Apple, AMD and February Services PMIs

Setting the stage for Fed Chair Powell's testimony tomorrow

US equity futures are pointing to a lower open pulled down in part by Apple (AAPL) and AMD (AMD) shares:

Research firm Counterpoint finds Apple's (AAPL) iPhone sales in China fell 24% year-over-year in the first six weeks of 2024. The report found total China smartphone unit sales fell 7% YoY during the first six weeks of 2024. Counterpoint’s findings put Apple's share of the Chinese smartphone market at ~16% compared to 19% in the same period last year, while Huawei's market share increased to about 17% from around 9%.

Apple’s manufacturing partner Foxconn Technology's (FXCOF) revenue in February fell 12.33% YoY and 32.5% MoM and the company continues to expect a year-on-year decline for the first quarter of 2024. According to the company, Cloud and Networking Products revenue showed year-over-year growth, while Component and Other Products' sales remained largely flat. For the first two months of 2024, Foxconn’s revenue was down 17.67% YoY. Foxconn is scheduled to report its fourth-quarter earnings on March 14.

Reports indicate Advanced Micro Devices (AMD) hit a hurdle at the US Commerce Department in attempting to sell an artificial intelligence (AI) chip specifically for the Chinese market. Meanwhile, Nvidia (NVDA) is set to begin mass production of an AI chip it designed for China in the second quarter of 2024.

Ahead of tomorrow’s semiannual testimony by Fed Chair Powell, this morning’s post-market open release of the February US Service PMI reports from ISM and S&P Global are bound to attract attention. The key areas of focus will be familiar to our readers - the speed of the Services economy and inflation. Leading into those reports, the February Service PMI data published by HCOB found that the rate of increase in costs rose to not just a nine-month high, but well above the long-term average. Also setting the stage for today’s US Service PMI data were last week’s February Manufacturing PMI reports that both found “The rate of charge inflation accelerated for the third successive month as firms sought to pass through higher costs to customers.”

Should this morning’s February Service PMI reports echo those findings, the odds Fed Chair Powell will reiterate there is no rush to cut interest rates will move higher. Where things could get a little dicey will be if the Services sector data comes in substantially weaker than market forecasts. ISM’s headline reading February Services PMI is 53.0, down from 53.4 in January. So long as the Service sector remains firmly in growth territory with a reading well above 50.0, the odds of recession fears creeping into the current market narrative are low. However, should headline ISM’s figures surprise to the upside, it would be another reason for Powell to reiterate the slow road to rate cuts.

Helping investors put these puzzle pieces together ahead of Powell’s 10 AM ET testimony tomorrow, Fed Vice Chair for Supervision Michael Barr speaks at 12 PM ET today and again at 3:30 PM ET.

For more, be sure to read our Daily Markets column published each day by Nasdaq.

Model Musings

Artificial Intelligence

“J.P. Morgan has been using cashflow management software that runs on artificial intelligence — and it has reportedly slashed manual work for some of its corporate customers by almost 90%. The AI tool, called Cash Flow Intelligence, was launched last year to allow corporate treasuries to analyze and forecast cash flows, according to Bloomberg. It has seen “tremendous” interest from JPMorgan’s clients, Tony Wimmer, the head of data and analytics at JPMorgan’s wholesale payments unit, told Bloomberg. The Wall Street behemoth has roughly 2,500 clients using the AI-backed tool — and its success thus far has JPMorgan closer to charging for the service, Bloomberg reported." Read more here

Data Privacy & Digital Identity

“American Express is warning customers that credit cards were exposed in a third-party data breach after one of its service providers was hacked. In a data breach notification filed with the state of Massachusetts, American Express said that the breach occurred at one of its service providers used by their travel services division, American Express Travel Related Services Company.” Read more here

Luxury Buying Boom

“Luxury goods giant LVMH is launching an entertainment venture to boost the marketing of its labels, overseen by a committee of executives led by LVMH heir Antoine Arnault and Anish Melwani, CEO of the group's North America operations. The move comes as the fashion industry becomes increasingly linked to the entertainment industry, with the presence of stars like Beyonce, Zendaya and Rihanna adding buzz to fashion shows and LVMH label Louis Vuitton bringing in Pharrell Williams to head menswear designs.” Read more here

Space Economy

“Varda aims to become a major player in the nascent in-space manufacturing industry, which takes advantage of the unique microgravity environment of low Earth orbit to make high-value products like pharmaceuticals. Such work has been done on the International Space Station already with the help of astronauts. But Varda offers customers an all-in-one autonomous option — a capsule that serves as both a minifactory and a return vehicle, taking pricey humans out of the orbital loop.” Read more here

The Strategies Behind Our Thematic Models

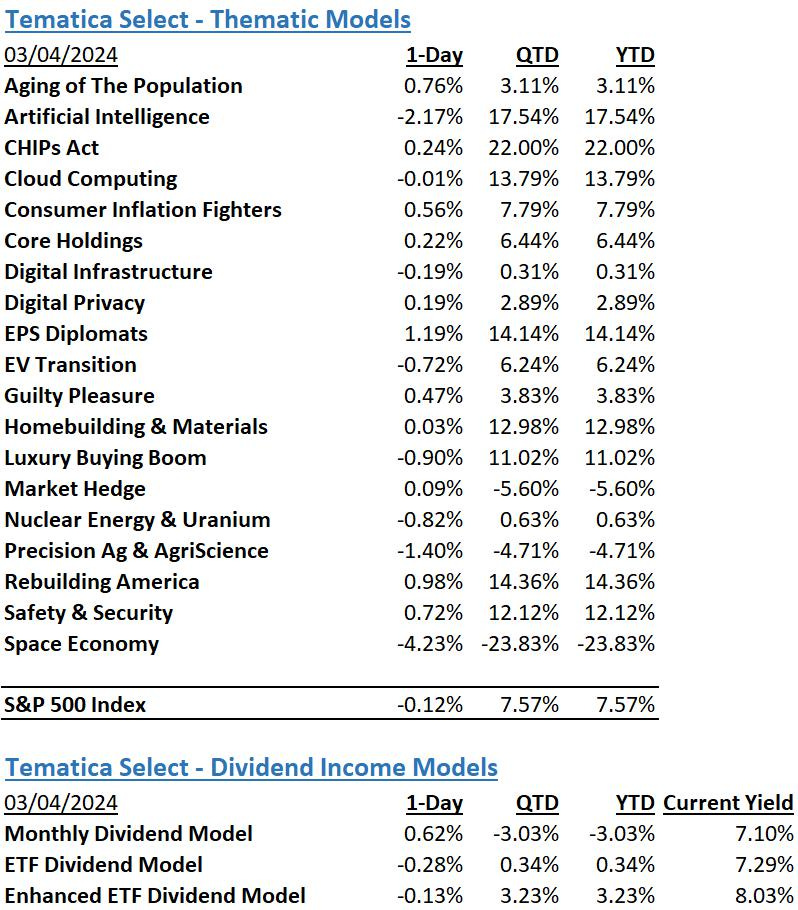

Aging of the Population - Capturing the demographic wave of the aging population and the changing demands it brings with it.

Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

Consumer Inflation Fighters - Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

Digital Infrastructure & Connectivity -The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

Data Privacy & Digital Identity - Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

EPS Diplomats - Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

EV Transition - Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Luxury Buying Boom - Tapping into aspirational buying and affluent buyers amid rising global wealth.

Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

Precision Ag & Agri Science – Companies that look to address shrinking arable land by helping maximize crop yields utilizing technology, science, or both.

Rebuilding America - Turning the focused spending on rebuilding US infrastructure into revenue and profits.

Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

Space Economy – Companies that focus on the launch and operation of satellite networks.

The strategies behind our Dividend Income Models:

Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed below.