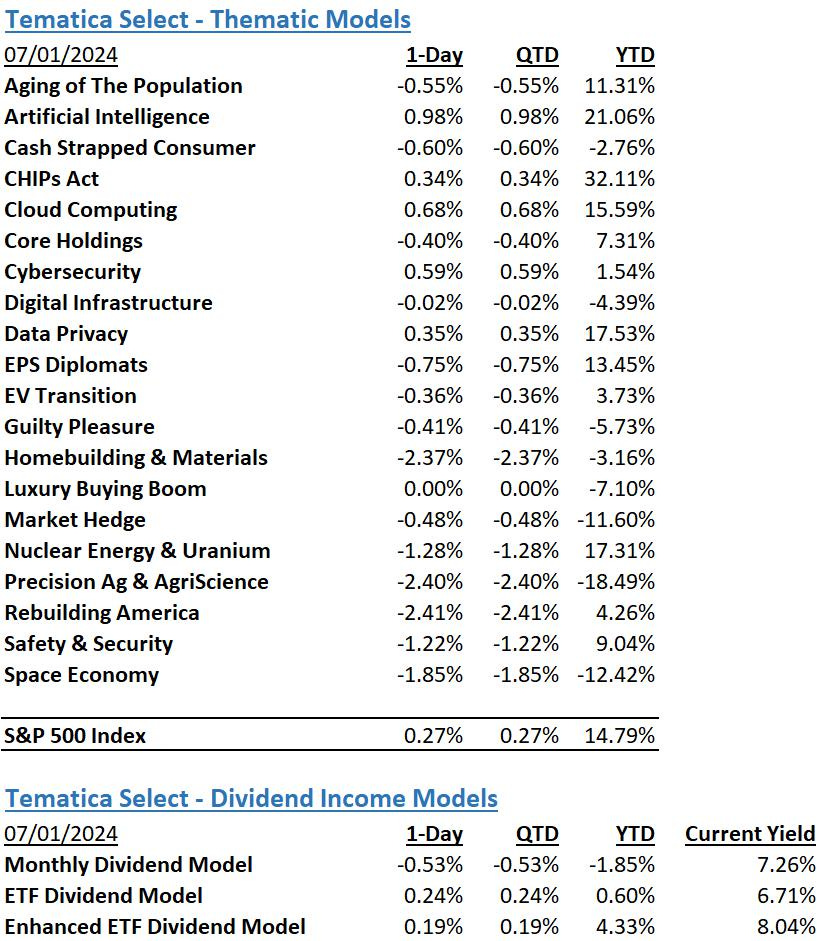

Model Signals

Artificial Intelligence, Digital Infrastructure

“Amazon, known for its aggressive spending to build a $2 trillion empire, is shifting its investment focus from retail warehouses to AI and cloud computing. The company plans to spend over $100 billion on data centers over the next decade.” Read more here

Artificial Intelligence, Cybersecurity

“Pure Storage is upping its AI game with a pair of announcements, including a new storage-as-a-service offering that’s designed for AI workloads and new AI-driven security features to detect and prevent ransomware. The company bills its new Evergreen//One product as the first purpose-built AI storage-as-a-service offering. It includes guaranteed levels of storage performance for GPUs in training, inferencing and high-performance computing workloads… Pure also boosted its anomaly detection capabilities with AI functions. Anomaly detection is used to discover threats such as ransomware, atypical activity, malicious behavior and denial-of-service attacks, by looking for performance anomalies.” Read more here

“Cybersecurity researchers have been warning for quite a while now that generative artificial intelligence (GenAI) programs are vulnerable to a vast array of attacks, from specially crafted prompts that can break guardrails, to data leaks that can reveal sensitive information… "This is a new attack vector that opens up a new attack surface…” Read more here

Artificial Intelligence, Safety & Security

“The U.S. Army plans to ask contractors for help integrating industry-generated artificial-intelligence algorithms into its operations, part of the service's 100-day push to lay the groundwork for sweeping adoption of AI.” Read more here

“Defense AI applications have long been touted as a potential long-term growth area and it appears that 2022/23 has been a turning point in the realization of those aspirations. While other agencies are continuing to invest in AI, either adding to existing investment or just starting, DoD is massively investing in AI as a new technology across a range of applications.” Read more here

Cash-Strapped Consumers

“Despite a robust economy, a significant portion of American consumers are grappling with financial challenges that affect their shopping habits in profound ways, and to win their spending, merchants must understand these shoppers’ needs and preferences. These consumers, earning $50,000 or less annually and living paycheck to paycheck, represent a substantial yet often overlooked segment of the market…” Read more here

“Consumers, for their part, want BNPL options. The report “Divided, Not Conquered: Acquirer and Merchant Confusion Clouds Split-Payments Landscape,” also created in collaboration with Splitit, revealed that roughly half of Generation Z and millennial shoppers had used BNPL at least once in the last year, with 23% of them increasing their BNPL usage in that period. Moreover, 79% of BNPL users said they were very or extremely satisfied with the experience.” Read more here

Cybersecurity

“In February, 577 documents stolen from the Chinese hacking firm iS00N were dumped onto GitHub… the iSoon document dump revealed activities of unexpected scope. Working on behalf of China’s Public Security Bureaus and State Security Departments, the company has spied on targets all over Europe, Asia, and North America. The leak was “narrow, but it is deep,” said John Hultquist, the chief analyst at cyber security firm Mandiant. “We rarely get such unfettered access to the inner workings of any intelligence operation.” Read more here

“TeamViewer, the company that makes widely used remote access tools for companies, has confirmed an ongoing cyberattack on its corporate network. In a statement Friday, the company attributed the compromise to government-backed hackers working for Russian intelligence, known as APT29 (and Midnight Blizzard).” Read more here

Digital Lifestyle

“Beauty brand e.l.f. has expanded its partnership with virtual world and gaming platform Roblox to include real-world commerce. In the new virtual kiosk within the e.l.f. Up! experience on Roblox, which is powered by Walmart, U.S. visitors can buy a Roblox-exclusive limited-edition physical product — a hoodie — as well as a selection of other physical products that include a skincare product, lip balm and sunscreen… Eligible users who purchase items through the virtual kiosk will also receive a “virtual twin” item for use on Roblox…” Read more here

“Global retail e-commerce sales rose to $4.4 trillion in 2023, up from $1.3 trillion in 2014. By 2028, Forrester forecasts that global retail e-commerce sales will grow to $6.8 trillion and capture 24% of global retail sales.” Read more here

“Walmart showed off its use of augmented reality and artificial intelligence in its retail operations. It turns out that AR is leading to better digital sales and cool new applications that haven’t been done before.

The techniques include virtual try-on of outfits, virtual showroom experiences and digital twins…” Read more here

Nuclear Energy & Uranium

“Tech companies scouring the country for electricity supplies have zeroed in on a key target: America’s nuclear-power plants. The owners of roughly a third of U.S. nuclear-power plants are in talks with tech companies to provide electricity to new data centers needed to meet the demands of an artificial-intelligence boom.” Read more here

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

Cash Strapped Consumer - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption or destruction of data.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Digital Lifestyle - The companies behind our increasingly connected lives.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Precision Ag & Agri Science – Companies that look to address shrinking arable land by helping maximize crop yields utilizing technology, science, or both.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed below.