Apple Digestion, Debate Preparation

Oracle's Larry Ellison delivers a shot in the arm for these models

Following a simply horrible first week of September, stocks notched their first winning day yesterday but ahead of today’s trading, US equity futures are mixed. That’s the same reaction to Apple’s (AAPL) “Glowtime” event yesterday with Bernstein sharing it was “somewhat underwhelming”, KeyBanc saw it as “a modest negative” and Citi thought it was “in line with expectations.”

In other words, there’s not a lot of buzz emanating from the event that left folks with a new array of devices and not much in the way of Apple Intelligence. The question to be determined is whether the relatively fat trade-in values being offered for older iPhones will be enough to spur what has been expected to be a large iPhone upgrade cycle. And that’s why we’re running a poll, which you can participate in here.

Lending a shot in the arm to beleaguered AI and data center stocks as well as our Digital Infrastructure and Cloud Computing models, last night during Oracle’s (ORCL) earnings call, Chairman and CTO Larry Ellison shared that the company has “162 data centers now. I expect we will have 1,000 or 2,000 or more data centers -- Oracle data centers around the world, and a lot of them will be dedicated to individual banks or telecommunications companies or technology companies or what have you or nation states, sovereign clouds, all of this other stuff.”

With little on tap for corporate earnings and economic data today, the fallout from those events will carry the market as investors get ready for tonight’s 2024 presidential debate between candidates Harris and Trump. With an expected run time of 90 minutes, it’s unclear how much new ground will be broken when the two square off in Philadelphia. With no other debates scheduled and polls putting the two neck and neck, both candidates will be targeting undecided voters. Let’s remember that both are campaigning, which means no matter which candidate is elected means related promises and declarations will have to contend with Congress.

As the market grapples with what new insights or lack thereof are had from tonight’s debate, tomorrow brings the August CPI report. The core inflation figure for the month is expected to remain unchanged at 3.2% YoY and 0.2% MoM, but comments found in the August PMI reports from ISM and S&P Global (SPGI) suggest those August figures could be up compared to July’s. Those figures and the ones for Thursday’s August PPI will be among the last data points before the Fed concludes its next monetary policy meeting on September 18. Currently the market is leaning toward the Fed kicking off a rate cutting cycle with a 25-basis point trim next week. The larger question is whether the Fed will get on board with 100-125 basis points in cuts before the end of this year, as depicted in the CME FedWatch Tool.

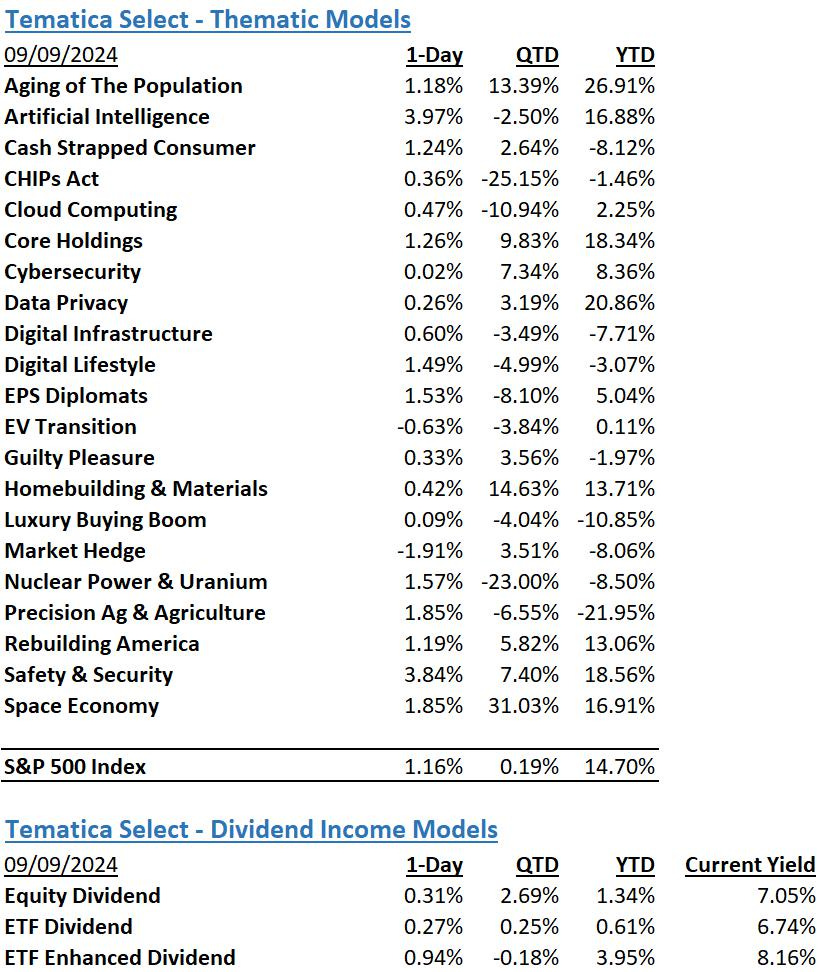

Coming off yesterday’s latest update for the Atlanta Fed’s rolling GDP forecast to 2.5% for the current quarter, the odds of the Fed pushing back on such aggressive expectations are high. If that is the outcome we get, we could see the market repeat its April sell-off, and that has us thinking about our Market Hedge model.

Model Musings

Artificial Intelligence

Dresses are “one of the most-searched apparel categories” on the platform, Google Shopping said in the release. The expansion into the category follows last year’s introduction of virtual try-ons for men’s and women’s tops, plus enhanced algorithms to help shoppers more easily refine their apparel search parameters. Google’s generative AI model manipulates an image of clothing and showcases the item on “a diverse set of real models, ranging in sizes from XXS-XXXL,” per the release. Users can choose a model that best aligns with their body, and click on a retailer’s site to buy the apparel.” Read more here

Artificial Intelligence, Digital Infrastructure

“This AI race is going to go on for a long time. It’s not a matter of just simply getting ahead in AI, but you also have to keep your models current, and that’s going to take larger and larger data centers, and some of the data centers we have that we’re planning are actually even bigger. Some are getting very close to — dare I say it — a gigawatt, which is enough for a pretty good-sized city or for one enormous AI-training cloud data center,” Ellison said. Read more here

“AT&T’s Chief Data Officer Andy Markus thinks that the advent of generative AI (GenAI) will have as big an impact as smartphones and the emergence of PCs as a household item… An important part of the equation for telecommunications companies, Markus said, will be having enough capacity for the explosion of data transport that generative AI makes likely.” Read more here

Cash-Strapped Consumers

“Connecting the dots between the two separate reports — the Federal Reserve Bank of New York’s reading on inflation expectations from the morning for the short- and long-term horizons, and the Federal Reserve’s Consumer Credit Outstanding report (known as G.19) from the afternoon — paints a portrait of a consumer who’s borrowing what they can, when they can, even as there’s acknowledgment that there’s a higher risk of sliding into delinquency.” Read more here

“We missed our sales goal due largely to continued pullback and consumer spending by our core customers, particularly in high-ticket discretionary items,” Thorn said at the time. “The consumer environment softened in the first quarter, and both consumer confidence and sentiment declined due to concerns about inflation, unemployment and interest rates. This year has also seen the northeastern U.S. discount merchant Bob’s Stores announce plans to shut down its entire 21-store chain as part of its bankruptcy proceedings, with 99 Cents Only doing the same thing for its 371 locations on the other side of the country. Likewise, Dollar Tree has said it plans to close almost 1,000 of its Family Dollar stores.” Read more here

Cybersecurity

“In recent months, cybercriminals have increasingly targeted Latin America with phishing campaigns designed to deploy banking Trojans. Mekotio, BBTok, and Grandoreiro—Trojans known for their financial fraud capabilities—are at the forefront of these operations. Traditionally, these Trojans focused on regions like Brazil and Argentina, but new intelligence suggests that their reach is expanding beyond the region.” Read more here

“Highline Public Schools, a K-12 district in Washington state, has shut down all schools and canceled school activities after its technology systems were compromised in a cyberattack.” Read more here

Safety & Security

“Japan today announced plans for its biggest defense budget in history, with a planned $57 billion investment in military capabilities. The reason for the increase isn’t hard to find: “The international community is facing the greatest post-war trial yet, and has entered a new era of crisis…” Read more here

“The Netherlands will increase defense spending by more than 10% next year, investing in new tanks, fighter jets, frigates and air defense systems in a push to strengthen its forces in the face of new security threats, the Dutch government said.” Read more here

“Poland’s budget proposal for 2025 includes record defense spending of 187 billion zlotys ($48.7 billion)… Poland, which supports Ukraine’s struggle against Russia’s full-scale invasion, is making large purchases of military equipment, including fighter jets, tanks and missile defense systems from the U.S. and South Korea.” Read more here

The Strategies Behind Our Thematic Models

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

Cash Strapped Consumer - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Cybersecurity - Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption or destruction of data.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Digital Lifestyle - The companies behind our increasingly connected lives.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Precision Ag & Agri Science – Companies that look to address shrinking arable land by helping maximize crop yields utilizing technology, science, or both.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed below.